Summary

- Grab is set to merge with SPAC Altimeter Growth Corp. by the end of the year. Investors wanting to invest in the company can do so by buying the SPAC shares now.

- The company is valued at ~$45 billion, which we believe is way too generous.

- It is still worth watching given the fact that it is the biggest super app in South East Asia and it offers a multitude of services.

- Economic growth in South East Asia is expected to be robust, with annual growth estimated at 4.9% per year.

Grab is the number one super app in Southeast Asia, investors not familiar with it can think of it as merging Uber with a banking app. Its services include mobility, package deliveries, food deliveries, and financial services. The company is still private but it is set to combine with SPAC Altimeter Growth Corp (AGC) by the end of the year.

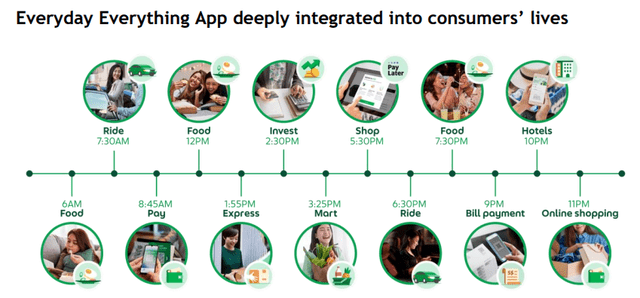

So what is a super app? Grab imagines customers can use the app for many of their daily needs, from ordering a ride to ordering food, or even booking a hotel.

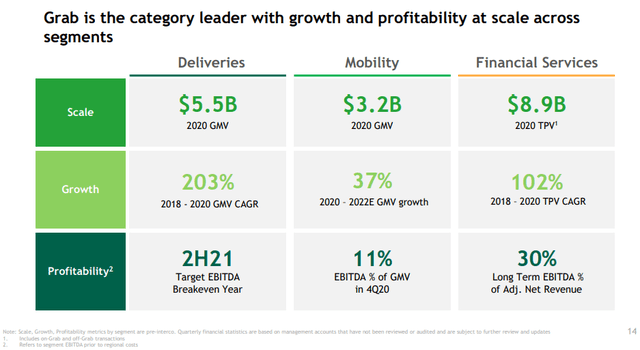

Such ubiquity and number of service offerings has resulted in enormous growth for the app, reaching a Gross Merchandise Value (GMV) on its platform of $12.5 billion in 2020. Its net adjusted revenue reaching $1.6 billion, thanks to 1.9 billion transactions, making the app the number one in the region for deliveries, mobility, and financial services.

This gives the platform significant scale, with year 2020 GMV of $5.5 billion for food deliveries, $3.2 billion for mobility, and $8.9 billion for financial services.

Such ubiquity and number of service offerings has resulted in enormous growth for the app, reaching a Gross Merchandise Value (GMV) on its platform of $12.5 billion in 2020. Its net adjusted revenue reaching $1.6 billion, thanks to 1.9 billion transactions, making the app the number one in the region for deliveries, mobility, and financial services.

This gives the platform significant scale, with year 2020 GMV of $5.5 billion for food deliveries, $3.2 billion for mobility, and $8.9 billion for financial services.

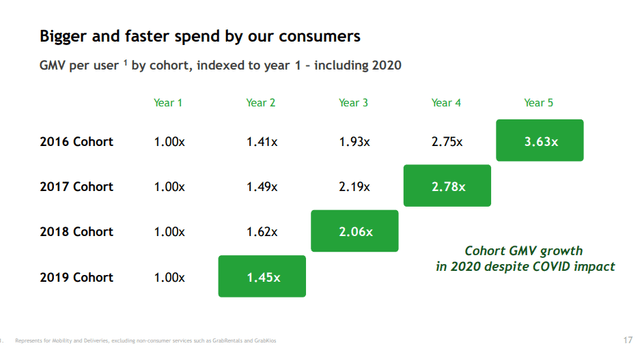

Cohort Analysis

Looking at the different cohorts of users it is clear that the longer they have the app installed the more they transact on it. After three years users approximately double the transaction amount, and by year five they more than triple their transactions. This speaks to significant stickiness for the app, and it reflects high user satisfaction with it.

International Expansion

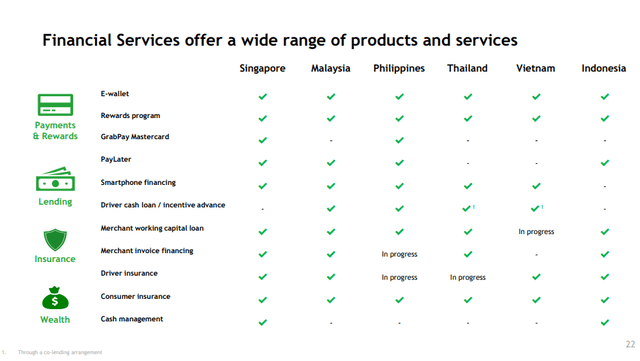

One of the more exciting things about Grab is how many countries it operates in, and the number of services it offers in each. The slide below shows the services offered in each of the markets served by Grab.

While users come to the app initially for food deliveries and rides, we believe it will be the financial services that really bring profitable growth for the company. Things like loans, micro-credits, and insurance products should bring profitable growth for the company.

According to the OECD,GDP for the region is expected to grow by 4.9% per year during the period 2020-2024, slightly down from the average rate of 5% in 2013-2017.

Financials

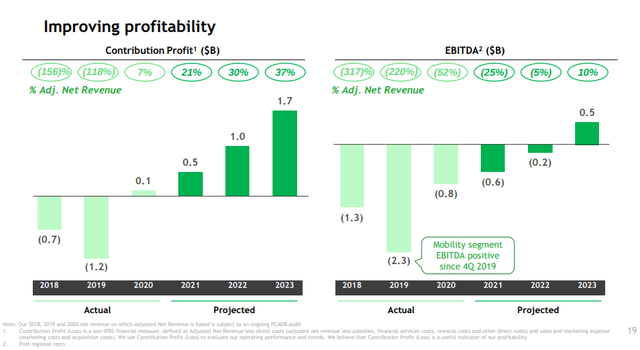

Turning our attention to the financials we see that the company isn't projecting to become EBITDA profitable until 2023, when it is projected to reach $0.5 billion. This gives the company an EV/EBITDA 2023 multiple of ~60x, which we find excessive given the uncertainty of the financial projections and the level of risk. We understand some investors are confident the company will achieve operating leverage and that it will continue growing for many years, but even then we believe the valuation to be too demanding given the level of uncertainty for future results.

Risks

The main risk we see with an investment in Grab is over paying for the shares. While the company's app is ubiquitous in South East Asia the current valuation already prices significant growth and profitability improvements. In other words, it is priced for perfection.

There is also the matter of competition, where several well funded companies are going to fight for market share and erode profitability. These include Uber in some markets, but mainly Indonesia's GoTo,the company created through the merger of ride-sharing firm Gojek and e-commerce company Tokopedia.

We find the company exciting and will continue to follow its progress, but at this time we are not buyers of the shares.

Conclusion

Grab is one of the most exciting companies right now that offers broad exposure to the economic growth in South East Asia. The company keeps growing and adding services to its app, while gaining users and getting closer to profitability.

The one problem we have with an investment in the company is that at current prices much of the growth is already priced in. Unless the company manages to exceed expectations we do not see how investors at this price could get a good return on investment.