After reporting Q2 earning, $Palantir Technologies Inc.(PLTR)$ fell 15% on trading day on with a profit miss and a lowering full-year guidance.

For Q2,

- Revenue increased 26% year-over-year to $473 million, slightly above consensus of $472 million;

- Gross profit of $382 million, up year-over-year and in line with consensus;

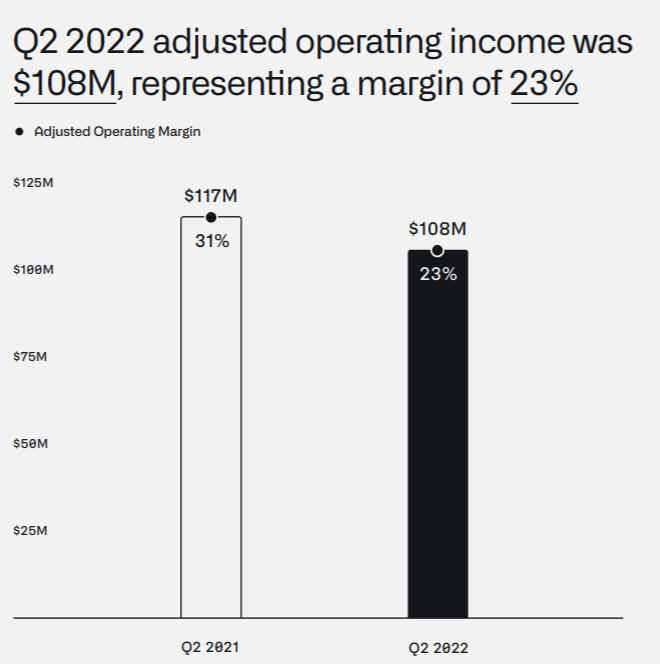

- Adjusted operating profit of $108 million, up year-over-year and slightly above consensus of $101 million;

- Adjusted EBITDA of $113 million, above market expectations of $105 million;

- Adjusted diluted earnings per share $-0.01, missing estimates of $0.03;

- Free cash flow $56.97 million, compared to market expectations of $72.95 million.

Government revenue come to $263 million, up 13.3% year on year, while commercials performed better at $210 million, up 46.3% year on year.

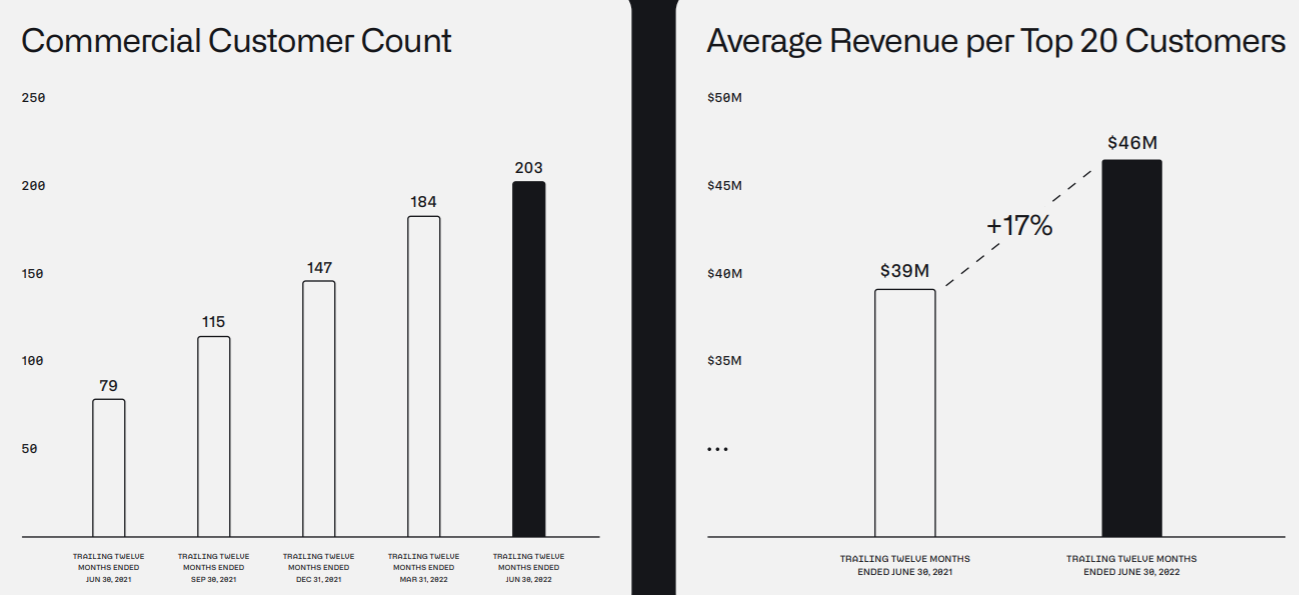

In terms of the number of customers, the net number of customers was 304, a net adds of 27. Besides, 203 of them were commercial customers, compared with 79 in the same period last year, while U.S. commercial customers increased from 34 customers in Q2 2021 to 119 in Q2 2022.

The biggest miss was the guidance. For the full year, the company expects total revenue to be in the range of $1.90 billion to $1.902 billion, an increase of approximately 23%, compared with previous forecasts of approximately 30% or higher and market consensus of $1.96 billion.

Meanwhile, the company expects Q3 revenue to be in the range of $474 million to $475 million and adjusted earnings of $54 million to $55 million, compared to market consensus of revenue $506.9 million and adjusted operating earnings of $116 million.

In fact, government orders are not decided by Palantir, only up to the governments. Markets expect an increase in the defence budgets of NATO members in the Russia-Ukraine crisis, but failed.

U.S. Revenue growth recovered to 45%, which means non-U.S. business was quite weak.

Why is NATO are not intereted in spending? There could be several reasons.

First, the strong dollar increased the cost, especially in Europe;

Second, the inflation make the government tightening in expenditure;

Third and simplest, NATO members have already been paying for "protection", why do they have to pay more on datas? After all, the Russia-Ukraine crisis seems not to escalate to a higher level.

So, PLTR can't rely on government, but on commercialization. In the commercial data analytics market, PLTR will face competition, which will inevitably increase the market cost.

PLTR's techs is excellent, but the actual business companies may not need the very scarce technology, business needs and government needs are not the same, so companies like Microsoft, Oracle and others have already launched similar services, which makes PLTR into a hot field of competition.

In addition, another "drawback" of PLTR is stock-based compensation. While adding to the burden on profits, non-cash compensation in these shares can also depress the company's share price in the secondary market. PLTR is also investing in SPAC companies to gain access to various markets in different industries. But now that the SPAC is also heading down in a volatile environment, even bigger losses cannot be ruled out.

Comments