With Q1 earnings on deck, SoFi has the opportunity to put an end to the freefall it has been in since last year.

On May 10th, just at the tail end of earnings season, fintech company SoFi Technologies will report its Q1 results. This will be SoFi’s fourth reported earnings since becoming a publicly traded company.

It's been a tough road for SoFi, especially since the last quarter of 2021. The stock is currently trading near its all-time low, at the $6.50 per share mark.

However, SoFi’s Q1 earning report has the potential to prove to investors that the worst is finally over. Here is a deeper look into what to expect ahead of SoFi’s earnings.

What To Look Out for During SoFi’s Q1 Earnings Call

Wall Street expects SoFi to report a Q1 loss per share of 13 cents, roughly in line with last quarter's reported loss per share of 12 cents. As for expected revenues, SoFi will need to report numbers above $284 million to beat the consensus. In the previous quarter, SoFi reported revenues of $279.8 million.

The company traded sharply higher the day after its last earnings report; the market reacted positively to SoFi’s projections that a positive EBIDTA was in sight.

Specifically, the company projected EBITDA to be between $0 and $5 million for the next quarter (Q1). Soon, investors will see whether SoFi was able to hit that mark.

SoFi’s earnings-fueled rise last quarter was very short-lived, however. SOFI shares plummeted nearly 30% in the two weeks following earnings after the federal student loan payment moratorium was unexpectedly extended to May 1, 2022. That forced SoFi - a big player in the student loan refinancing sector - to revise its 2022 sales guidance to $1.47 billion, down from $1.57 billion.

SoFi’s management estimates that the payment moratorium will cost the company $20 to $25 million in revenue in Q1 alone.

However, CEO Anthony Noto seemed unconcerned about the moratorium extension.According to Noto, SoFi has successfully faced down difficulties in its refinancing division for over two years now. Since the pandemic began, SoFi has only managed to do 50% of its normal student loan refinancing.

"SoFi has done an outstanding job achieving record financial results, member and product growth and consistent profitability, despite the negative impact of the extended student loan payment moratorium. And we will work diligently to continue that trend in 2022."

Wall Street’s Unchanged Bullishness On SOFI

Although SoFi shares have tanked over the past several months, Wall Street’s bullishness has remained relatively unwavering. The stock still sports a “moderate buy” recommendation, according to a consensus of twelve analysts who have assigned price targets over the past three months.

Citi analyst Ashwin Shirvaikar is one of the bulls, although he did recently trim his price target on SoFi to $17 from $20. According to Shrivaikar, the short-term negative effects of the student loan moratorium extension will continue to impact SoFi shares.

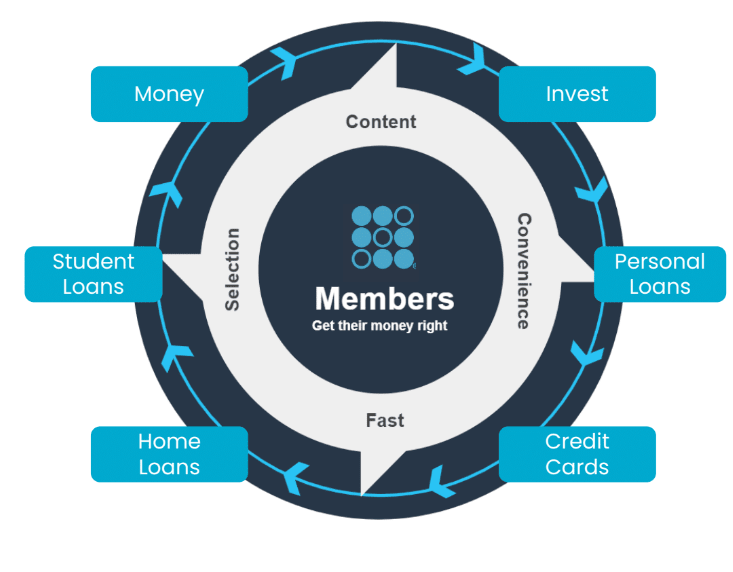

However, the analyst believes that SoFi’s value stems not from its current EBITDA, but rather through its smart business model. SoFi has found success in attracting high-earning members and then monetizing them via a flywheel of increasingly profitable financial services, which are supported by its market-leading technology.

Mizuho Securities analyst Dan Dolev, meanwhile, projects that SoFi will narrowly beat the market consensus on its Q1 revenue. He foresees $1.482 billion in revenue, which tops the $1.47 billion guidance provided by SoFi itself.

Dolev believes that the company will not be hurt by rising interest rates as much as many investors think. Since the company has hedged its position against interest rate hikes, it may evenbenefitfrom rising interest rates.

Final Thoughts

We foresee more turbulence in SoFi’s immediate future. It has undoubtedly been a rough time for other fintechs, and the shaky macro backdrop that has caused investors to flee from riskier growth stocks doesn’t seem like it’ll be changing any time soon. SoFi has made multi-billion-dollar investments into its platform service model yet remains unprofitable. The latest headwinds, driven by the extension of the student loan payment moratorium, have not helped much either.

However, it is quite likely that Q1 will prove favorable for SoFi. If the company reports positive EBITDA, it may be able to convince investors that its worst days are behind it. If SoFi can hang on for the next few quarters, investors may start to see the long-term benefits of the company’s bank charter and resulting banking services.