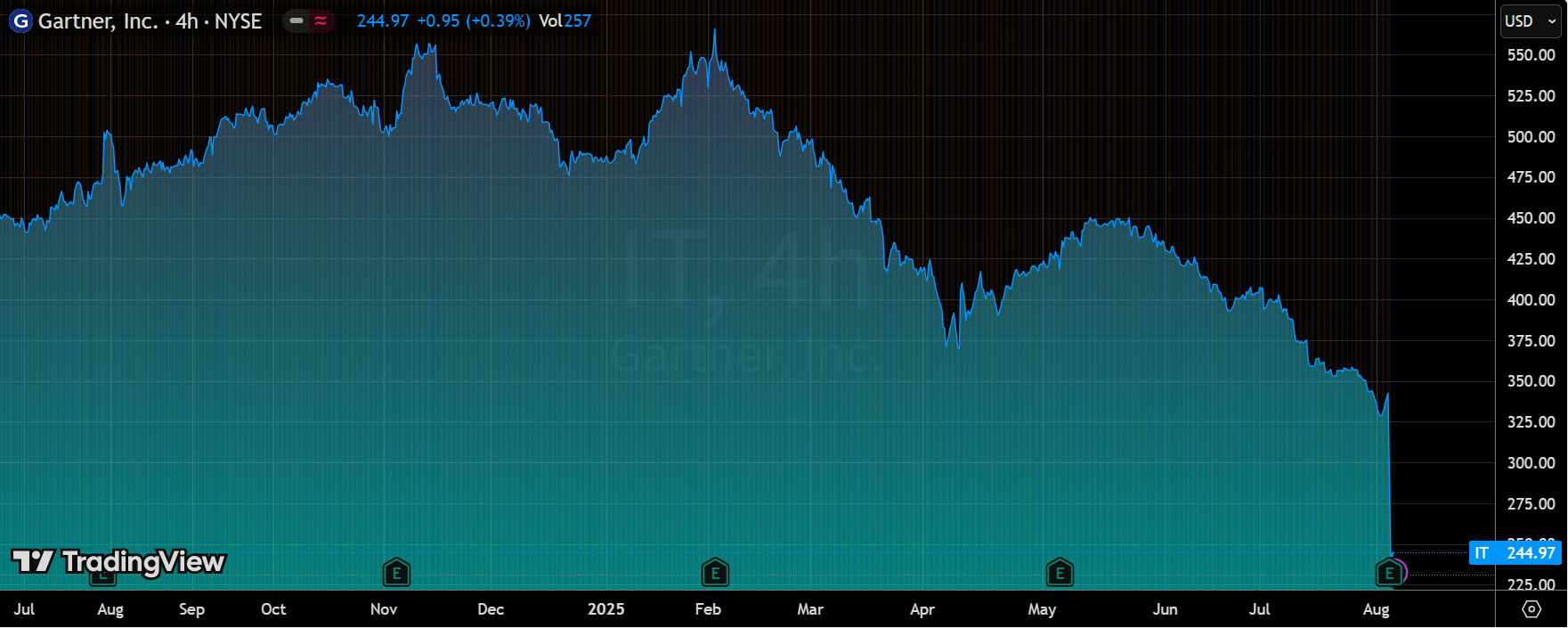

$Gartner(IT)$ After more than a quarter of consecutive negative declines, it plunged more than 27% after the Q2 earnings report, although the performance demonstrated a resilient earnings model (cost control + cash flow resilience) and forward-looking AI layout, but it was not helped by the macro and policy perturbations, as well as the market's great concern about the impact of AI on it, which suppressed growth momentum, and thus the current valuation of the share price at 14x PE is stillUnder pressure.

Currently need to wait for two major signals to validate:

Policy end: simplification of the US federal procurement process or the retreat of the tariff crisis;

Product side: AI product AskGartner to drive CV growth inflection point.

Core performance and market feedback

Gartner Q2 2025 revenue was $1.7 billion, up 6% year-over-year and 5% FX-neutral growth, below market expectations of $1.68 billion, and adjusted EPS was $3.53, up 10% year-over-year, exceeding market expectations of $3.38, with cost control outperforming revenue growth.

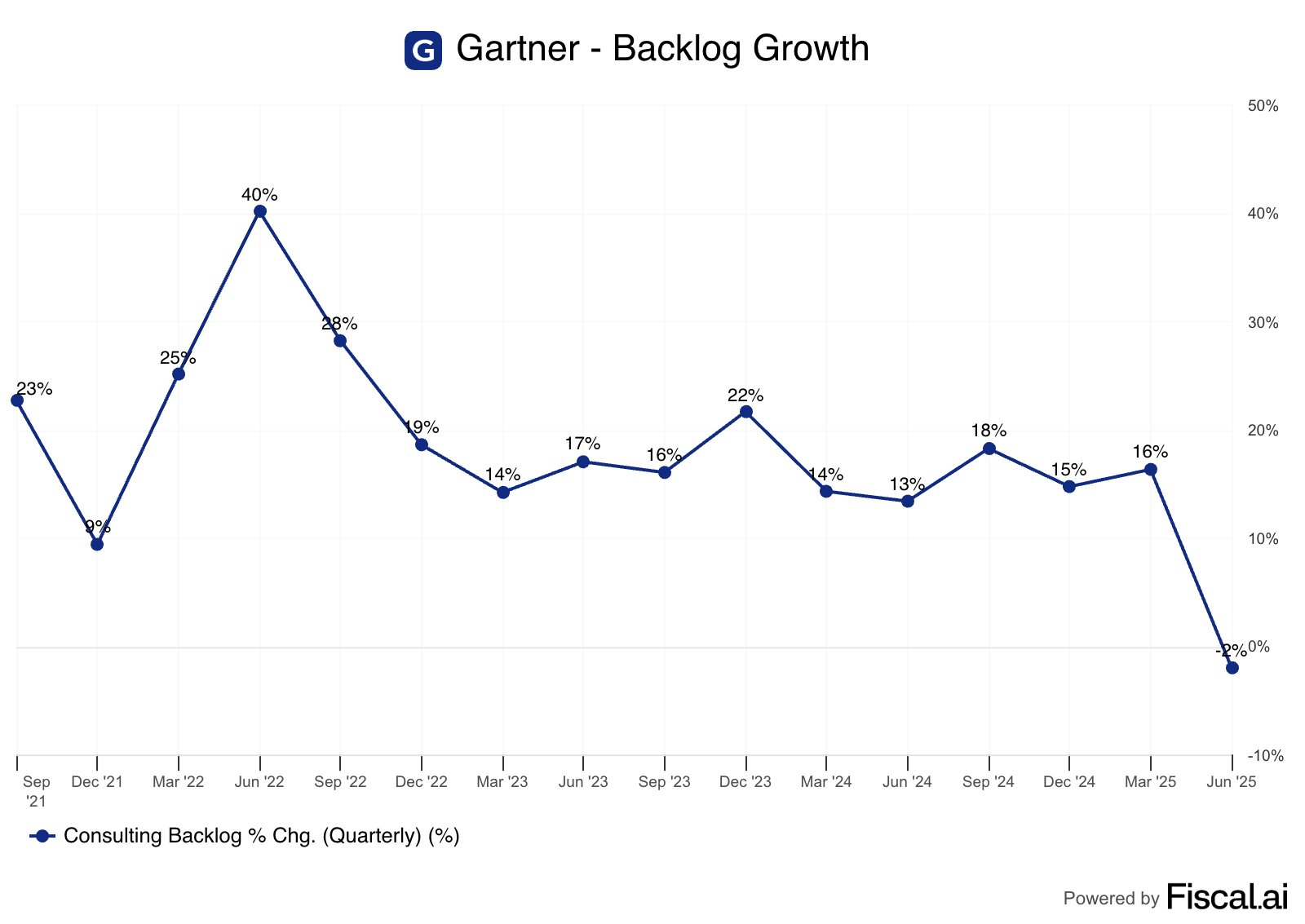

Year-on-year and sequential trends: Q2 contract value (CV) was $5 billion, up 5% year-on-year, slower than Q1's 7% growth rate, reflecting the impact of external macro headwinds; adjusted EBITDA was $443 million, up 6.6% year-on-year, with a gross margin of 68%, stable sequentially.

Beat or Miss? Revenue slightly below expectations mainly dragged by US federal government procurement policy (DOGE initiative) and tariffs impacting industry demand; EPS exceeded expectations thanks to strict expense management and share buybacks ($720 million YTD), boosting EPS.

Full year guidance lowered, revenue guidance of $6.455bn, down from $6.535bn previously, and margins lowered by 160bps.

Market feedback is quite pessimistic: the August 6 plunge of more than 27% after the report, the market considered the report "catastrophic", coupled with weak macro demand (research business decline), even if it intends to transform AI, the market is more skeptical.

Although the valuation of 14.7 times, in the same industry can not be considered overvalued, but still facing the pressure of investor sentiment on the side of caution.

Investment Key Points

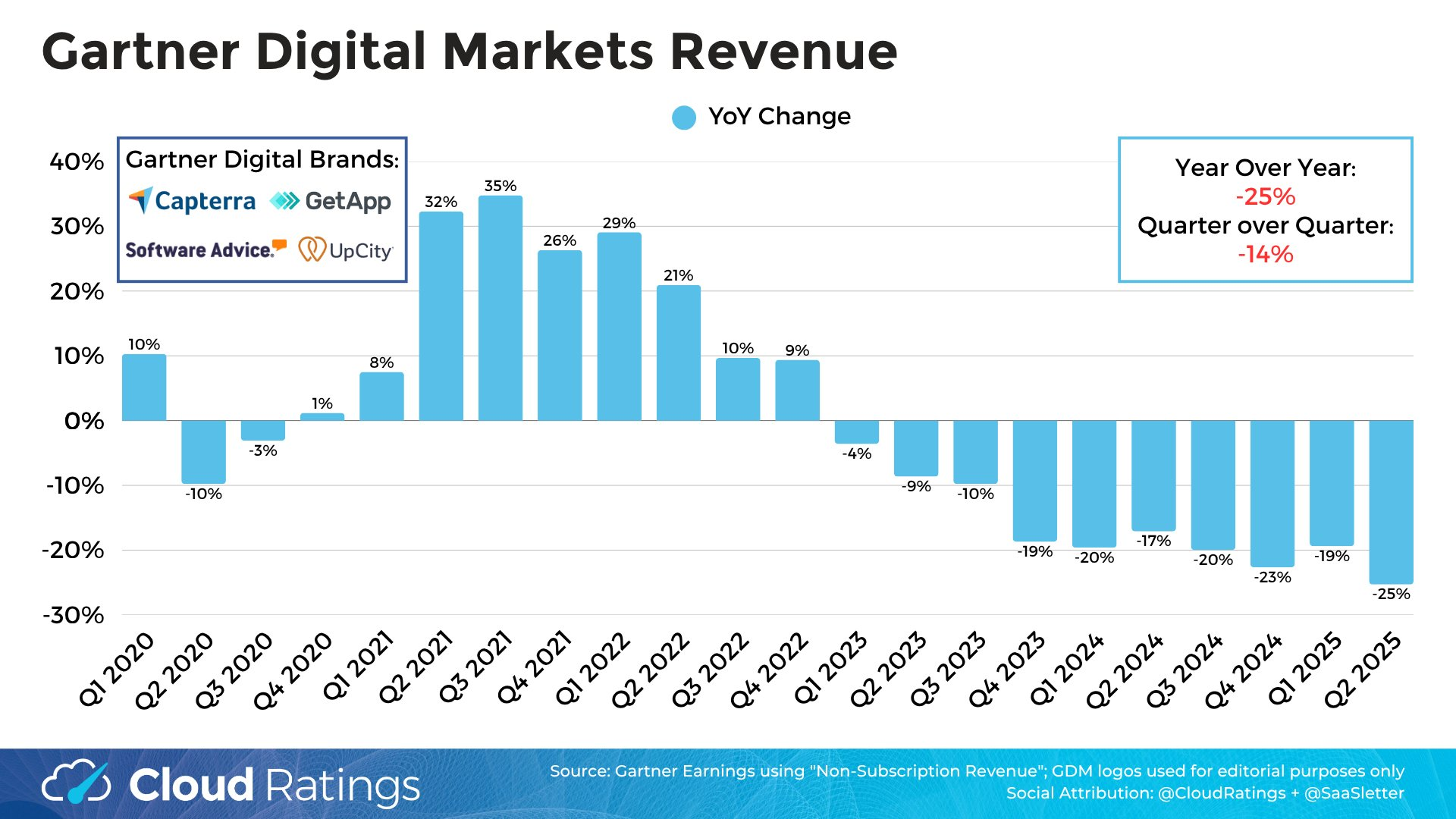

What's dragging down growth?Policy headwinds or macro demand?

There are two core drag factors: 1. the broad brush reform of the DOGE sector, the complexity of the procurement process has led to delays in the renewal of federal customers, directly suppressing CV growth ((CV share of 4%, retention rate of only 47%, NCVI minus $26 million, if you do not take into account the factor, CV growth rate can be up to +6%); 2. At the same time, tariffs impacted about 35%-40% of the CV customers (concentrated in the manufacturing industry and themultinationals), driven by tariff policy to optimize costs, demand is on hold, GBS business (consulting) is affected more than GTS (scientific and technical research), and sales cycle is prolonged.

How is the company responding?

Segment performance diverges, Insights remains core, AskGartner AI a reversal bet?

Insights (formerly Research) revenue grew 4%, with subscription revenue FX neutral growth of 5%, contributing 78% of total revenue and a gross margin of 73.9%, indicating a solid subscription-based strategy.Conferencing revenue of $211 million, up 14% year-over-year, and consulting business of $156 million, up 9% year-over-year, both better than the overall growth rate, reflecting the resilience of diversified revenue sources.

In the face of AI blowback, Gartner positioned AI as the biggest area of demand, with the Q2 launch of the AskGartner AI tool, with time savings of up to 75% on internal testing, and plans to cover all licensed users by the end of the year.Management emphasized that AI supports customers in key journeys such as AI, network security and cost optimization, which is in line with current market trends (the market is expected to generate an AI market of $66.89 billion by the end of the year).

However, competition in the market has intensified, with other peers McKinsey, Deloitte and Forrester leading the way in AI governance, ethical frameworks, etc., and Gartner will need to maintain differentiation through proprietary data and expert guidance. the AI strategy may become a key variable in valuation repricing, with a high single-digit CV growth target for 2026 achievable if execution is strong.

Although management emphasized that AI does not pose a substitution risk, Gartner addresses "mission-critical decisions" rather than simple questions and answers.However, its strategic value is dependent on subsequent AI productization to enhance customer stickiness and potentially increase contract value per capita (ARPU) to validate commercialization.

Any highlights?

There are two growth highlights in Q2, one is conference business: revenue of $211M (+14% yoy), driven by the revival of offline activities; the other is cost optimization services: revenue of $46M (+26% yoy), which is directly targeting clients' cost reduction pain points.This indicates that short-term growth is disturbed by policy, but enterprise demand (especially cost optimization and AI) is still resilient, and we need to pay attention to marginal policy changes and customer budget migration.

At the same time, cost control has become the core driver of earnings exceeding expectations.Expense optimization: SG&A expense growth declined to 4.7% (previous 8.8%), tightly control recruitment and operating expenses;

In terms of investor returns, $720M shares were repurchased during the year; free cash flow coverage ratio remained healthy (debt ratio < 2x EBITDA).

Guidance for the full year 2025 also shows cost reductions.Revenue estimates were lowered to 6.455B (previously 6.555B), reflecting growth pressures, while EPS estimates were revised upward against the trend to 11.75 (previously 11.70), highlighting cost discipline.

Troubled recovery?

2026-2027 Growth Path Framework:

Short term (2025): low to mid-single digit CV growth (current +5%);

Medium-term (2026): high single-digit growth;

Long-term (2027+): return to double-digit growth.

The supporting logic is mainly

Retention rate improvement: non-policy impacted customer renewal rate stabilized;

Sales system upgrade: CRM and AI tools to improve efficiency of new signing;

Macro headwinds easing: CEO confidence index bottoming out after repair possible. Risk point: recovery timetable may be delayed if policy and tariff pressures persist.

Valuation repricing key variables

Policy sensitivity: DOGE sourcing rules and tariff changes will be short-term valuation volatility catalysts, need to track US post-election policy trends.

AI product monetization: AskGartner user penetration and renewal premium are key indicators to validate AI strategy.

Cost control sustainability: if revenue growth does not recover as expected, the pull effect of expense optimization on EPS will decay.

Competitive barriers: whether it can withstand the diversion of pure AI research tools (e.g., competing products integrating LLM) to small and medium-sized customers.

Comments