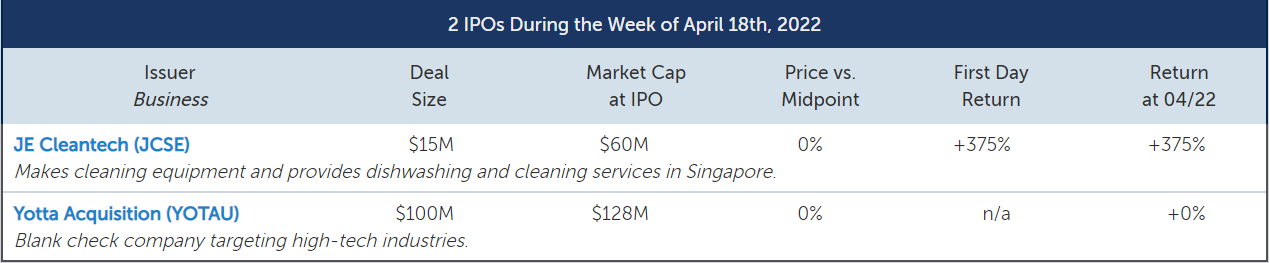

The IPO market cooled off with just one small IPO this past week, joined by one SPAC. The pipeline also saw little activity, with two IPOs and three SPACs submitting initial filings.

Singapore-based JE Cleantech Holdings (JCSE) raised $15 million at a $60 million market cap. The company makes a broad range of cleaning equipment and systems, and also provides dishwashing and cleaning services in Singapore. JE Cleantech became the latest micro-cap to soar on its debut, following Genius Group’s (GNS) massive pop the prior week; the company finished up 375%.

Yotta Acquisition(YOTAU) was the sole SPAC to come to market, raising $100 million to target high-tech industries. Blank check issuance has been on a steady decline since the start of the year driven by poor post-merger returns, which have incited a wave of merger terminations and SPAC IPO withdrawals.

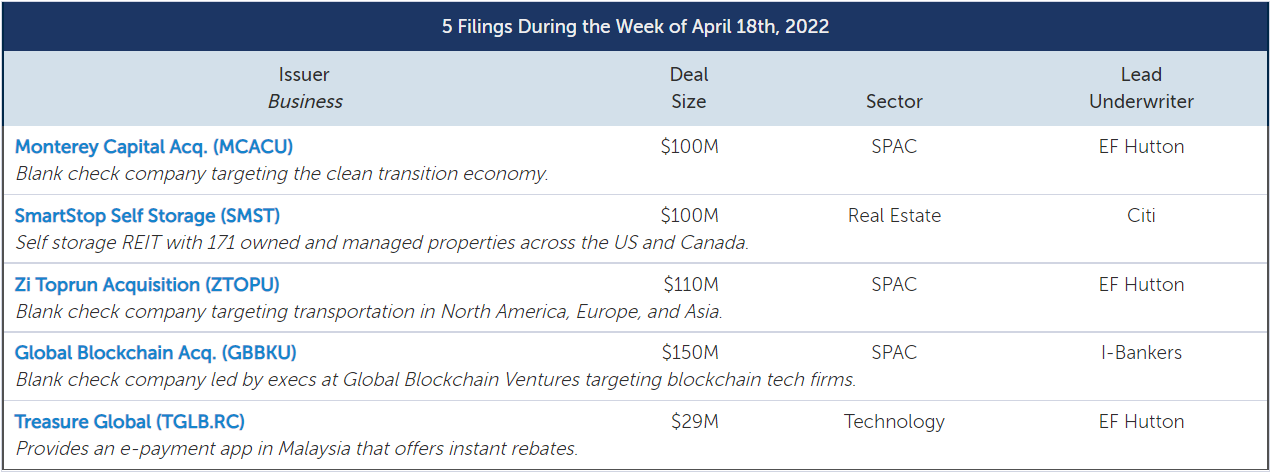

There were two new IPO filings this past week. California-based SmartStop Self Storage REIT (SMST) filed to raise $100 million.Treasure Global (TGLB), which provides an e-payment app in Malaysia, filed to raise $29 million. SPACs Global Blockchain Acquisition (GBBKU), Zi Toprun Acquisition (ZTOPU), and Monterey Capital Acquisition (MCACU) also submitted initial filings.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 4/21/2022, the Renaissance IPO Index was down 35.0% year-to-date, while the S&P 500 was down 7.4%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Uber Technologies (UBER) and Crowdstrike Holdings (CRWD). The Renaissance International IPO Index was down 26.5% year-to-date, while the ACWX was down 8.0%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Volvo Car Group and Kuaishou.