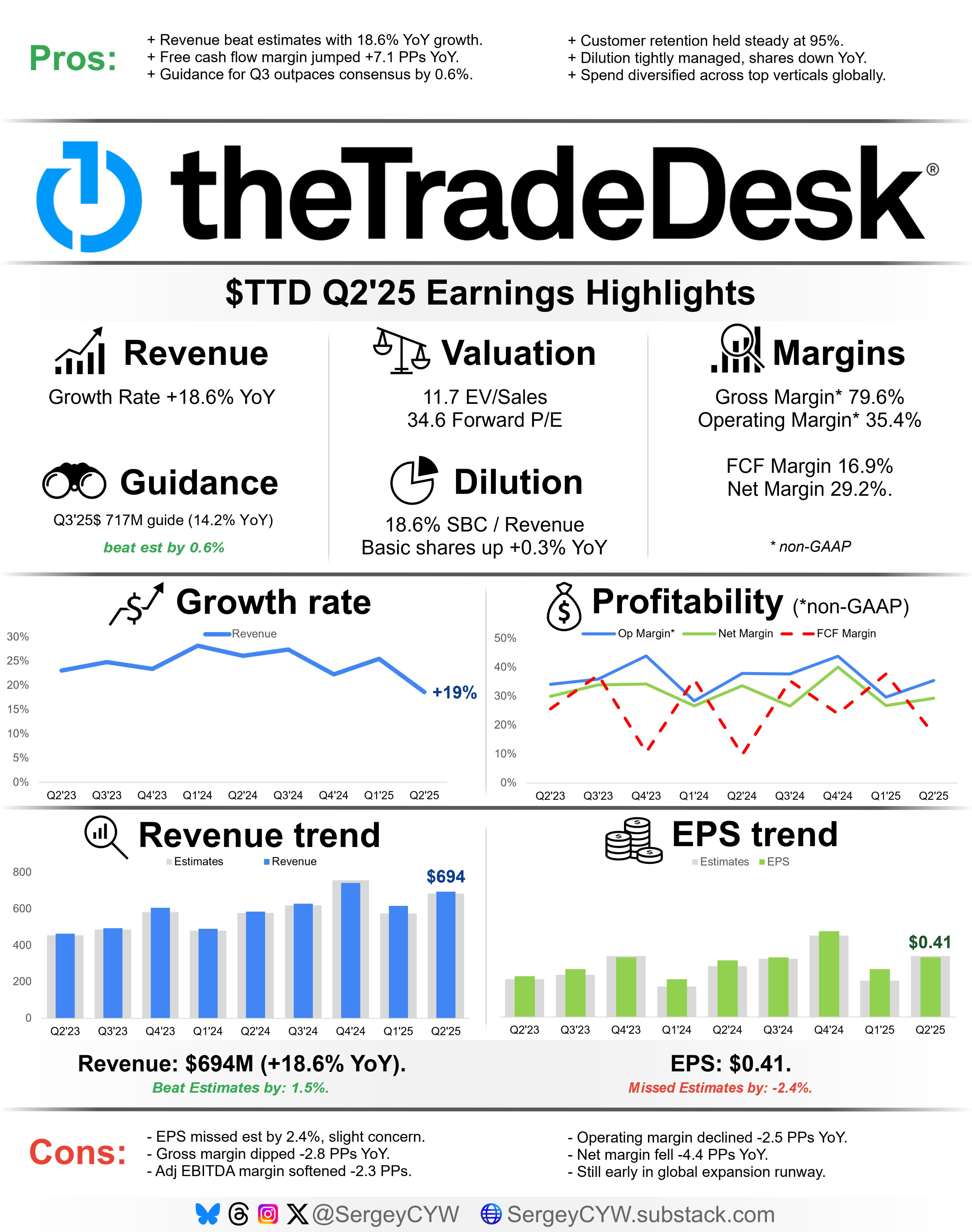

$Trade Desk Inc.(TTD)$ While the Q2 earnings report appeared solid—revenue grew 19% year-over-year to $694 million and profits slightly exceeded expectations—the market reaction was extremely pessimistic, with the stock price plummeting more than 26% in after-hours trading. Investors are clearly more sensitive to the combination of "slowing growth + lackluster guidance," leading to a significant disparity between market expectations and the company's actual performance, which became the core reason for the sharp decline in stock prices.

Detailed explanation of key financial data

Revenue and User Trends

Q2 revenue: $694 million, up ~19% year-over-year, slightly above market estimates of ~$686 million.

The cumulative growth rate for the first half of the year was ~22%, which is slightly slower than the overall growth rate for the same period last year.

Profitability and cash flow

Non-GAAP EBITDA was $271 million, with a margin of approximately 39%, exceeding the expected ~$261 million (~37%), but slightly lower than last year's ~41%.

GAAP net income was approximately $90 million, with earnings per share of $0.18 (GAAP) / $0.41 (Non-GAAP), slightly better than market estimates.

Guidance and Future Expectations

Q3 guidance: Revenue of at least $717 million, EBITDA of $277 million, broadly in line with market expectations, with no GAAP net income guidance provided.

Key Updates to Organizational Structure and Product Strategy

CFO Laura Schenkein has announced her resignation, and Alex Kayyal will take over as CFO in August and continue to serve as a member of the board of directors. At the same time, Omar Tawakol has joined the board of directors.

The company continues to promote the application of products such as Kokai (AI platform), OpenPath, and Unified ID 2.0 in areas such as CTV and retail media, and strengthen cooperation with ecosystem partners such as Visa, Instacart, and Snowflake.

guidance

Management's revenue guidance for Q3 is $717 million, representing year-over-year growth of approximately 17%, with adjusted EBITDA of $277 million and an EBITDA margin of approximately 38.6%, slightly lower than Q2. We believe the guidance is conservative, reflecting caution regarding macroeconomic uncertainty.

During the earnings call, CEO Jeff Green said, "Q2 was a strong quarter for us, with revenue growing to $694 million, up 19% year-over-year, and we continue to lead the digital advertising market." This statement is optimistic and reassuring, emphasizing the potential of Kokai and CTV, but also mentioning that macroeconomic fluctuations may affect future advertising demand.

Investment View

Structural perspective: Is the growth path stable?

Trade Desk is transitioning from a traffic platform to an AI + ecosystem platform, particularly through comprehensive布局 in areas such as CTV, retail media, and new identity systems (UID2), establishing a long-term competitive advantage. CTV and retail media are the core growth engines for TTD, while the AI-driven Kokai platform further solidifies its technological barriers, positioning it in a long-term viable market segment. Businesses reliant on short-term trends may experience strong international growth but could be impacted by global economic fluctuations, necessitating vigilance regarding advertiser budget adjustments. $Roku Inc(ROKU)$

Divergent perspectives: Have growth expectations been prematurely exhausted?

Although revenue and profits met targets, growth slowed from 25% in Q1 to 19% in Q2. Combined with guidance that failed to exceed expectations, the market is concerned that high valuations lack new growth drivers, leading to downside risks for valuation premiums.

The current valuation implies high growth expectations, with a P/E ratio of 108.54, far exceeding the industry average of 15.7, indicating the market's optimistic pricing for AI and CTV. The market may be overpriced, with a DCF fair value of only $28.39. If execution falls short of expectations, the stock could face a correction of over 20%. Comparable companies such as Zeta (Q2 revenue growth of 35.4%) and DoubleVerify (growth of 21.3%) have lower valuations, and TTD's premium will need to be justified by future growth.

Strategic Assessment: A Constructive Perspective

Deepening Kokai's full customer coverage (with over 75% of spending now processed through the platform) and enhancing AI-driven advertising efficiency improvements. Colleagues, during the CFO transition period, avoid imbalance between growth and cost control, particularly focusing on Edge ad buying, OpenPath conversion efficiency, and AI platform marginal benefits. Additionally, continue to drive initiatives with $Visa(V)$ $Snowflake(SNOW)$ $Instacart, Inc. (Maplebear Inc.)(CART)$ to build stronger traffic dominance and data barriers.

Comments