S&P 500 is on course to recoup some losses, while bond yields are rising

Stock futures edged higher, while bond yields and oil prices rose, a day after fears of a recession pushed the Dow Jones Industrial Average into a correction.

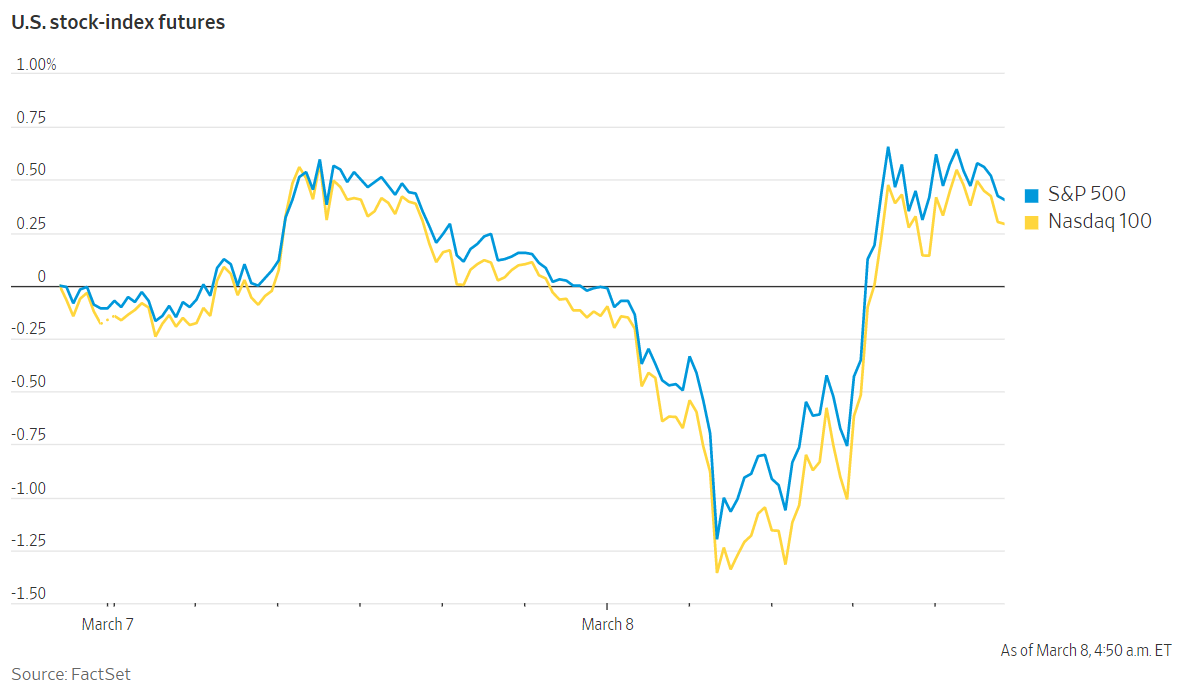

Futures tied to the S&P 500 edged up 0.4% Tuesday, while blue-chip Dow Jones Industrial Average Futures rose 0.4% and technology-heavy Nasdaq-1000 futures gained 0.2%. Overseas, the Stoxx Europe 600 rose 1.1% led by its financial and utilities sectors.

Brent crude, the international oil benchmark, continued to climb higher on fears of a U.S. ban on Russian oil imports. Brent crude, the international oil benchmark, rose over 3% to $127.09 a barrel.

Investors are scrambling to analyze the likely broader impact of the conflict between Russia and Ukraine and the hardening Western response. Market volatility has jumped as relations between the West and Russia have hit new lows, while soaring commodity prices have raised the prospect that global growth could take a hit and have muddied the outlook for central banks seeking to tame inflation by raising interest rates.

The yield on the benchmark 10-Year U.S. Treasury note rose to 1.851% Tuesday from 1.748% Monday. Bond yields and prices move in opposite directions.

On Monday, the Dow Jones index slipped into correction territory for the first time in two years, the Nasdaq Composite index fell into a bear market and the S&P 500 experienced its worst one day decline in about a year-and-a-half.

“I would say the market is in a state of shock. Given the tectonic shift we have seen, everyone is second guessing what the end game may be,” said Brian O’Reilly, head of market strategy at Mediolanum International Funds.

The impact has been most dramatic in commodity markets, due to Russia’s outsized role as a resource producer. Prices for oil, natural gas and key raw materials like metals and grains have soared, heaping pressure on businesses and households already feeling the pinch of rapidly rising inflation. Concerns that the U.S. could be poised to ban imports of Russian oil have sent crude prices soaring, driving fears of recession.

“Not every recession has been caused by an oil price spike but every oil spike has caused a recession,” said Mr. O’Reilly. “This is likely to be a drawn-out affair and will have a sustained impact on commodity prices.”

Investors are awaiting U.S. trade deficit data, due at 8:30 a.m. ET. Economists expect another record monthly trade gap for January, as consumers spent heavily and inflation pushed up prices.

In Asia, stock markets slumped, following Monday’s moves on Wall Street. Japan’s Nikkei 225 fell 1.7%, while Hong Kong’s Hang Seng index dropped 1.5% to its lowest level since 2016.