Summary

- Nvidia's GPU stronghold provides it with secular growth attributes.

- CPU market penetration could tap into the data center space, with time-series AI providing a value-add.

- Supply Chains are still a mess, but a few critical aspects are shifting. In addition, Nvidia has market dominance, providing it with bargaining power.

- The stock's recent downturn has led to it being undervalued on a relative basis.

- A quantitative risk analysis implies that it's an extremely risky bet. However, the recent sell-off is likely overdone.

I'm sure the majority of semiconductor investors are relatively discouraged after most related stocks have experienced significant drawdowns since the turn of the year. However, after analyzing the industry and Nvidia's (NASDAQ:NVDA) role, we've concluded that there's been an overreaction by market participants and that Nvidia, the most prominent GPU producer, is part of a secular growth pattern that's currently underpriced by the market.

Market & Product Analysis

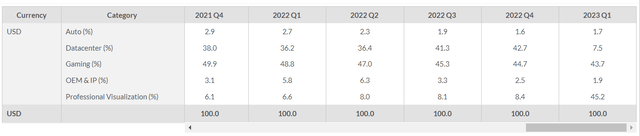

Nvidia's exposure is still concentrated on gaming and professional visualization, with the two markets combined making up nearly 90% of the firm's revenue mix. Nvidia's gaming unit is currently being driven by robust growth in desktop GPUs, with high-end demand for its GeForce RTX 30-Series products continuing.

Due to the growing demand for enterprise AI, I see much scope emerging for Nvidia's data centre operations. Existing GPUs provide image recognition abilities. However, the company's newly launched Grace CPU chip provides time-series attributes that could end up being a big breadwinner for the firm.

BusinessQuant

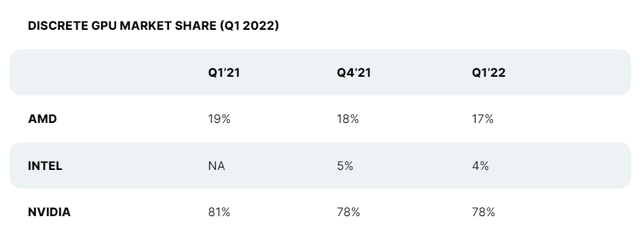

As mentioned, Nvidia's primary focus is on GPUs, where it owns approximately 78% of the market, which provides it with significant pricing power. The firm's pricing power is conveyed by its ROIC (Return on Invested Capital) ratio of57.48%(explanation here) and its gross margin of65.26%. Gross margins are a valuable indicator of economies of scale. Nvidia's economies of scale status allows it to take advantage of matters such as bargaining power over its suppliers and pricing power over its customers.

As Nvidia expands into the CPU market and as competitors enter the hotly contested semiconductor industry, we'll likely see a slight dilution of its GPU market share. Nonetheless, the firm's massive exposure to a market (GPUs) with a projected 2020-2025 CAGR (Constant Annual Growth Rate) of32.7%means that Nvidia is a secular growth stock, and transitory economic downturns don't provide much of a headwind.

WCCF TECH

AI Could Really Spark Nvidia's Growth Trajectory

I mentioned before that Nvidia could tap into the AI market. I'd like to expand on this, as many aren't quite familiar with the growth areas in the market.

Nvidia recently launched a library called cuDNN. The library is a database for artificial neural network (ANN) related concepts. ANNs are state-of-the-art AI networks that mimic the human brain to replicate time-series and image recognition patterns.

Time-series patterns can be applied to various enterprise solutions and automotive applications. In contrast, image recognition can be applied to artificial art, fashion, and advertising.

In essence, Nvidia has the scope to pivot with its existing technology into a neural network market that's growing at21.5%per year.

Supply-Chain Aspects

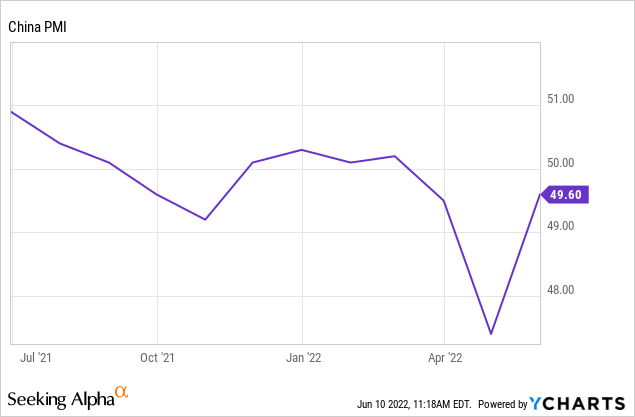

Let's start by looking at the main congestion points in the supply chain. First of all, we need to look at Polysilicon production, which has increased by7.24%since April in China. This is a tremendous positive for the semiconductor domain and related industries. A broader look at production conveys that China's PMI is gathering steam again, providing optimism to supply chain prospects.

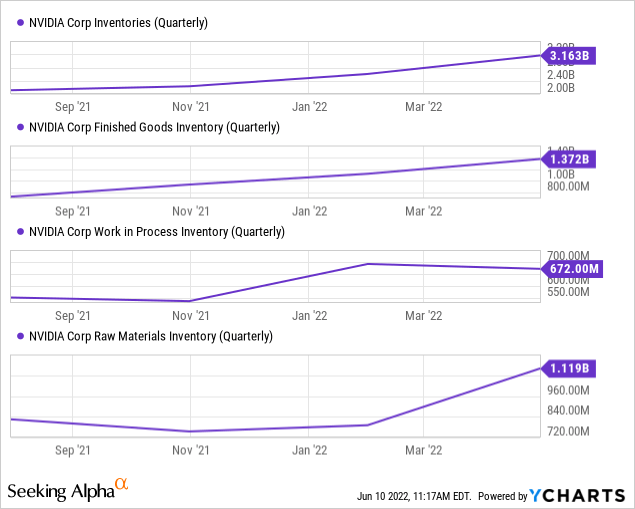

Furthermore, Nvidia itself is stocked with inventory, as it's experienced a year-over-year increase in finished goods and raw materials. Processed goods are an issue. However, with the PMI in China picking up, processed goods will likely come good soon.

Although I'm generally bullish about Nvidia's supply-chain issues, I'm concerned about the Russia-Ukraine war. Russia, Belarus, and Ukraine are massive exporters of ferrous metals. If we're in an ex-Black Sea trade globe, we'll likely see input costs continue to rise in the semiconductor space, as primary sector procurement restructuring will take considerable time. Lastly, China's Covid-19 lockdown policies are uncertain and inconsistent. Thus, supply-chain consolidation could be at risk.

Relative Valuation

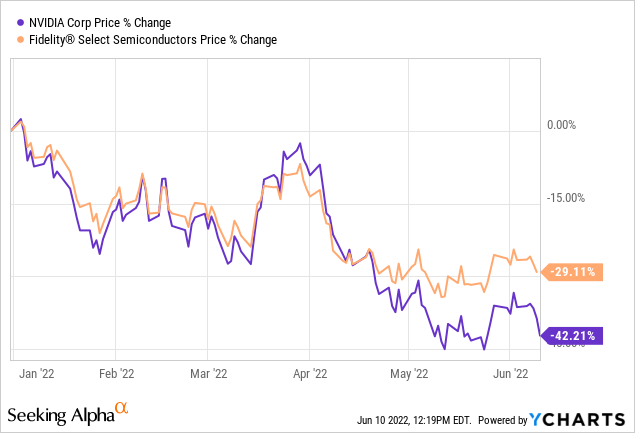

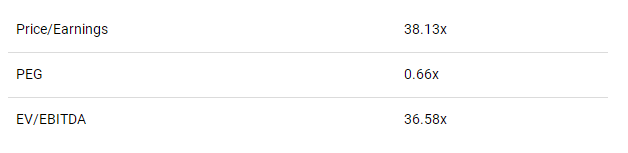

It's clear that Nvidia's potential to expand is there. Yet, from a stock investing vantage point, we must discover whether the possibilities have been priced in or not. Before its more than 40% year-to-date downturn, I'd say we'd be having a different conversation right now. However, relative valuation metrics imply that Nvidia stock is undervalued at its current price.

Nvidia's price-earnings is at a 21.77% normalized discount, which means that it's trading lower than its 5-year cyclical average. In addition, the stock's PE is accommodated by a PEG, which is below its 1.00x valuation threshold. A PEG ratio of below1.00xconveys that the firm's earnings-per-share growth is outpacing its P/E growth. Thus, considering both metrics cohesively, we can conclude that Nvidia stock is undervalued on an earnings-per-share basis.

Furthermore, the stock's EV/EBITDA suggests that the market undervalues Nvidia's operating earnings before depreciation and amortization, as the metric is at a22.50%discount to its 5-year average.

Quantitative Risk Analysis

Quantitative risk measures contextualize the risk/reward we're getting whenever we invest in a stock. Additionally, it helps us stay away from the panic button as we're aware of what kind of stock price deviations to expect.

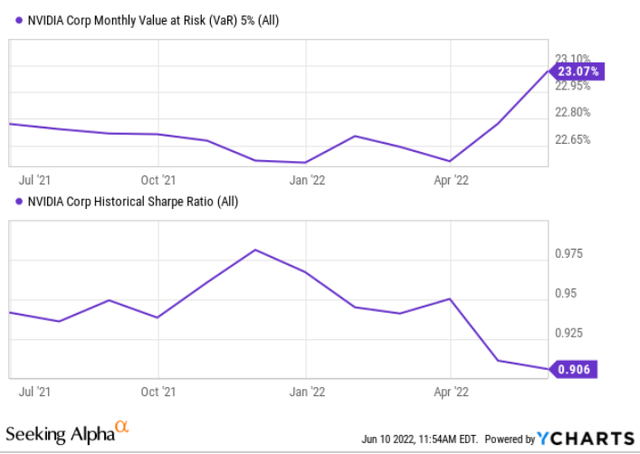

Nvidia's stock doesn't provide an ideal Sharpe Ratio (below 1.00x), which can be explained by its Value at Risk. The VaR indicates that Nvidia's stock could lose 23.07% of its value in a month, 5% of the times.

These deviations are quite substantial. However, consider that Nvidia's already lost nearly half of its value since the turn of the year and that these statistical downward deviations usually occur whenever the stock's topped out.

YCharts on Seeking Alpha