$Okta Inc.(OKTA)$ delivered commendable performance this quarter, with both revenue and non-GAAP EPS exceeding expectations, strong RPO growth, and significantly improved cash flow, while raising its full-year guidance. Particularly amid accelerating demand for AI-driven secure identity management, Okta leveraged its platform-agnostic advantage to secure major public sector contracts. While growth moderated slightly compared to previous quarters, the overall business mix remains high-quality with notable profitability efficiency. Overall, this quarter can be characterized as "upward momentum within a strong foundation", with a positive investment thesis.

Key Financial Highlights

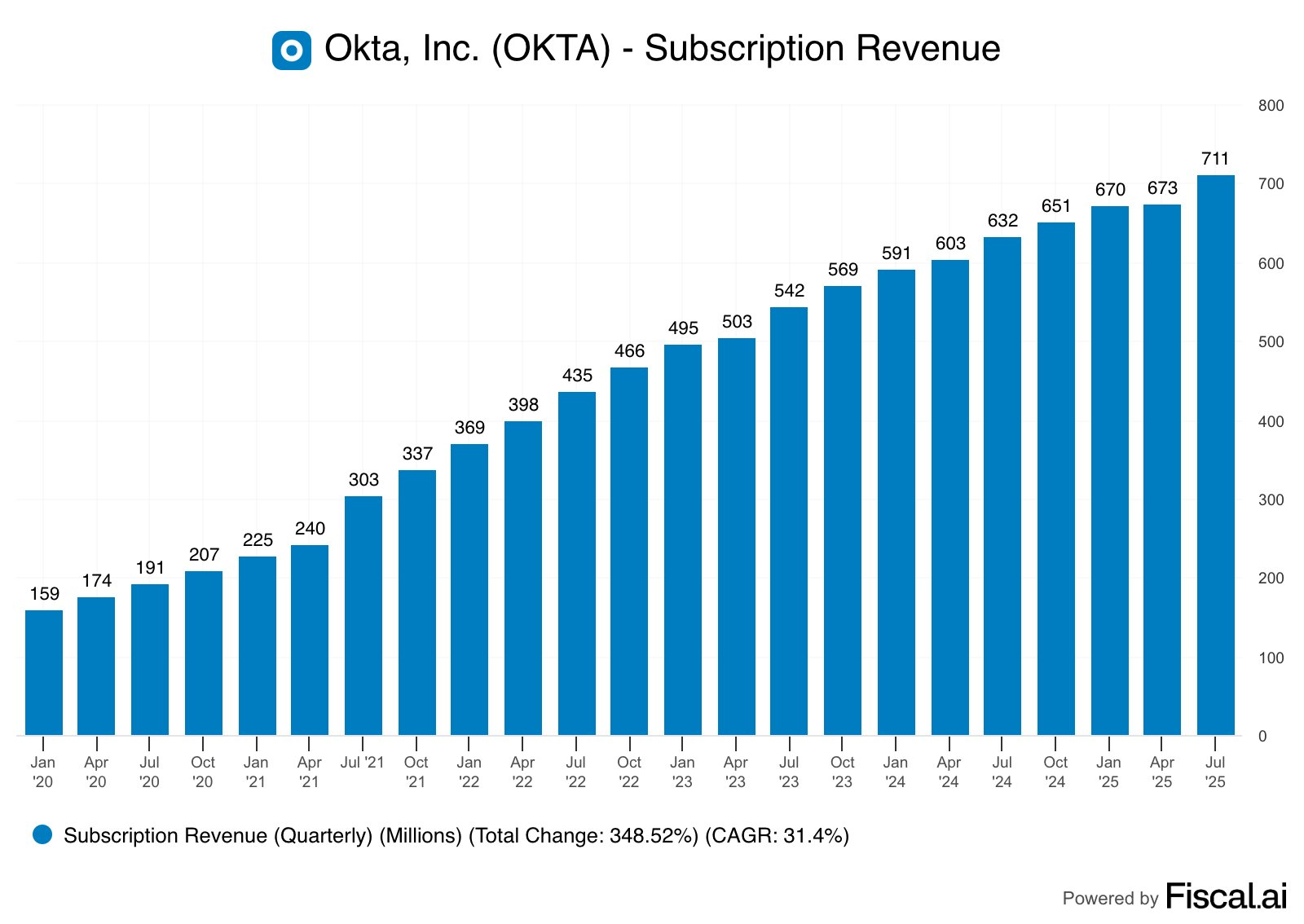

Total Revenue: $728 million, up 13% year-over-year and 5.8% quarter-over-quarter. This growth was primarily driven by subscription services, benefiting from strong adoption of new products (such as Identity Security Posture Management) and the Auth0 platform, as well as the execution of public sector contracts. The company emphasized the essential need for identity management in the AI era, driving expansion among large enterprise clients. This figure exceeded market consensus of $712 million, demonstrating strong business execution. Signs of shifting business structure emerged: increased contribution from the public sector indicates a transition from enterprise-level contracts toward more stable government contracts. However, subscription growth (+12%) slightly lagged behind total revenue, suggesting enhanced support from professional services.

Current Remaining Performance Obligations (cRPO): $2.265 billion, up 13% year-over-year. As a leading indicator of revenue over the next 12 months, cRPO reflects a robust accumulation of contract backlog, driven by strong renewals from federal agencies and the penetration of AI-related identity solutions. This metric exceeded analyst expectations of $2.26 billion, demonstrating demand resilience; however, the year-over-year growth rate slowed compared to the previous quarter, suggesting macroeconomic uncertainties (such as government procurement delays) are beginning to impact performance. Nevertheless, the overall result remains above market consensus, with signs of a business structure shift toward higher-value customers.

Non-GAAP earnings per share (EPS): $0.91, up 26% year-over-year. Profitability improvement stemmed from cost control and enhanced operational efficiency, with non-GAAP operating margin reaching 28% (up 5 percentage points year-over-year). This figure significantly exceeded expectations of $0.84, highlighting the company's inflection point from loss to profitability. Key drivers included a doubling of free cash flow to $162 million, reflecting enhanced cash generation capabilities. However, it should be noted that while GAAP net income turned positive ($67 million), it remains dependent on adjustments for non-recurring items.

Non-GAAP operating margin: 28%, up 5 percentage points year-over-year. This metric reflects the company's achievement of economies of scale through market specialization and product innovation, exceeding market expectations. The underlying logic stems from the high gross margin of the subscription model (approximately 76%) and cost optimization, though it remained flat quarter-over-quarter, indicating that expansion has stabilized. Business changes: Adjustments to Auth0's independent sales team are beginning to show results, signaling potential future differentiation of customer segments to enhance efficiency.

Free Cash Flow: $162 million, up 108% year-over-year. Strong cash flow benefited from operating cash inflow of $167 million (23% of revenue), exceeding expectations. Drivers included accelerated customer payments and cost savings. This metric outperformed consensus, reflecting a structural shift toward cash-rich contracts. However, caution is warranted as heightened macroeconomic pressures could impact customer payment behavior.

During the earnings call, the CEO stated that Okta's unified identity platform is winning customers ranging from the world's largest organizations to major government agencies. In the AI era, Okta's independence and neutrality will continue to empower organizations with the freedom to innovate securely. This statement leans toward optimistic reassurance, emphasizing the company's strengths as an independent vendor (in contrast to Palo Alto Networks' integration strategy following its acquisition of CyberArk). It aims to bolster investor confidence in the long-term trajectory. The underlying logic is to pragmatically acknowledge contract restructuring and delays (such as with civilian agencies) while mitigating short-term pressures by highlighting opportunities in "mission-critical" applications and AI agent identity management. This demonstrates management's maturity in balancing reality with future prospects.

Key Investment Highlights

Okta's core identity management business is positioned for sustainable long-term growth, particularly in the AI era where security demands for non-human identities (such as APIs and agents) will drive enduring expansion—unlike short-term, sentiment-driven businesses reliant on cyber incidents, such as certain incident response tools. The company's public sector expansion (e.g., FedRAMP-certified products) delivers stable cash flow, while Auth0's developer-centric platform captures emerging AI applications. This mirrors the successful transition from enterprise to government clients in previous quarters, avoiding overreliance on economically cyclical commercial customers.

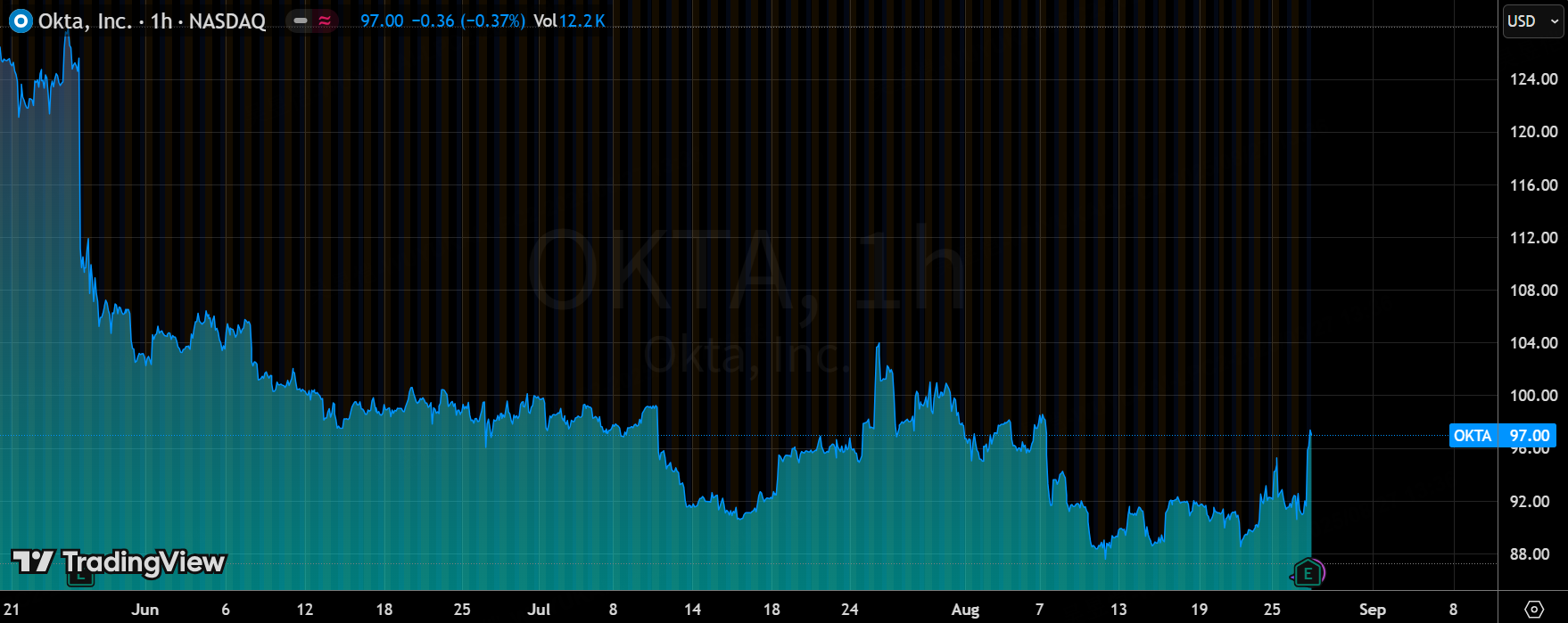

In terms of valuation, the current price implies approximately 10% long-term growth expectations. At an EV/FY26 Sales multiple of 5.4x, it trades at a discount compared to peers like MongoDB (7.1x) and Dynatrace (7.5x). The market appears to be pricing in the risk of growth deceleration but may be underestimating profitability and cash flow strength—Okta's free cash flow margin has reached 22%, outperforming many SaaS peers like Zscaler (ZS) at 15-20%. Compared to peers, Okta's valuation does not fully reflect the premium associated with its position as an independent vendor (whereas CrowdStrike CRWD commands higher multiples due to ecosystem integration premiums). Should AI adoption accelerate, valuation expansion could occur. However, the market is currently fairly priced, and short-term caution is warranted: a further decline in cRPO growth could trigger downward revisions.

Strategically, management's focus on key accounts and product innovation shows no significant missteps; rather, it warrants amplification—such as completing the market specialization adjustment to enhance Auth0's independent sales efficiency. The acquisition of Axiom Security (though minor in impact) signals the company's shift toward platformization and horizontal expansion into AI security. Comparable to past quarters, this mirrors an evolution from single authentication to a governance suite. Management is advised to further emphasize bundled sales with federal contracts to secure high-retention revenue streams.

Regarding variable indicators, investors should continuously monitor cRPO growth (as a leading demand indicator), AI product penetration rates (such as adoption of authentication for GenAI), and shifts in government contract structures. Should these metrics exceed expectations—such as the execution of more AI agent management contracts—they could catalyze valuation repricing. Conversely, macro delays or intensified competition (e.g., Palo Alto's ecosystem integration) may serve as warning signals, triggering short-term volatility.

Comments