Let's discuss $Tesla Motors(TSLA)$ 25Q3 earnings.

Overall, the company is making a graceful exit from its traditional automotive business and shifting toward the "spark" era of autonomous driving and AI. While the financial results were mixed, Elon Musk dropped a series of bombshells during the earnings call that truly caught everyone's attention.

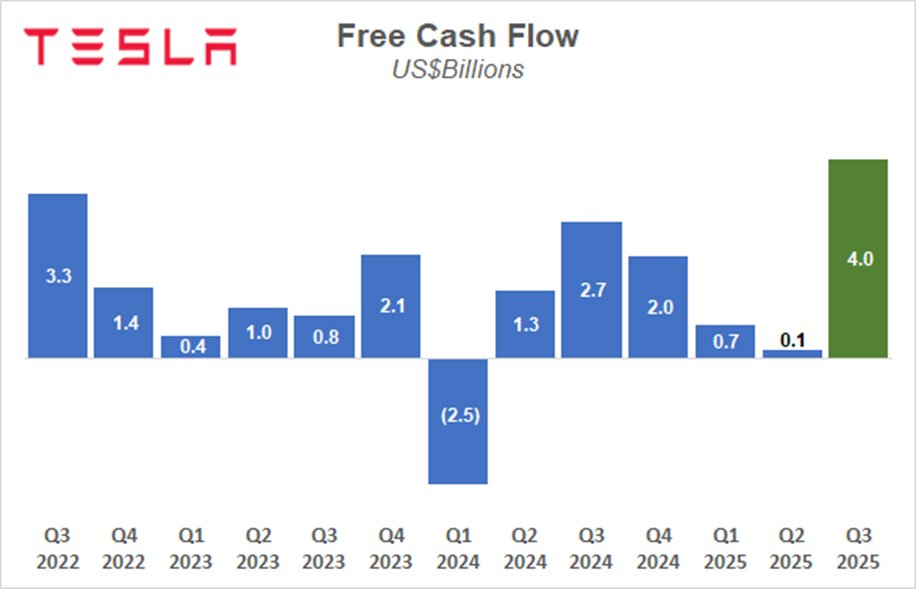

First, let's look at the financial report: The numbers are "pretty standard," but the cash flow is mind-blowing.

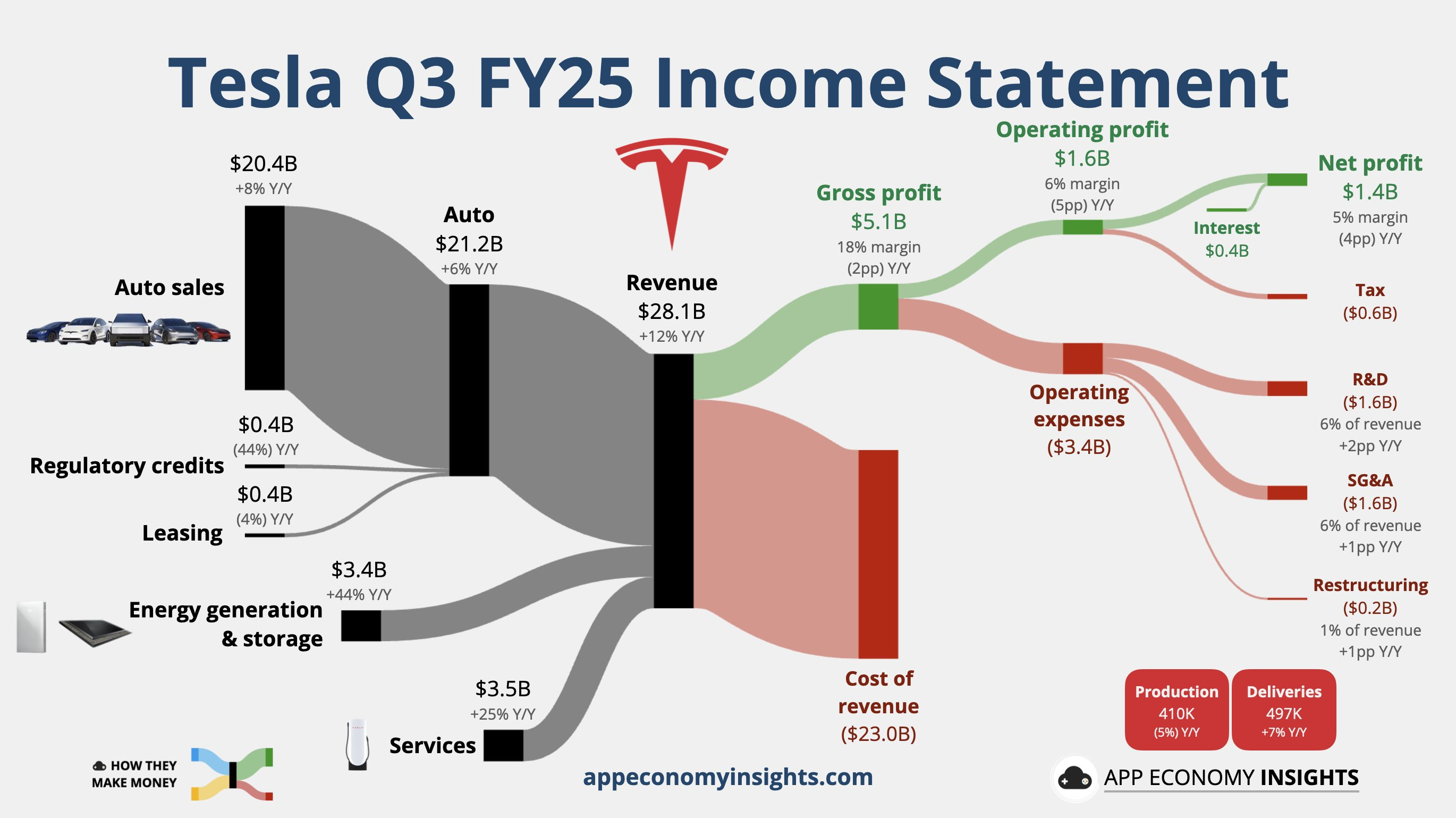

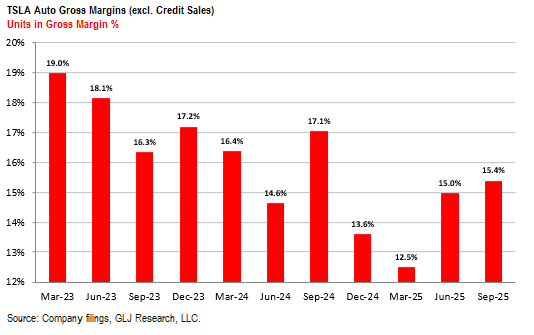

Q3 earnings were "in-line" with expectations, delivering solid numbers that won't shake market consensus but demonstrate high quality. Total revenue reached $28.1 billion, surging 11.6% year-over-year (with a 29% quarter-over-quarter increase mentioned in the conference call), exceeding the market consensus of 7.17%. The automotive segment's share declined to 75%, with energy and services emerging as new growth engines. Energy and services revenue surged 44% year-over-year, while services revenue grew 25%. Gross margins reached 20.9% for energy and services and 18% overall. Excluding regulatory credits, automotive gross margin rose slightly to 15.4%, indicating effective cost control.

The most eye-catching figure is the free cash flow (FCF), a whopping $4 billion—more than triple the consensus estimate! Inventory stands at just 10 days' supply, while cash reserves have surged to $41.6 billion. During the conference call, CFO Vaibhav Taneja emphasized: "We never shy away from challenges. Bringing AI into the real world is difficult, but we've done it." This also underscores Tesla's shift from traditional automotive manufacturing toward a recurring revenue model.

EPS of $0.50 missed expectations by 7.41%, but net income of $1.37 billion remained largely unchanged. Tariff impacts exceeded $400 million (half from automobiles and half from energy), a point also raised during the conference call, indicating significant macroeconomic pressures.

Key Takeaways from the Conference Call: Robotaxis, FSD, and Optimus Take Center Stage—Is Musk Building a "Robot Army"?

Robotaxi: The Era of Driverless Operation Has Arrived! The market had previously anticipated removing safety drivers in Q1 2026, but Musk was more aggressive at the meeting: "We expect to achieve driverless operation across most of Austin by year-end, with full coverage within months." Currently, Robotaxi has accumulated over 1.25 million miles in Austin and the Bay Area, with the fleet seamlessly integrated and requiring no additional sensors. Plans to expand to 8-10 metropolitan areas by year-end, including Nevada, Florida, and Arizona (subject to regulatory approval). Musk emphasized the vehicle will feel like a living entity. Cybercab (a steering-wheel-less model designed specifically for autonomy) will enter production in Q2 2026, targeting an annual production capacity of 3 million units with a potential ARPU of $1.46 per mile.

FSD: European and Chinese approvals underway, safety surpasses human capabilities. The meeting confirmed FSD has accumulated 6 billion miles of supervised driving data. V14 has been rolled out to US users, with V14.2 enhancing comfort. By year-end, V14.3/14.4 will add "reasoning" capabilities. Musk expressed full confidence: "100% certain unsupervised FSD is safer than human driving." " China and European approvals are progressing. Ashok Elluswamy (Head of AI) stated: "Safety is the priority, and customer feedback has been excellent." FSD is the "highest-margin product" (90% subscription margin), and approval will be a "major unlock."

Optimus: From Sci-Fi to Reality, Million-Unit Production by 2026 Musk called Optimus "the toughest challenge ever," noting that hand dexterity proved harder than full-body development—yet the entire supply chain was built in-house. The robot currently navigates offices 24/7, guiding people to meetings. V3 debuts Q1 next year, resembling "humans wearing robot suits"; production launches late 2025, reaching 1 million units/year by late 2026. Optimus 4 targets 10 million units, Optimus 5 aims for 50 million units. Musk warns: "What if I build a massive robot army only to get ousted?" This directly links to his compensation package—requiring 20% voting rights to prevent "takeover." The meeting emphasized Optimus's AI transfer for vehicle use, achieving five times human productivity (24/7). This aspect holds significant valuation potential.

xAI Investment: It's Not About Money, It's About AI Synergy Conference clarifies complementarity between xAI (Grok) and Tesla AI: Grok pursues AGI (massive models, Grok 5 requires GV300), while Tesla models are smaller (5% size) and focused on the real world. Grok will be used for vehicle/robot voice systems.

Other Highlights: Energy Surge, No Starlink Updates Energy storage hits record levels, Megapack/Powerwall demand through 2026; new Megablock/Megapack 3 unveiled, solar panels shipping Q1 2026. Tesla Semi trial production in H1 2026, mass production in H2. Mission updated to "Sustainable Abundance"; AI addresses poverty/healthcare (Optimus as surgeon). Risks include supply chain, regulation, competition, tariffs. CapEx $9 billion in 2025, significant increase in 2026 for AI/Optimus.

The conference call, much like Musk's "AI Manifesto," far surpassed the dull earnings report. Market concerns over "execution risks" and "Dojo services not gaining market acceptance" received positive responses here, though regulation remains a variable.

Competition intensifies, but Tesla's AI momentum shows no signs of slowing down.

Morgan Stanley lists downside risks: Mag 7 and big tech competition, factory ramp-up challenges, China exposure, valuation bubbles. Conference mentioned tariffs exceeding $400 million and supply chain hurdles, but Musk remains optimistic: "We are the real-world AI leader." Upside potential: FSD adoption rate growth, new vehicle models (Cybertruck/Semi), third-party battery orders.

This earnings report highlights Tesla's AI platform more than its automotive business. While the stock price may fluctuate in the short term, if you believe Musk can successfully "steal fire," the long-term potential is compelling.

$Direxion Daily TSLA Bull 2X Shares(TSLL)$ $Tradr 2X Short TSLA Daily ETF(TSLQ)$ $GraniteShares 1.25X Long TSLA Daily ETF(TSL)$

Comments

Be smart buy Nio!