It is earnings season again and a good time to size up how businesses are performing.

Banks, being pillars of the economy, offer good clues as to how a vast swath of companies is doing.

United Overseas Bank Ltd , or UOB, was the first bank to report its second quarter (2Q2022) and first half 2022 (1H2022) earnings.

This was followed by OCBC Ltd which announced a record net profit for 1H2022.

Finally, Singapore’s largest bank, DBS Group , weighed in with its results and outlook for the remainder of the year.

At this juncture, investors may be wondering which of the three banks makes the most attractive investment.

We put the three local lenders side by side to come up with the answer.

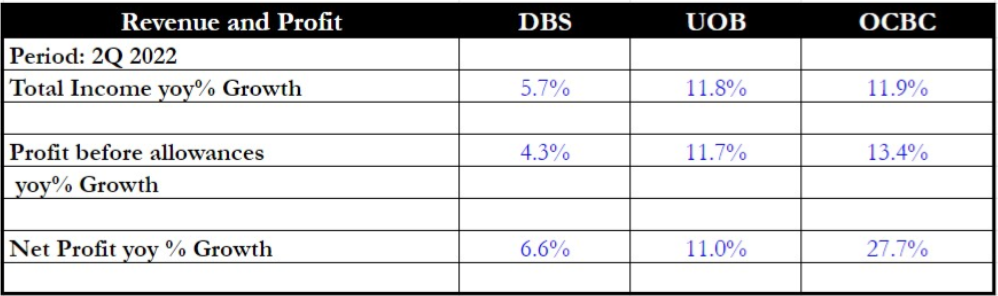

Financials

OCBC ties with UOB with a near-12% year on year increase in total income, contributed mainly by higher net interest income.

However, OCBC wins hands down with a 27.7% year on year jump in net profit as higher trading income and a surge in profits from its life insurance arm aided its outsized performance.

Winner: OCBC

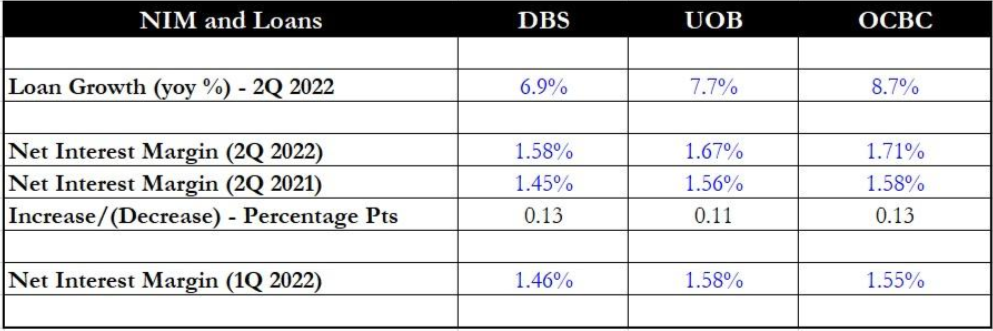

Loan growth and NIMs

All three banks saw healthy single-digit year on year growth in their loan books, with OCBC leading the pack with an 8.7% year on year improvement.

Of the three lenders, OCBC also has the highest NIM for 2Q2022 at 1.71%, with DBS holding up the rear at 1.58%.

When compared with the same period last year, both DBS and OCBC enjoyed a 0.13 percentage point increase whereas UOB saw a smaller 0.11 percentage point rise.

On a quarter on quarter basis, OCBC also saw the biggest jump in NIM, up 0.16 percentage points compared with DBS (0.12) and UOB (0.09).

OCBC looks like the clear winner in this case, but investors should note that DBS has disclosed that July’s NIM is “above 1.8%”, portending better days for the bank as interest rates rise globally.

Winner: OCBC

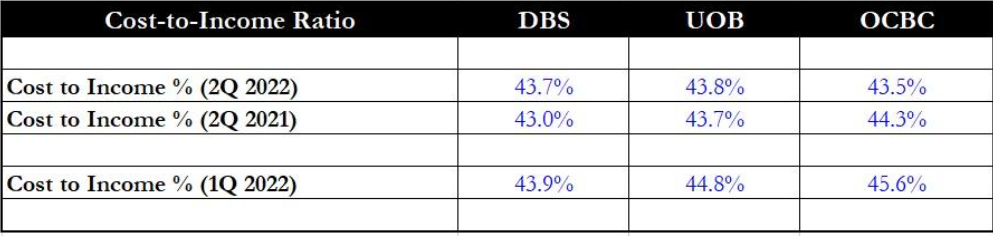

Cost-to-income ratio

In comparing this metric, a lower ratio is better.

All three banks’ ratios were pretty close, but OCBC’s 43.5% wins for 2Q2022.

It was a different story in the last quarter as OCBC had the highest cost-to-income ratio of the three at 45.6%.

In addition, for 2Q2021, OCBC also reported a cost-to-income ratio of 44.3%, higher than its two peers.

Both UOB and DBS have seen little fluctuations in their cost-to-income ratio on a year on year basis for 2Q2022, while OCBC enjoyed the biggest improvement.

Winner: OCBC

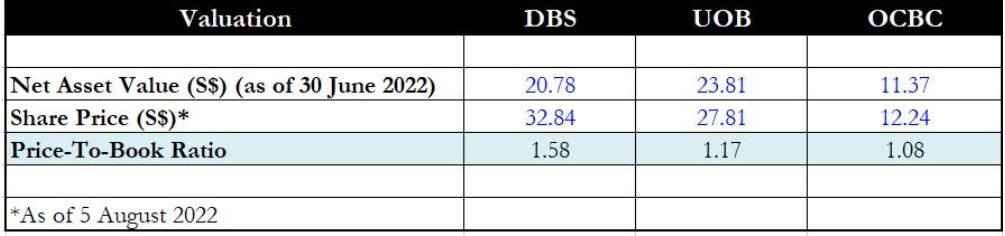

Valuation

Its price-to-book (P/B) ratio of 1.08 times is the lowest, with UOB coming in a close second at a P/B of 1.17 times.

With its heft and large size, DBS commands the highest P/B of close to 1.6 times, making it the most expensive lender of the trio.

Winner: OCBC

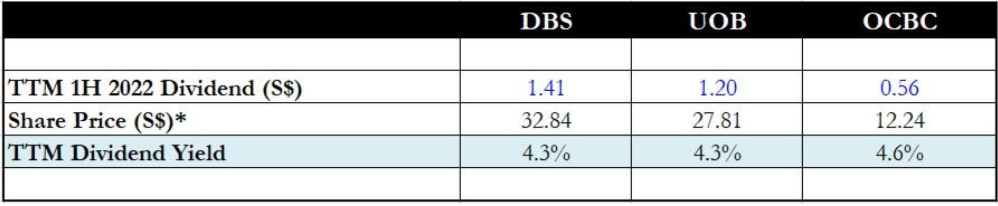

Dividend yield

OCBC currently sports the highest trailing dividend yield of the three banks at 4.6%.

Both DBS and OCBC had upped their year on year interim dividends while UOB had kept its interim dividend constant.

Winner: OCBC

Get Smart: OCBC wins on all attributes

From the above, it’s pretty clear that OCBC wins hands down as it scored the best on all five attributes.

The bank offers a compelling valuation along with a good dividend yield and is seeing both its loan book and NIM growing steadily.

All three banks are seeing their loan books remaining resilient even as prospects of a recession loom.

Looking ahead, investors should remain watchful of risks that could result in slower loan growth or higher provisions.