Highlights

- Virtus Health Limited has received a revised nonbinding conditional indication of interest from BGH Capital Pty Ltd.

- The proposal concerns acquisition of 100% of VRT shares.

- VRT stocks were spotted trading 3.310% higher at AU$7.490 per share on ASX at 12:57 PM AEDT.

Shares of Virtus Health Limited (ASX:VRT) were in focus on Monday (28 February 2022) after the assisted reproductive services company revealed that it has received a revised nonbinding conditional indication of interest from BGH Capital Pty Ltd (“BGH”). The updated proposal is concerning the acquisition of all of Virtus’ shares by way of a scheme of arrangement at AU$7.65 cash per share, less the value of any dividends or other distributions declared, proposed or paid post the date of this letter, including the A$0.12 per share dividend declared by Virtus on 22 February 2022.

At AU$7.490 per share, the share price of Virtus Health Limited has gained 21.99% in the past 12 months. In this year so far, Virtus’ shares are 10.96% higher on Year-to-date (YTD).

BGH’s Revised Proposal is conditional on Virtus and BGH signing an Engagement Deed, which incorporates specific discrete provisions from the current CapVest Process Deed, which was released to ASX on 24 February 2022, in the same form but with select necessary modifications.

The private equity company BGH intends to fund the acquisition through equity and debt financing. As per today’s announcement, the equity financing will come from BGH Fund I, and BGH advises that they have received highly confident debt financing letters from several institutions to support a binding proposal.

Virtus also informed today that the implementation of the Revised Proposal is conditional.

Other details of the revised proposal:

BGH has advised that its entry into the SIA will be subject to the following:

- The satisfactory completion of due diligence

- After today’s date (28 February 2022), Virtus does not sell or agree to sell any material assets or enter into or agree to enter into any joint venture or similar arrangements concerning any of Virtus’ domestic or international operations;

- No material change to Virtus’ assets and prospects (including litigation or regulatory action arising), or financial markets;

- Final approval to submit a binding proposal from the BGH Investment Committee

BGH noted that it has already applied for a no-objection notice from the Foreign Investment Review Board to acquire 100% of the shares in Virtus and expects to receive it soon. The company has said that the Board is yet to evaluate the revised proposal.

BGH’s old proposal:

On 14 December 2021, Virtus had informed that it received an unsolicited, non-binding indication of interest from BGH Capital to acquire 100% of the issued, and to be issued, shares of Virtus by way of a scheme of arrangement. The proposal attributed a cash value of AU$7.10 cash per Virtus share, valuing the target at approximately AU$607 million.

Company’s interim results for the half-year ended 31 December 2021:

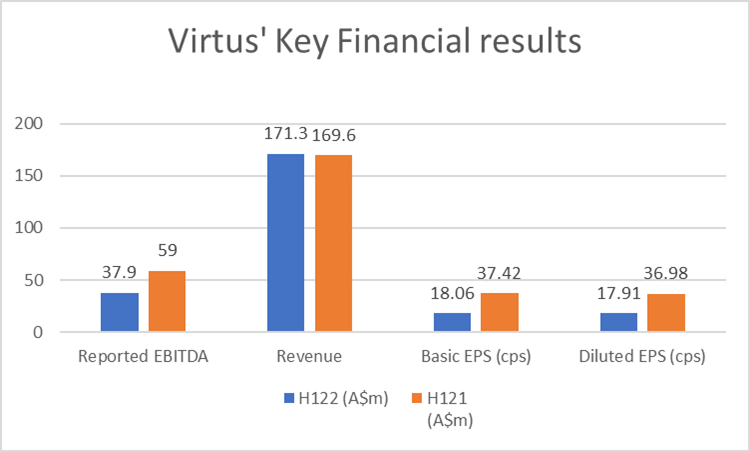

The company has declared an interim dividend of 12.0 cents per share fully franked. The interim dividend will be payable on 14 April 2022. The Group has reported its revenue at AU$171.3 million compared to AU$169.6 million in H1FY21.

The reported EBITDA declined 35.7% to AU$37.9 million from AU$59 million in H1 FY22.

In an announcement dated 20 January 2022, Virtus Health advised that it has received a proposal from CapVest Partners LLP (“CapVest”) to acquire 100% of Virtus through a scheme of arrangement offering AU$7.60 cash per share.