When rumors of a 70% price hike for the MI350X hit the coldest winter in the PC market in a decade, $Advanced Micro Devices(AMD)$ Q2 earnings report will be very interesting, either igniting a second revolution in AI chips or becoming a bubble bursting point?

Longs: AI Pricing Hegemony + Share Grabbing

Pricing power nuke verification is the core trump card.

Recently there are very many news pointed out that AMD will be the flagship AI chip MI350X pricing, from 15k violently pulled up to 25k, the price increase is as high as 67%, directly approaching the $NVIDIA(NVDA)$ H100 30k + range.This is not only a branding blow to the competition, but also a nuclear bomb level filler for gross profit.If the implementation, single GPU gross profit increase or more than 8k

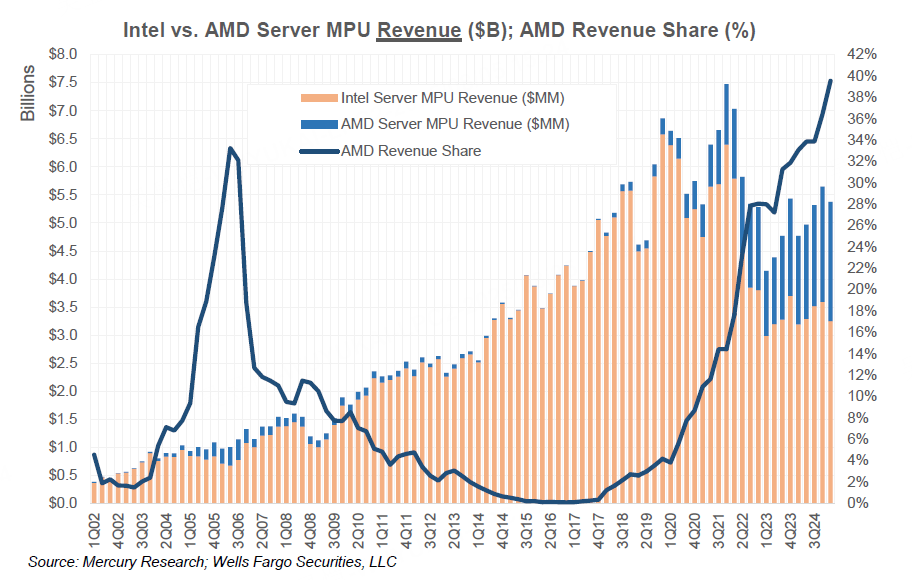

AMD in the server market to $Intel(INTC)$ enjoy 64% pricing crush (PC side also has a 17% premium), completely subvert the "price war" industry logic.

Shorts: PC cliff, 128x PE shaky

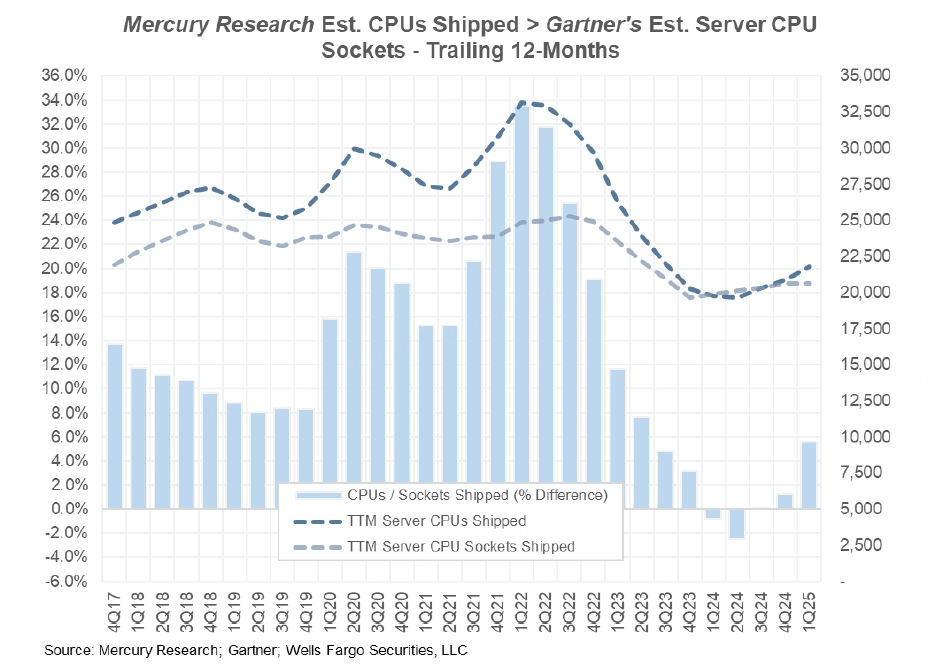

PC cold front or trigger an avalanche of performance. PC market is experiencing epic seasonal deviation - Q3 expected growth rate of only 2% (historical average of 15%), Q4 is afraid of falling into zero growth! AMD's client business H2 growth rate plummeted 1,300-1,400 bps compared to the normal level, while the business accounted for more than 30% of revenues.The harsh reality is that AI can't fill the holes in PC even if it is fierce - if Q3 guidance is weaker than expected, the long/short balance will instantly collapse.

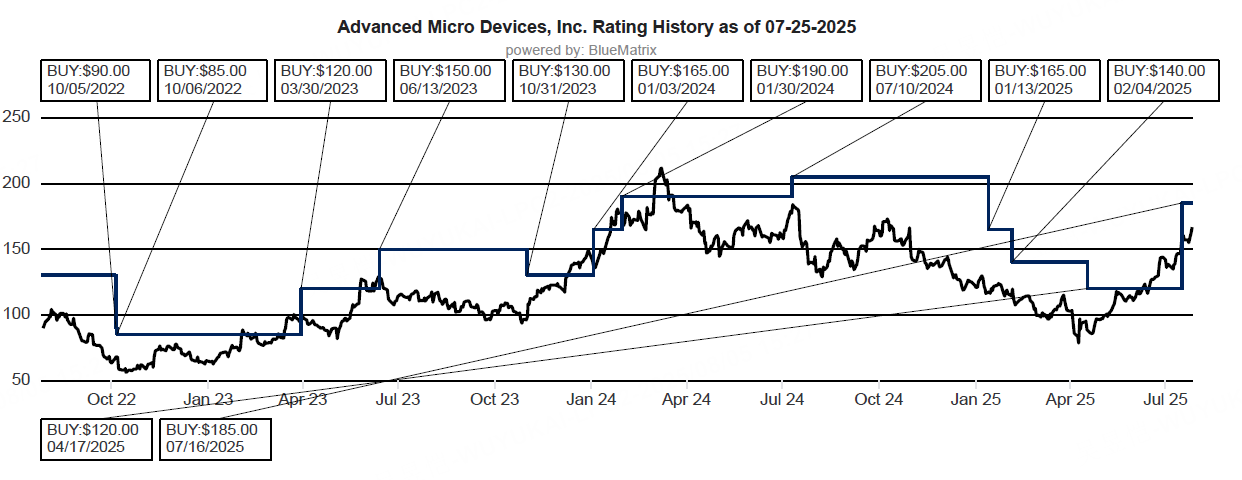

Meanwhile, high valuation may also become a constraint on the stock, with a 48x PE tower standing on quicksand.Currently AMD's TTM P/E 128 times (semiconductor industry average 28 times, NVDA 57 times), the current price to calculate, its forward PE also reached 43 times. 2023 Q1 due to the PC thunder single day plummet 13% of the tragedy, now the high chips more vulnerable.

Therefore, the short-seller's logic is that MI350X price increase is expected to have overdrawn the stock price, any PC "cold wind" will trigger profit-taking plate blood wash.

Earnings day will be the battle?

Three quantitative factors will be key to investors voting with their feet:

Pricing power check: is the MI350X price increase on the ground?Can gross margin break through the 50% threshold (currently 45%)?

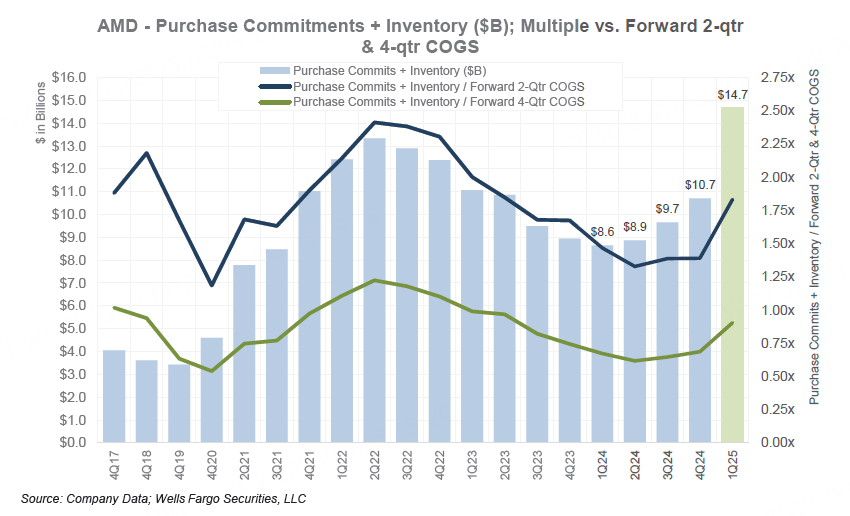

The PC bottom line is a matter of life and death: can client revenue hold on to positive growth?Are inventory days (93) worsening?

Countdown to the China variable: Is MI308's export license to China to be released in August?

The current reaction in Lai An, including in the options market, is that institutional bets may be on a "violent breakout" (direction uncertain), with the current stock price at 177 in a delicate position - if earnings hit a home run, 200 would be just the starting point; if PC thunders, the $150 technicals will beface short bombing.

In the long run, AMD handholding server share of 30% ambition and GPU revenue quadrupled in three years (3B → 12B) of the nuclear bomb script, every pullback is a golden pit!

Comments