$Uber(UBER)$ Q2 earnings released. Market's eye on Pelosi, but the outstanding performance really made investors excited, UBER surge nearly 20% .

A overall beat on Q2 performance

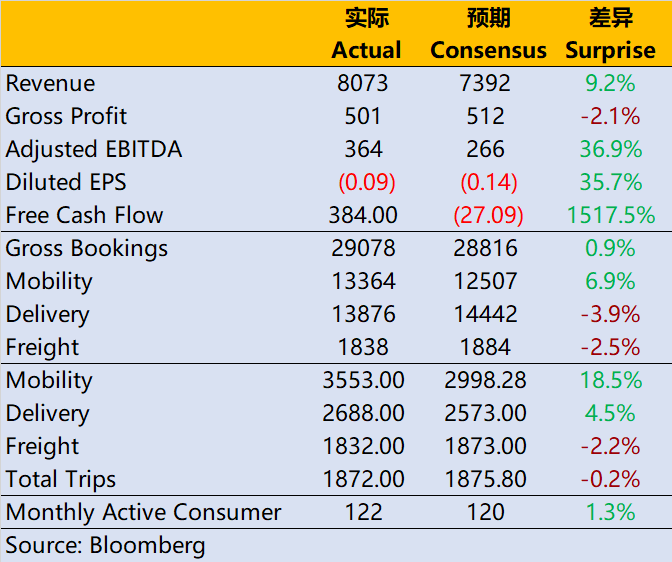

- The overall revenue was 8.07 billion US dollars, a year-on-year increase of 105%, higher than the expected 7.39 billion US dollars;

- The adjusted EBITDA reached 364 million US dollars, a year-on-year increase of 171.5%, higher than the expected 266 million US dollars;

- Free cash flow was US $382 million, an increase of US $780 million over the same period of last year and higher than the expected-US $27 million.

From operation,

- The monthly active users reached the highest level of 122 million in history, which has exceeded the level in 2019 before the epidemic and is higher than the expected 120 million;

- The overall order volume reached 1.82 billion, a year-on-year increase of 24%, higher than the expected 1.81 billion;

- The order amount reached US $29.08 billion, up 32.8% year-on-year, higher than the expected US $28.82 billion.

UBER's three major business lines: mobility, delivery and freight , all performed well.

In terms of mobility, activl orders means that the travel market is far more active than expected. The order growth rate of mobility reached 55%, and the total booking amount exceeded 13.36 billion US dollars, which was the highest level in history. On the one hand, it is the enhancement of offline economic activities, on the other hand, it may also be related to high oil prices, which increases the amount of spelling orders (the Take rate of spelling orders usually is high). But at the same time, UBER has the price well controlled, and the overall order "Take Rate" has reached the hsighest 26.6% in all time high, so the overall revenue of shared travel has greatly beat estimates.

Like Wal-Mart, afraid of losing market share, bears the pressure of rising raw materials and it's profit hurt. With the stabilization of competition in recent years, UBER's shared travel industry has formed an "oligopoly" market with high bargaining power.

In the delivery, the overall order amount also reached 13.88 billion US dollars, up 7.5% year-on-year, but the growth rate is not high. However, due to the pandemic last year, the delivery performed against the trend, so the base was high. The Take Rate of the take-out business also reached the highest level of 19.4% in history, so the revenue of the take-out business also exceeded expectations.

Interestingly, UBER's travel and take-out business are precisely the two most influential items in this wave of inflation in the United States-energy and food. Energy price increase is a nightmare for all drivers, and food price increase is also a test for restaurant business. However, UBER seems to make good use of its influence in the industry and set a reasonable price, so that its business has not been greatly affected and achieved the effect of "rising volume and price".

At the same time, UBER's revenue from another freight business was US $770 million, with a growth rate of 331%, but it was mainly due to the acquisition of Transplant, another company in the same industry. Of course, even if there is no acquisition, the performance of Q2, a service provider in the supply chain, will not be too bad.

Of course, in terms of profit, UBER's net profit is still negative, not only because of the high growth of marketing expenses caused by marketing strategies in different regions, but also because there are many non-cash expenses, such as restructuring, investment gains and losses, equity incentives and so on. If you look at EBITDA, the growth rate is also 171%, which is equivalent to a "profit" of 300 million US dollars.

Cash flow also improved simultaneously, with operating activities providing 440 million US dollars in cash and free cash flow reaching 380 million US dollars.

Of course, we also need to observe that after 2 days,$Lyft, Inc.(LYFT)$Financial report, whether the simple travel business has really recovered to the level before the epidemic, and whether the market share of shared travel has changed.

Comments