NIO reported healthy delivery figures for July early Monday morning. But in a first, NIO’s peers delivered more cars in the month than the Chinese electric vehicle maker did.

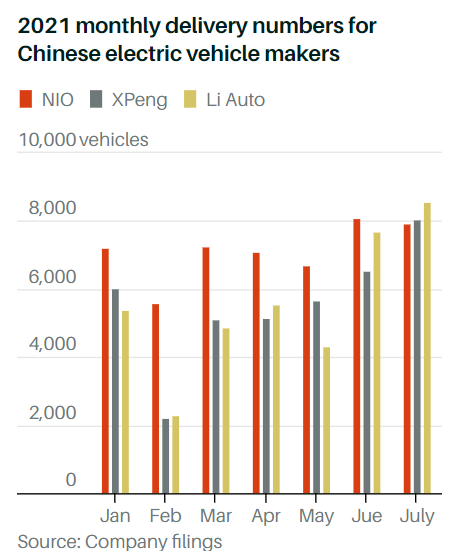

NIO (ticker: NIO) delivered 7,931 vehicles in July, down a little from the 8,083 vehicles delivered in June. Deliveries in the 8,000-range usually look good, but month-to-month declines are typically problematic for the stock.

NIO deliveries dropped from January to February, from March to April, and from April to May. The stock dropped each time the sequential delivery drops were disclosed, falling about 13%, 1%, and 2%, respectively.

That might not be the case this time. NIO shares have gained 2.6% on Monday, while S&P 500 and Dow Jones Industrial Average futures are down about 0.2% and 0.3%. The shares of NIO peers Li Auto(LI) and XPeng(XPEV) are both up between 0.9% and 5% on their own delivery numbers.

July was the first month NIO’s deliveries fell behind Li and XPeng’s totals since delivery numbers have become available, stretching back to May 2020. XPeng delivered 8,040 vehicles in July, a new monthly record and up from 6,565 vehicles delivered in June. Li delivered 8,589 vehicles, a monthly record for Li too, up from7,713 vehiclesdelivered in June.

Citigroup analyst Jeff Chung blamed Tesla(TSLA) for the lackluster month-over-month numbers from NIO. The “trend for ES6 and EC6 is likely due to the recent price cut of Tesla’s Model Y,” wrote Chung in a Monday report. “But the company should be able to achieve our [2021- deliveries estimate of [93,000]units as long as it maintains monthly deliveries of [8,000 to 9,000] units.” Chung rates shares Buy and has a $72 price target for the stock.

(The ES6 and EC6 are SUV/crossover vehicles similar to the Model Y.)

In July, the three Chinese electric vehicle producers delivered roughly 24,500 vehicles combined. That’s up almost 10% compared with June and up about 190% over July 2020. The companies are, essentially, selling all the EVs they can make.

NIO is still the largest, most valuable of the three, but its stock has lagged behind recently. NIO stock is up 12% over the past three months. XPeng stock has added 36%. Li shares have added 69%.

Closing to Monday trading, NIO shares are down about 8% so far in 2021. XPeng stock has rose 1% year to date. Li shares have added almost 17%.