One of the main pillars of the bearish thesis on Apple stock is the rich valuation. But compared to the peer group, maybe AAPL is not so pricey after all.

Apple stock is considered a buy by the majority of analysts that cover the name. According to TipRanks, more than 80% of Wall Street experts think that owning shares is a good idea, while only one analyst has a sell rating on the stock.

Among skeptics, one of the main arguments against owning AAPL is the elevated P/E ratio. But a closer look at the peer comparison suggests that Apple stock may be more affordable than many seem to believe.

Apple’s valuations: fair, too rich, or a bargain?

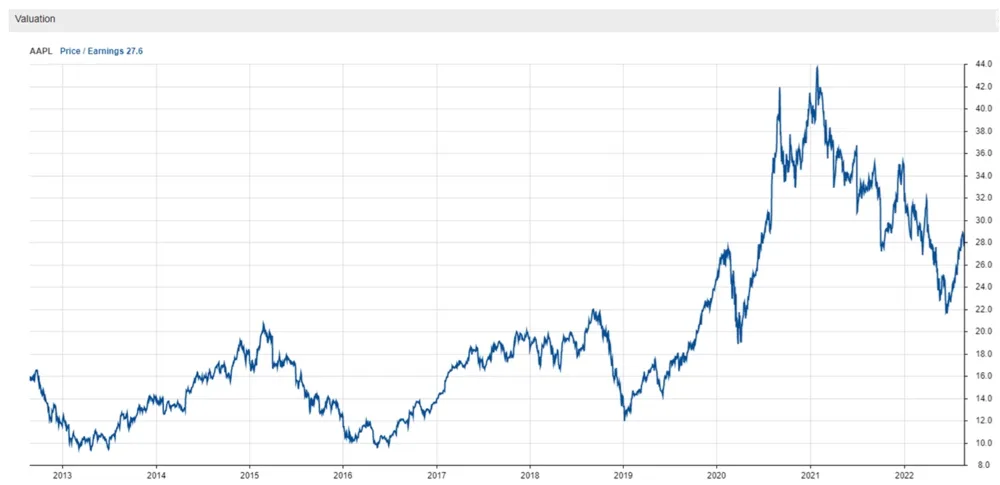

The following graph probably explains why so many value investors are cautious about Apple stock today. Notice what has happened to AAPL’s price-to-earnings (or P/E) ratio over the past 10 years:

Starting a couple of years after the launch of the original iPad, Apple’s P/E fluctuated between 10 and 20 times for a few years. Then, beginning in 2019, the valuation multiple skyrocketed to as high as 44 times early last year, settling now to just below 30 times.

The multiple expansion happened for a few reasons, the most relevant of which was probably Apple’s business model shift to higher-margin and more predictable services. The post-iPhone X success of Apple’s smartphone segment, along with the company’s generous cash return policy, probably helped too.

But tech companies, especially those in high growth stages of their lifecycles or whose “moats” are considered wide, tend to command high P/Es. Take a look at the following table comparing some of Apple’s key valuation metrics with those of peers selected by Stock Rover:

Starting with P/E, in the sixth column, notice how AAPL’s 27.6 times is actually much lower than NVIDIA’s 46.1 and Adobe’s 40.1 times, for example. Part of the reason for AAPL’s more de-risked valuation is the growth profile: while the Cupertino company is expected to increase EPS by 6% next year, NVIDIA and Adobe should deliver growth of 17% instead.

The only companies on the list with substantially lower P/E vs. Apple are Intel and Cisco, possibly Broadcom. But considering these companies and their industries’ much less encouraging growth profile, it is understandable that these stocks would trade more cheaply.

Let’s look beyond P/E. On a price-to-FCF (free cash flow) basis, Apple’s 25.6 times multiple seems even cheaper compared to the peer group. Only Broadcom and Cisco, at about 16 times, look substantially more de-risked.

Apple’s cash flow-based valuation metrics look good because the Cupertino company is particularly competent at turning earnings into hard cash. Tight control of working capital and capex is probably what best supports the argument.

Lastly, notice how Apple looks quite overvalued on a price-to-book basis. A multiple of 46.1 times, in fact, is an eye sore compared to Salesforce.com’s 3.0 times and Intel’s 1.4 times.

But here, the metric is deceivingly distorted. Because Apple buys so many of its shares via stock buybacks, the company’s equity size has been shrinking quickly over the years – which is not a bad thing at all. Since equity is the denominator in the P/B ratio, the multiple understandably looks too rich, on the surface.

My views on AAPL’s valuation

I still believe that Apple’s valuations are far from being a bargain. But at the same time, once I look at the peer group comparison, I find it hard to side with the bears as well. To me, AAPL’s P/E is fair and consistent with the robust business fundamentals of the company.