Over the past few months, the market has been asking one question: Is AI the hammer that demolishes old structures, or the cement and rebar that builds upon them?

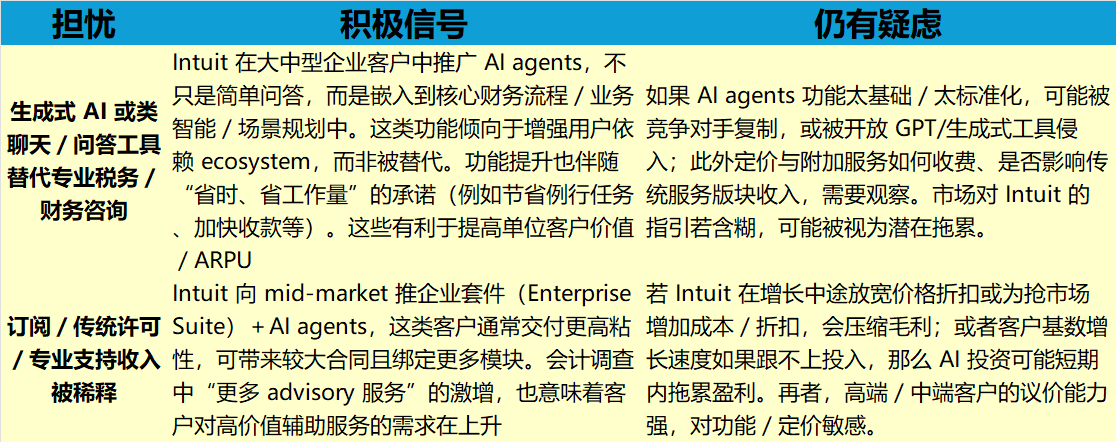

This issue is particularly sensitive for companies like Workday and Intuit, whose business models fundamentally rely on subscriptions, seats, services, and specialized financial/accounting or human resources processes. The rise of AI brings both anticipation and anxiety, fueled by concerns that new AI agents and offerings could ultimately cannibalize traditional segments and dilute customer payment models.

However, I have observed that several key events this week have begun to build a counter-narrative in reality.

WDAY: AI Isn't About Disruption, but Integration and Expansion

The acquisition of Sana, valued at approximately $1.1 billion, is a company specializing in AI-driven knowledge management and learning platforms. This transaction is not merely about touting "AI" but about deeply integrating capabilities such as knowledge, learning, agentic workflow, and low-code agent tools into Workday's core HR + finance product line. $Workday(WDAY)$

Activist investor Elliott Management has entered the fray, purchasing over $2 billion in shares and publicly backing its leadership and strategic direction, particularly following the Financial Analyst Day.

Q2 subscription revenue increased by 14%, with total revenue growing by 12.6%. This indicates that its core revenue business continues to expand steadily, and the adoption rate of new AI SKUs is exceptionally high: "Over 70% of net-new deals include AI modules or SKUs; the proportion of existing customer transactions incorporating AI is also rising."

Do these events alleviate concerns about AI cannibalizing each other?

Overall, Workday tends to send positive signals. AI is positioned as a new engine for revenue growth, driven by "add-on growth + module stacking." Its subscription revenue, AI SKU penetration rates, and partner/ecosystem expansion all indicate that AI enhances current operations rather than significantly replacing them. Workday counters market concerns about AI eroding traditional SaaS core revenue models with concrete data.

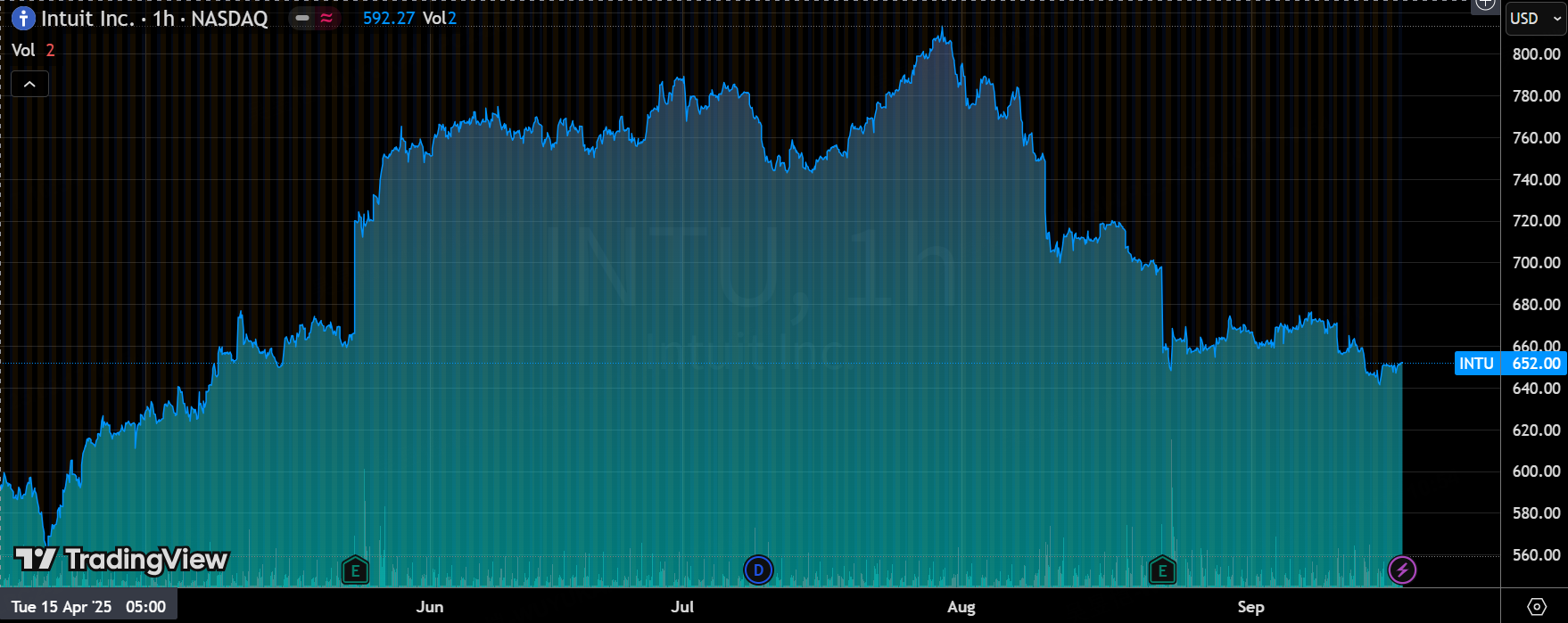

INTU’s AI agents

The latest "Accountant Technology Survey" reveals that a high proportion of accountants/accounting firms believe AI enhances productivity (81%) and anticipate shifting more traditional compliance/routine tasks to technology/AI-driven tools to free up time for advisory/strategic work.

Based on conferences such as Morgan Stanley, revenue and growth from mid-market and high-end clients (mid-market + QBO Advanced + IES enterprise suite) are accelerating.

Is it enough to ease concerns about AI encroachment?

Other companies

Zoom (ZM)

$Zoom(ZM)$ reported Q2 2026 revenue growth of approximately 4.7%, with enterprise revenue increasing by ~7%. The market was dissatisfied at the time.

Launching agentic AI capabilities such as Virtual Agent 2.0 and Custom AI Companion add-ons, with significant growth in contact center operations where AI supports live agents and automates tasks.

The company raised its full-year revenue and profit guidance, citing AI capabilities as one of the driving factors.

This model reinforces the concept that AI can generate additional revenue while increasing average transaction value in the enterprise segment and expanding product boundaries.

CrowdStrike (CRWD)

$CrowdStrike Holdings, Inc.(CRWD)$ reported better-than-expected second-quarter results, with both total revenue and ARR growing. Net new ARR reached approximately $221 million, surpassing the same period last year.

Meanwhile, its new product Signal (AI-powered threat detection) has launched and is now generally available (GA), emphasizing its ability to detect subtle activity during the early stages of an attack—outperforming traditional rules and static models.

Although the guidance for the upcoming quarter reflects caution (due to uncertainties in customer spending, etc.), the overall trend remains upward. Compared to WDAY and INTU, this also supports the strategy of "AI enhancing defense capabilities and product depth/platforming."

Positive signals prevail, but be wary of turning points.

In summary, I believe the current trajectory of events is largely positive: Workday and Intuit are leveraging AI as a "growth lever" rather than engaging in "self-cannibalization." However, this assessment hinges on certain prerequisites and carries inherent risk points.

Premise/Supporting Point:

The revenue contribution from AI SKUs and agents must continue to rise and be visible to the market.

Customer retention rate + pricing premium + module expansion + ecosystem partnerships and partner contributions must be clearly demonstrated (WDAY's partner channels, new modules, and marketplace app expansions are all positive examples in this area).

Management continues to maintain transparency in its guidance, avoiding ambiguity, particularly regarding the impact of AI investments versus returns versus traditional business revenue and gross profit margins.

Risk Node:

Generative AI tools or open platforms, if introduced, are likely to offer AI agent-like capabilities at low prices or with low barriers to entry. This could potentially capture low-end demand or depress prices for niche features.

Cost Control: While AI capabilities can enhance user experience and efficiency, excessive costs associated with training, maintenance, inference/infrastructure, and model updates can erode profit margins.

Customer adoption speed and usage depth: If many customers merely "test drive" AI agents with limited usage or small budgets, it will be difficult to significantly boost the company's overall revenue.

The overall trend is more likely to favor "Positive Leverage > Cannibalization," particularly for WDAY and INTU. The market now appears increasingly receptive to the view that AI ultimately serves as an amplifier—enabling these companies to sell more features to their core customer base, increase ARPU, expand their product ecosystems, and reduce reliance on manual or service-intensive processes.

Comments