Critical information for the U.S. trading day.

What comes after a spectacular move down for stocks followed by a stunning rebound? Equity futures aren’t giving much away so far on Tuesday, as investors wait for testimony on Capitol Hill from Federal Reserve Chair Jerome Powell (see the buzz for more on that).

While the market has decided, for now, to look past any inflation threats, as the Fed keeps telling us it’s transitory, that action has created a blind spot among investors, cautions ourcall of the dayfrom Mary Lisanti, president of Lisanti Capital Growth and manager of the Lisanti Small Cap Growth Fund ASCGX,+2.35%.

“There is a firm belief that companies will not be able to offset costs by raising prices, and it’s totally not true,” particularly in areas that have seen capacity disappear, Lisanti told MarketWatch in a recent interview.

Pockets where companies can probably raise prices could be found in retail and restaurants, which have seen tons of businesses close, while building materials and semiconductors are in demand, yet no one is building new plants. Think cyclical companies that have pricing power and drivers of growth that are more secular than cyclical, or secular growth stories that can deliver growth and show a path to profitability, said the 36-plus-year veteran of small cap research.

She also sees a clear stock pickers’ market ahead, as equities just can’t keep going up in a straight line. “I think the big story of the markets is it’s going to be more dispersion, so it should be better for active managers,” she said.

Lisanti appeared in this columnabout a year ago, with recommendations such as pet-food maker FreshpetFRPT,+1.22%and cloud contact center Five9FIVN,-0.17%,both up more than 60% over a year. Her fund has returned about 54% over a year and 24% over an annualized three-year basis.

One she is flagging now is SI-BONESIBN,+1.72%,an orthopedic group that has developed a minimally invasive way to treat sacroiliac joint disorders. The company has beefed up its sales force through the COVID-19 pandemic and has a “very differentiated product,” that caters to a big market. “We think this is one of the ones that clearly has a path to profitability,” and not just from pent-up pandemic demand as procedures were put off, she said. Shares are up 5% year to date.

Lisanti also likes MasTecMTZ,+3.36%,which helps with the installation, building and upgrading of communications, energy and other infrastructure. The company has a “huge tailwind,” amid a big shift right now in “trying to fix the grid,” and modernize the infrastructure, she said. It is a big cyclical play as it’s tied to lots of secular global trends, such as 5G, and MasTec has little competition, she added. Shares have gained 51% year to date.

Finally, there is Chart IndustriesGTLS,+2.62%,which the fund manager described as a “unique play on energy infrastructure.” The company is a manufacturer of liquefaction and cryogenic equipment for applications in the clean energy space. “They call it cryogenic equipment but it’s highly engineered equipment that allows them to basically freeze and transport industrial gases. And that is absolutely critical to the energy complex and into some other areas,” she said. Shares are up 16% so far in 2021.

Brent taps $75 and Fed chair on tap

U.S. stock futuresES00,0.09%YM00,0.04%NQ00,0.22%are going nowhere, alongsideEuropean stocksSXXP,0.09%,though energy names have been rising as Brent crude pricesBRNQ21,-0.57%touched above $75 a barrel earlier. BitcoinBTCUSD,-3.18%remains weak after Monday’s slump that has been attributed to aChinese crackdown.

“We at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery,” said the Fed’s Powell inprepared remarksfor Tuesday’s testimony to the House Select Subcommittee on the Coronavirus Crisis. Also late on Monday, New York Fed President John Williams,saidthe economy is improving, but not enough to curb asset purchases yet.

Existing home sales are also ahead for later.

The European Union said it has opened antitrust probe into the ad-technology practices of tech giant Alphabet’sGOOGL,+1.42%Google.

COVID-19 vaccinations in the world’s poorest nations are in danger of stopping altogether,the World Health Organization has warned.

Chart of the day

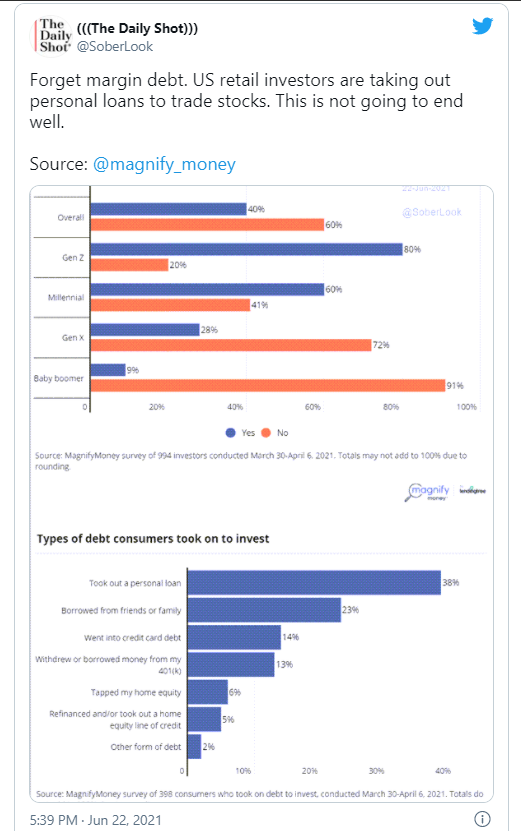

Trouble ahead? Investors are borrowing to buy stocks, says this chart fromMagnify Money(thanks to @SoberLook):