Gamestop Corp. shares have soared the past few days with the stock up nearly 200% at one point from last week (but still down significantly from recent short squeeze highs). We'll look at the unique situations that arise in the options of a highly volatile stock like Gamestop and a few things that might be considered before trading options.

Gamestop: The Expected Move

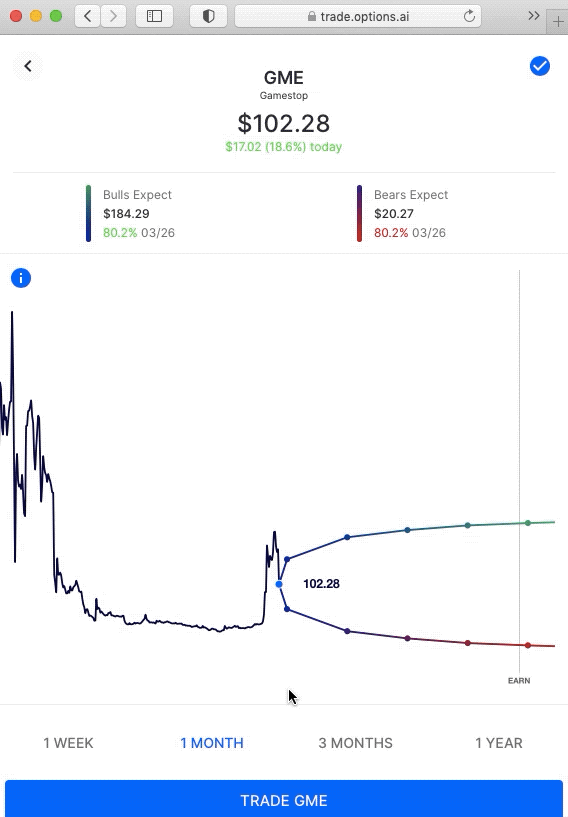

First, a look at how options are pricing upcoming moves. Here's theOptions AIexpected move chart for Gamestop, with a nearly 30% move being priced into this Friday's close. And a roughly 80% move being priced for the next month. A month that includes an earnings event (unconfirmed):

Gamestop: Call Spreads vs Outright Calls

Using March 19th as an expiry we first looks at bullish spreads, and compare directly to outright calls. With a stock as volatile as Gamestop, calls can be expensive. Because of that, many traders resort to buying far out of the money calls. That demand for upside calls increases volatility in those calls, making them expensive relative to at-the-money calls – a phenomenon known as skew. However, for those that are bullish, this may create an opportunity to utilize spreads rather than buying an outright call. Let's see how.

Here we'll focus on one alternative – using debit spreads to lower the overall cost of a directional trade (while potentially improving the probability of profit of the trade itself by lowering the breakeven level). It does so by selling those relatively expensive out-the-money Calls to help finance the purchase of a nearer to at-the-money Call.

With Gamestop near $105, the March 19th 110/190 Debit Call Spread is roughly $15 and targets the bullish expected move for March 19th. The debit call spread would need the stock to be above $125 on March 19th to be profitable.

As a comparison, the GME March 19th 200 calls are trading $29. That's nearly twice the cost for a 200 call that needs the stock above $229 by March 19th… versus a call spread, that needs the stock above $125. Here's a side by side comparison of those two trades on the Options AI chart. First, the 200 call:

And next, the 145/200 debit call spread:

As you can see, not only is the call spread less expensive, the point at which is becomes profitable to the upside is much closer to where the stock is currently trading. (As indicated by the grey price of the breakeven.)

A note on probability of profit. The probability of profit displayed on these trades is based on the delta being assigned to the breakeven of the trade. The fact that a 200 call in a $105 stock is trading near 50 deltas shows just how distorting an effect Gamestop volatility is having on its options (hard to borrow, skew, retail demand for out-of-the-money calls).

Directional Butterflies vs Outright Puts

High volatility also affects bearish options trades. One of the counter-intuitive aspects of a high volatility stock like Gamestop is that its implied volatility can go up as the stock goes higher and down as the stock goes lower. This is the opposite of how we generally think about volatility. Therefore, buying outright puts carries a risk of collapsing volatility (and therefore collapsing premiums) as the stock goes lower. So, even though the stock is moving in the intended direction, as an option holder you may not be realizing the gains expected.

One way to counter high implied volatility in a stock, especially when having a bearish view, is to be a net seller of option premium. To sell to bullish option traders rather than join bearish option traders. Traditionally that might take the form of selling a Credit Call Spread. But in GME's case that means buying the (expensive) upper strike Call at a higher volatility than the Call that is closer to the money (as described above).

So, one option strategy that can be considered by traders is using a Butterfly. An option trade that is more typically associated with a neutral trading view, but here adapted to actually create a targeted (bearish) directional view.

Here, as an example, is a Butterfly with its center strikes focused at $80 in the stock, with a March 19th expiry:

This 130/80/30 butterfly has breakevens of 115 and 45, meaning the trade is profitable if the stock is between those two prices at March 19th expiry… with a max gain occurring if the stock is at or near $80. It has the additional dynamic of being short premium, and if the stock stays within its range would see mark to market gains if implied volatility compressed.