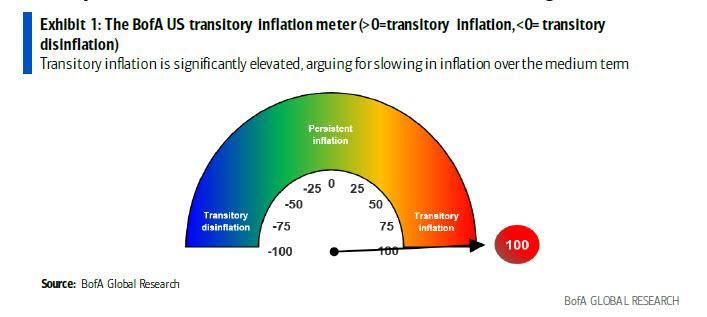

One month ago we reported that Bank of America had released a new proprietary indicator tracking the level of transitory inflation, which incidentally was at the highest possible reading of 100.

Of course, since then it's only gotten worse and the June CPI report released earlier this week revealed another explosion in transitory price pressures. Used cars, new cars, lodging, and transportation services together accounted for 70bp of the 88bp increase in broader core CPI as discussed previously. As a result, core CPI surged 0.9% mom in June: these components primarily reflected the price pressures from goods shortages and the reopening. To no surprise, the BofA US transitory inflation meter (TIM) remained at 100 this month, because it simply couldn't rise any further.

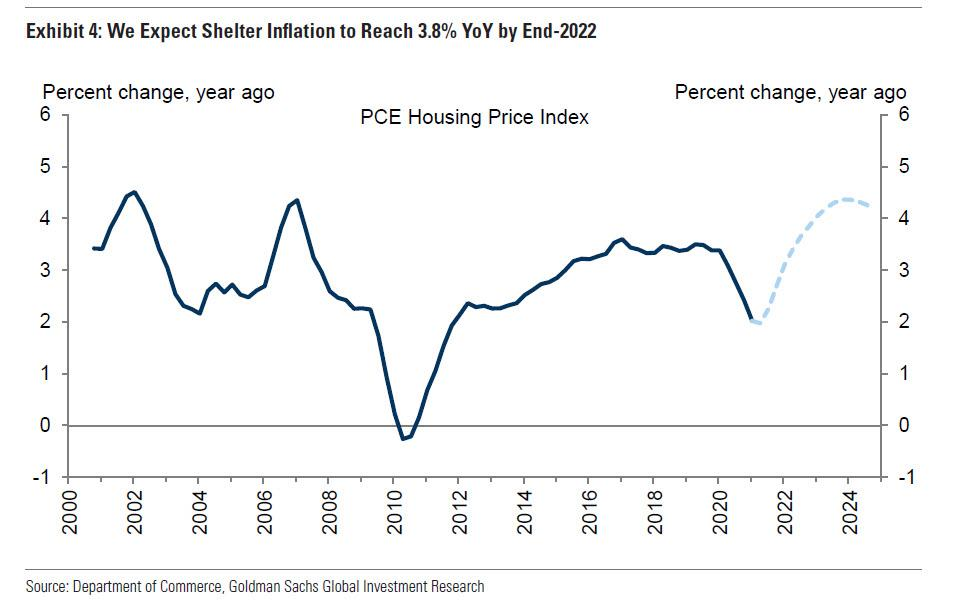

But while the transitory strength in inflation took the spotlight, another development in the June CPI report - which we had discussedextensively before- was a strong 0.32% increase in owners’ equivalent rent (OER) which is a far stickier source of inflation and whichGoldman sees hitting 4% around the end of 2022.

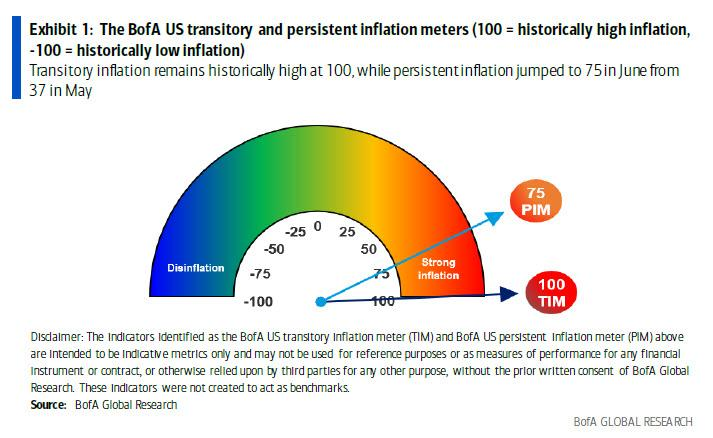

In other words, persistent inflation looks to be rising sharply as well.

This, as Bank of America economist Alex Lin writes today, highlights the importance of being able to track persistent inflation while keeping transitory inflation in perspective.

So to get a more complete picture of current inflation dynamics, BofA has revised its transitory inflation meter with the BofA US Persistent Inflation Meter (PIM), and here, a shock:it soared to 75 in June from 37 in May, indicating elevatedpersistent, as in non-transitory, inflation.

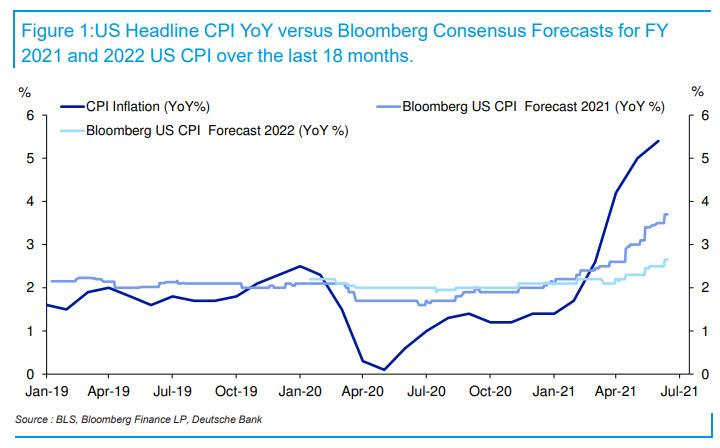

This confirms that contrary to its best wishes, the Fed already has a major headache on its hands. Furthermore, as Deutsche Bank pointed out earlier this week,Wall Street consensus inflation expectations for 2022 are already well above 2%,which is impossible if inflation is transitory and if there is going to be a deflationary phase after the current burst in transitory inflation ends.

In other words, the Fed is again wrong and sooner or later, 10Y yields which continue to pretend that everything is fine, will face a day of very painful reckoning.