These tech giants might multiply your $5,000 investment substantially in the coming years.

The Nasdaq-100 Technology Sector index has retreated more than 7% in the past month, bringing down the valuations of some fast-growing names in tech that were considered overvalued earlier. But one shouldn't forget that this same index has jumped more than 240% in the past five years, which means that a $5,000 investment in the index would be worth $17,000 now.

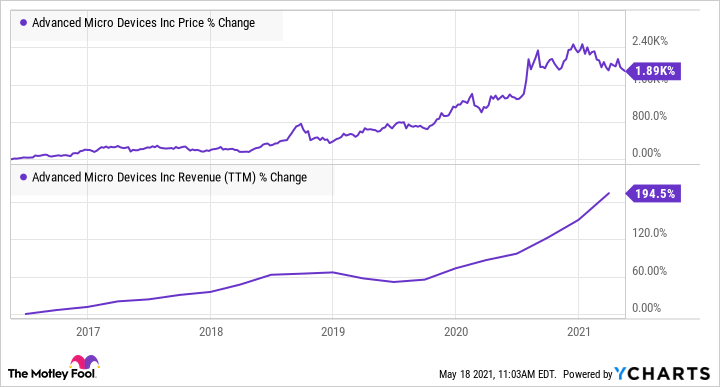

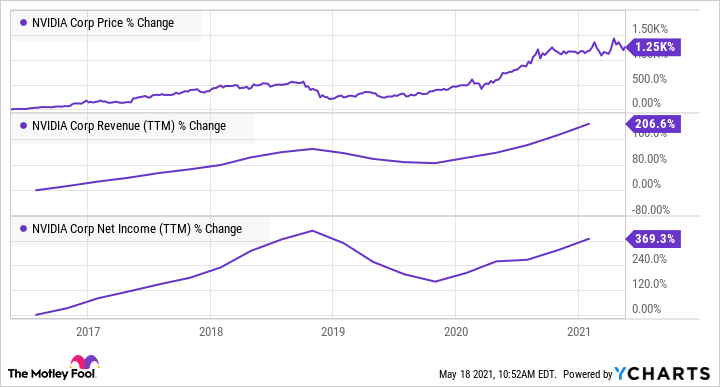

Advanced Micro Devices (NASDAQ:AMD) stock has done even better over five years, rising over 1,850% and turning $5,000 into nearly $100,000. Rival graphics card specialist NVIDIA(NASDAQ:NVDA)has soared over 1,200% over a similar period. Both stocks have pulled back thanks to the tech sell-off, but these two stocks could deliver outsized gains over the next five years as well, thanks to the catalysts they are sitting on. Let's find out why.

1. Advanced Micro Devices

AMD's fortunes have changed big time over the past five years. A competitive product lineup has allowed it to take market share away from Intel (NASDAQ:INTC) in the x86 processor market, a trend that's expected to continue in the next five years.

AMD has made solid progress in the PC market through its Ryzen CPUs (central processing units) and Radeon GPUs (graphics processing units). According to the latest data from Steam Hardware Survey for April, AMD now controls almost 29.5% of the PC CPU space. It controlled 25% of the market in December 2020, with Intel holding the rest. Steam data is a credible source for PC market share information, as the platform is used by 120 million monthly active users worldwide.

Meanwhile, Mercury Research estimates that AMD's desktop PC market share increased to 19.3% at the end of the first quarter, up from just 11.4% four years ago. It also holds 18% of the mobile CPU market. AMD's CPU market share is expected to jump as high as 50% in 2021 as per Wall Street. This doesn't seem surprising given thetechnology advantage AMD enjoys over Intel, as well as Chipzilla's troubles with getting its latest chips out of the gate.

AMD has also turned on the heat in the laptop market. The company's Ryzen 5000 mobile processors are expected to power 50% more models this year and pave the way for more market share gains.

Meanwhile, AMD has made solid progress in the server processor market, finishing Q1 with an 8.9% share. It was nowhere to be seen in server processors four years ago, but the arrival of the EPYC chips has given it a big shot in the arm. AMD is poised to take away more market share from Intel in servers in the coming years and could make billions of dollars from this space.

On the other hand, the arrival of the latest gaming consoles from Sony and Microsoft that are powered by AMD's chips is moving the needle in a big way for the chipmaker. The PlayStation 5 has sold 7.8 million units so far. It is expected to sell over 200 million units over its lifetime, according to an analyst at Japanese firm Rakuten Securities, as compared to 116 million units of the previous generation PS4.

What's more, AMD is reportedly getting 80% more revenue from each unit of the PS5 over the PS4. So, a combination of higher shipments and stronger revenue from each gaming console should unlock a massive revenue opportunity for the company in the long run. Not surprisingly, analysts expect AMD to deliver almost 30% annual earnings growth over the next five years -- making it a top growth stock where one can park $5,000 right now, given that it is trading at less than 28 times forward earnings.

2. NVIDIA

NVIDIA has come a long way in the past five years. The chipmaker has branched out into several fast-growing applications such as data centers, artificial intelligence, autonomous cars, and 5G wireless networks from supplying graphics cards for gaming PCs.

Gaming continues to be NVIDIA's biggest source of revenue, accounting for 46% of its top line last fiscal year. The segment's revenue was up 41% in fiscal 2021 to $7.7 billion, thanks to the launch of NVIDIA's new RTX 30 series graphics cards, which have set the sales charts on fire by triggering a massive upgrade cycle.

NVIDIA estimates that 85% of its installed base is yet to upgrade to the RTX series cards, which pack a huge performance bump at aggressive price points over prior generation cards. That's a huge opportunity, as NVIDIA's installed base of gaming graphics cards stands at 140 million. More importantly, the company's new GPUs are driving an increase in the average selling price (ASP).

The latest Ampere-based GPUs recorded an ASP of $360 in the first six months of their launch thanks to an increase in the proportion of customers buying higher-priced cards. That's 20% higher than the previous generation Turing cards that had an ASP of $300 in the initial six months, and well above the $245 ASP of the Pascal cards that were released five years ago.

So, NVIDIA's gaming business could keep growing at a terrific pace over the next five years thanks to a combination of strong volumes and improved pricing. Jon Peddie Research estimates that 41.5 million discrete GPUs were sold in 2020, and NVIDIA dominated this market with a share of 82% at the end of the year. This bodes well for NVIDIA's future, as the GPU market is expected to clock annual growth of nearly 34% through 2027 as per third-party estimates.

Beyond gaming, NVIDIA is sitting on huge opportunities in nascent markets such as self-driving cars. The company has struck several partnerships in this space and has already lined up automotive design wins worth $8 billion for the next five years. This figure could keep growing thanks to NVIDIA's solid product roadmap, which indicates that it is working on more powerful self-driving platforms that should hit the market in the coming years.

Throw in the fact that NVIDIA's terrific growth in the data center market won't be fading any time soon, and investors will have one more reason to hold on to this tech titan. The data center business generated $6.7 billion in revenue in FY21, up 124% year over year. It accounted for 40% of the total revenue. NVIDIA is now branching out into new areas to ensure that this business keeps growing at elevated rates.

It recently announced the Grace CPU, a server processor that's expected to go on sale in 2023. This would be new territory for NVIDIA, and success here could supercharge the company's data center business, as the server processor market is expected to be worth $19 billion by 2023.

So, NVIDIA still has a lot of room for growth. Analysts forecast 20%-plus annual earnings growth for the next five years, though NVIDIA could do better if the new opportunities it is attacking bear fruit. In all, NVIDIA looks like a top stock where investors can park $5,000, as it is set for multi-year growth and trades at an attractive 36 times forward earnings as compared to 2020's average multiple of 46.