Advertising companies' Q2 performance divided. $Snap Inc(SNAP)$ and facebook $Meta Platforms, Inc.(META)$tumbled after miss the expectations, and the streaming CTV platform $Roku Inc(ROKU)$ also lowered its guideline, while Google performs good on its platform advantages to maintain the ads.

As the largest independent demand platform in the adtech, $Trade Desk Inc.(TTD)$'s Q2 results were also a surprise. Unexpectedly, the annual performance guidelines were raised when the revenue and profit "exceeded expectations".

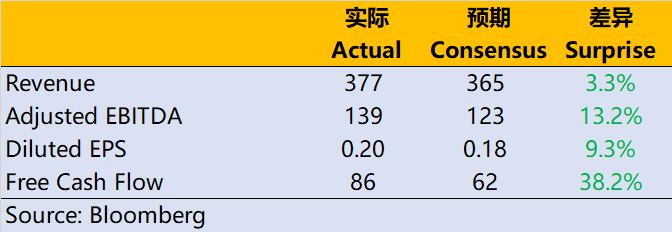

Q2 Performance:

- Revenue was US $376 million, a year-on-year increase of 34.7%, higher than the market expectation of US $364 million;

- The adjusted EBITDA was US $139 million, a year-on-year increase of 17.8%, higher than the market expectation of US $123 million;

- The adjusted diluted earnings per share was 0.2 US dollars, higher than the market expectation of 0.18 US dollars;

- Free cash flow reached 86.01 million US dollars, higher than the market expectation of 62.25 million US dollars.

At the same time, Q3's revenue is expected to be US $385 million, which is higher than the market expectation of US $382 million, and EBITDA is expected to be US $140 million, which is higher than the market expectation of US $90 million.

As an advertising platform, why can TTD raise its performance guidelines beyond expectations?

The main reason is that, Google is pushing off the depreciation of "third-party cookies" again.This is very important for the demand advertising platform. To be frank, Google will replace "third-party cookies" with a "Privacy Sandbox", which is the same as$Apple(AAPL)$ did to prohibits tripartite advertisers from tracking user behavior. The demand advertising platform like TTD is mainly to improve the efficiency of advertisers, but once the user behavior cannot be tracked, advertisers may withdraw.

From$Snap Inc(SNAP)$And$Meta Platforms, Inc.(META)$In the previous financial reports, investors have clearly discovered the importance of user privacy policy.

As long as Google delays this policy (currently postponed until the second half of 2024), the existing advertising intensity is more likely to be maintained. But$Alphabet(GOOG)$By postponing this policy, it also leaves more room for its own advertising, and it also needs to adopt a way that has the least impact on its own advertising business.

Of course, TTD is not waiting to die, and is currently adopting the new digital advertising technology of UID2 instead of cookies.

In addition,TTD is also one of few foreign companies that can directly enter the Chinese advertising market with unique channels, that Link Chinese advertisers to overseas platforms.

Therefore, compared with Meta, Snap and Roku, which focuses on streaming media, TTD does have incomparable advantages. At present, as long as Google's policy does not change, its performance will be better than other platforms.

Comments

Like please