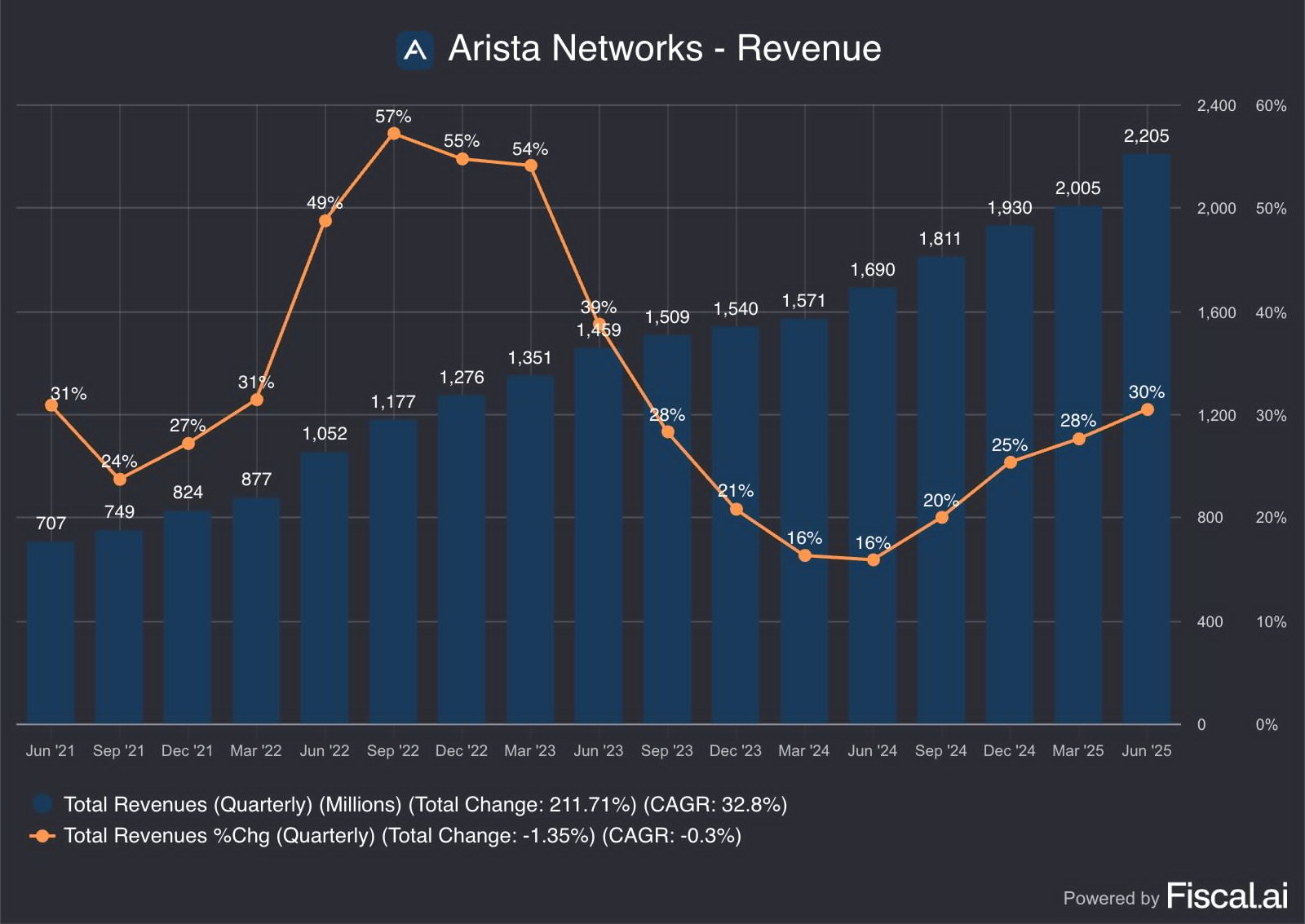

$Arista Networks(ANET)$ just reported Q2'25 financial results that continue to show strong growth momentum, with both revenue and earnings exceeding expectations.

Among other things, demand from the AI networking and enterprise markets drove performance, expanded branch network capabilities with the acquisition of VeloCloud, and raised full year guidance, demonstrating confidence in future growth.Despite pressure from competitors such as NVIDIA, Arista maintained its market leadership through innovation and customer intimacy.

Earnings Beat and Guidance Increase

Revenue Beat: In the second quarter of 2025, Arista Networks delivered revenues of $2,205 million, up 30.4% year-over-year (YoY) and 10.0% quarter-over-quarter (QoQ), exceeding market expectations of $2,110 million (+4.5%).Strong growth was driven by broad-based demand in the AI networking, cloud and enterprise markets.

Strong earnings performance: Non-GAAP earnings per share (EPS) of $0.73, up 37.7% year-over-year, exceeded analysts' expectations of $0.65 (+12.31%).Non-GAAP gross margin was 65.6%, up from 64.1% in Q1 2025 and 65.4% in Q2 2024, reflecting efficient supply chain management and a quality customer portfolio.

Outstanding operational efficiency: Non-GAAP operating profit was US$1.08 billion, with an operating margin of 48.8%, surpassing the US$1 billion mark for the first time, demonstrating the company's ability to maintain excellent cost control amidst scale expansion.

Cash Flow and Balance Sheet: Record operating cash flow of $1.2 billion and ending cash and equivalents of $8.8 billion.Deferred revenue increased to $4.1bn (Q1 $3.1bn), reflecting customer confidence in long-term contracts.

Full year guidance significantly raised, revenue target from $8.2B (+178.75B (+25% yoy), incremental $550M from AI/Cloud/Enterprise demand exceeding expectations across the board; AI network revenue recognition exceeded $1.5B (original target of $1.5B), back-end clusters $750M target advancing well; campus network target raised to $750M-800M(including VeloCloud M&A contribution)

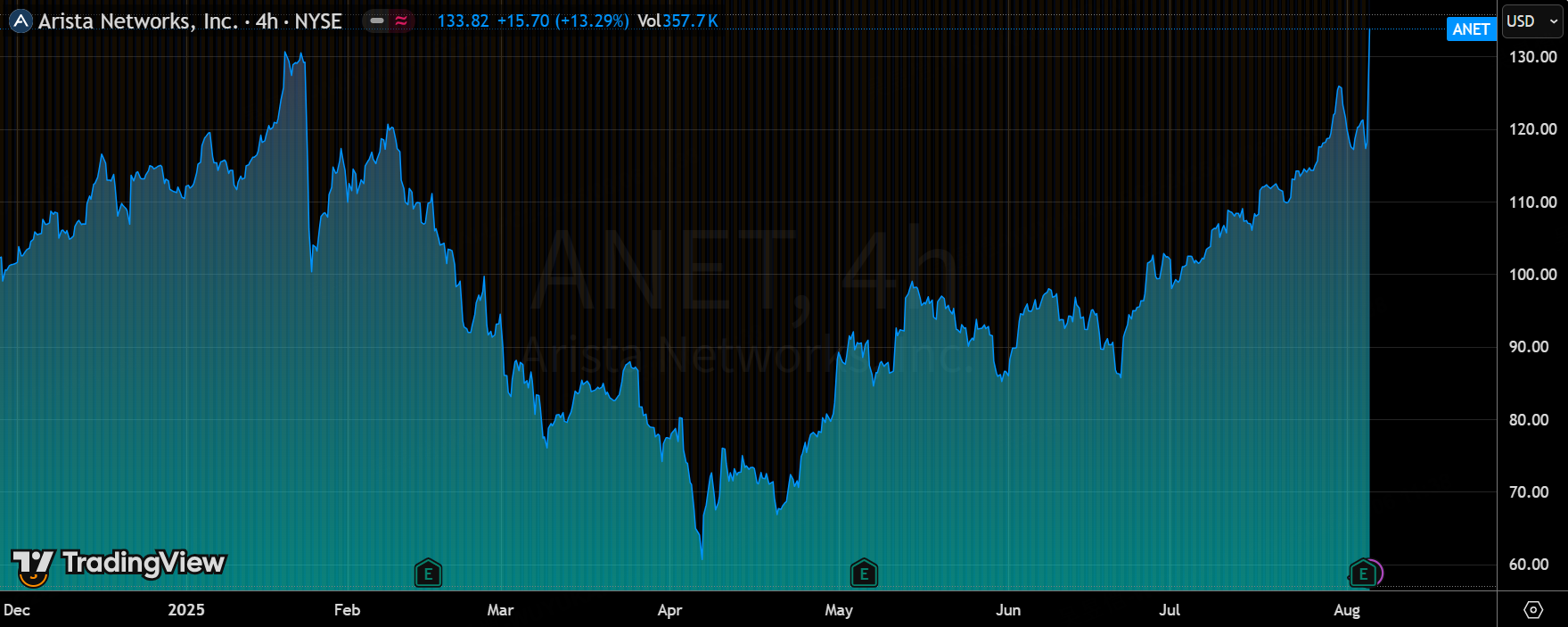

Following the earnings release, Arista shares rose 13% in after-hours trading to near record highs, reflecting positive investor sentiment on the results and upward guidance.The current valuation valuation (44x PE TTM) will also generate discussion in the market.

Investment Highlights

Strategic breakthrough in AI network substitution and ecological expansion

Leadership in AI Networks was a core driver of results in the quarter.Back-end AI networking revenue is expected to reach $750 million, in line with year-to-date targets, and full-year AI networking revenue is expected to exceed $1.5 billion, representing significant growth from a near-zero starting point in 2022, according to management.Arista's Etherlink product family has become the industry standard for AI backbone and leaf node network design, and has particularly excelled in supporting large-scale GPU clusters, such as 50,000 to 100,000 GPU deployments.The company also began testing alternative AI gas pedals (e.g. AMD MI series) to further expand the market.

AI Ethernet leadership is consolidated, in which the technology replaces InfiniBand. the CEO made it clear that the feasibility of Ethernet in the deployment of ultra-large-scale AI clusters was verified, and 3 out of 5 customers adopted the Arista EOS system (Leaf Ridge Architecture), breaking the monopoly of NVIDIA's closed ecosystem.

In addition, the company's order visibility to improve, Meta 100,000 card GPU cluster, Microsoft Azure expansion and other orders to support the 2025 AI revenue exceeded expectations, and "growth sustainable for many years"

Strategic value of the VeloCloud acquisition

Arista announced the acquisition of SD-WAN leader VeloCloud to strengthen its competitiveness in the branch network and managed service provider (MSP) market.VeloCloud's application-aware solutions will complement Arista's datacenter and campus network offerings, particularly in the "Age of Agentic AI" to support the needs of modern branch offices.VeloCloud's application-aware solutions will complement Arista's data center and campus network offerings, particularly in the "Agentic AI Era" to support the needs of modern branch offices.Management expects VeloCloud to have limited revenue contribution in FY2025, but will recover to pre-acquisition levels through consolidation and enhance cross-sell capabilities in the MSP channel.

Completing the enterprise footprint: VeloCloud, the SD-WAN leader, fills the distributed branch network gap and integrates "AI-optimized WAN" solutions to enter the $30B+ SASE market.

Channel synergy: Relying on VeloCloud's MSP (Managed Service Provider) network, VeloCloud will accelerate penetration into the enterprise market and create synergy with campus switches.

Operational Efficiency and Risk Perspective

The source of gross margin resilience is two-fold, one is the increase in the proportion of high-end products, 800G switch penetration in AI clusters exceeded 30% (only 15% in 2024), the premium ability to offset the potential impact of tariffs; the second is the optimization of the supply chain, the company's direct cooperation with TSMC to ensure the supply of chips, inventory turnover rate of 1.4 times (YoY improvement)

Key Risks and Market Divergence

Despite competition from $NVIDIA(NVDA)$ InfiniBand and GPU bundling and white box solutions, Arista maintains a competitive advantage through innovation, platform performance, and customer intimacy, with the CEO emphasizing that Arista's differentiation in "platform performance, feature iteration, and customer responsiveness" has not wavered, and that the company continues to strengthen its market position through a single point of control for the network and the ability to identify performance bottlenecks.The company will continue to strengthen its market position through a single network control point and performance bottleneck identification capabilities.

Volatility in deferred revenue (due to increased customer-specific acceptance clauses) and supply chain management challenges could pressure near-term margins.In addition, gross margins may be pressured by 1-2pp if tariff hikes on China materialize (current 65.6% safety cushion is thick)

Valuation controversy: Forward PE 37.9x vs 25x for hardware peers, relying on AI revenue growth rate to maintain (need to continue to validate 800G release).

Comments