Summary

- The article's goal is to discuss today's price and the fundamentals of Meta.

- Meta recently dropped more than 35% from its highs.

- Headwinds from IDFA and inflation are strong, and the fundamentals of Meta are suffering.

- Moreover, Meta started investing strongly in Reality Labs, its Metaverse division.

- Will the Metaverse add or destroy value?

The article discusses the latest earnings report of Meta(NASDAQ:FB). The quarterly report was below expectations in many ways. Today, we want to understand the market rhetoric for this price drop and actually see the pricing of FB compared to its history, to its prospects and the price of the overall market.

The Metaverse

Let's start with a little introduction about Meta's recent history. The company is currently undergoing a rebranding, which started with investments in the so-called metaverse.

What is the metaverse? Simply a virtual reality shared on the web, where each of us is represented by an avatar. And I'll give you a preview: this investment can change the valuation of FB, downwards or upwards.

FB has taken this path to counter a decline that may be inevitable as the maturation process of the business related to social networks and advertising progresses. How does FB make money today, indeed? Mainly from advertising, and to grow revenues and profits, it needs to increase users or the number or cost of ads. But when you are in a situation of almost total monopoly, it is not easy to continue to grow, and we are already seeing the first results now with the quarterly report released last Wednesday.

Meta Earnings Q4 2021

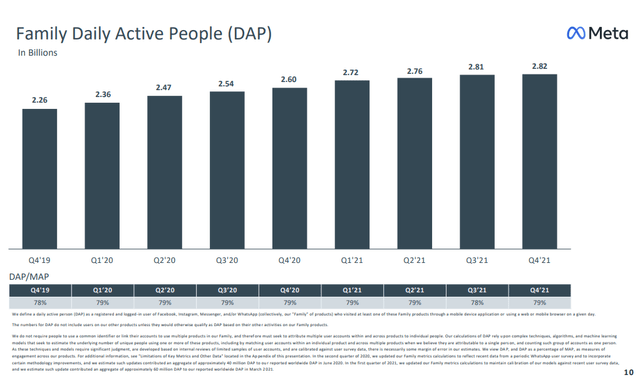

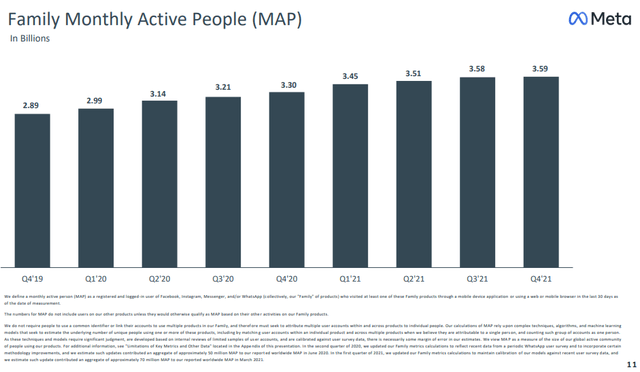

I would start with an essential metric to increase sales: the number of active users. Unfortunately, FB is no longer able to increase users aggressively.

If we look at the user numbers on all FB apps this quarter, sure, we notice an 8-9% YoY growth on daily and monthly active user numbers.

However, I also find it interesting to compare these QoQ numbers and here we see how the difference is not remarkable. In Q3 and Q4, Meta had pretty much the same numbers.

What does this mean? FB has fewer options to increase earnings:

- Increase revenues through higher average revenue per user, as happened in 2021.

- Increase revenues through new products, as it is doing through the development of the metaverse.

- Improve margins, a path towards which FB has not decided to move, given the massive investments in the metaverse that will actually bring the margins down in the next few years.

The Guidance

The downward guidance provided by Meta has frightened the market.

After a year in which it has grown revenues by 37% and profits by 35%, FB guided for revenues between 27 and 29 billion. The company expects to grow between 3 and 11% year-over-year, it could have certainly been worse, but analysts' expectations were more than 8% higher than the midpoint given by FB.

Reels

Listening to the call, there are numerous insights into Reels. First, management tells us how they expect that going forward, the use of short-form videos will gain traction on social media, and so the Reels section will be one of the parts where Meta will be investing the most in 2022. Second, Meta sees Reels as an extremely engaging medium for the audience, so there will definitely be a continuation of this growth in the use of this format. In addition, at the current time, the monetization of Reels is lower, but the company expects to grow it with time. Finally, they told us how the transition with Reels is different from other transitions FB experienced in the past. This time they are facing a competitor like TikTok that is also growing impressively, so Meta will have to manage to compound higher growth rates to be able to catch up with TikTok.

Generally speaking, Meta has noticed the danger of TikTok and has managed to intervene in an important market. It will certainly take time to reach them, but it has the right economic weapons to do so.

IDFA Impact

We know that analysts were expecting 140 billion in sales in 2022, and FB tells us that Apple(NASDAQ:AAPL)IDFA and inflation issues will roughly impact 10 billion, 2.5 billion per quarter. This is in line with what has been reported. Meta, in fact, missed analyst estimates on Q1 guidance by 2.3 billion if we take the midpoint of the guidance.

This is a one-time impact. After this year, FB will have real comps, meaning it will be comparing its growth between quarters when the new Apple update that changes privacy management within iOS devices was active. This can bode well for growth in subsequent years.

Margins

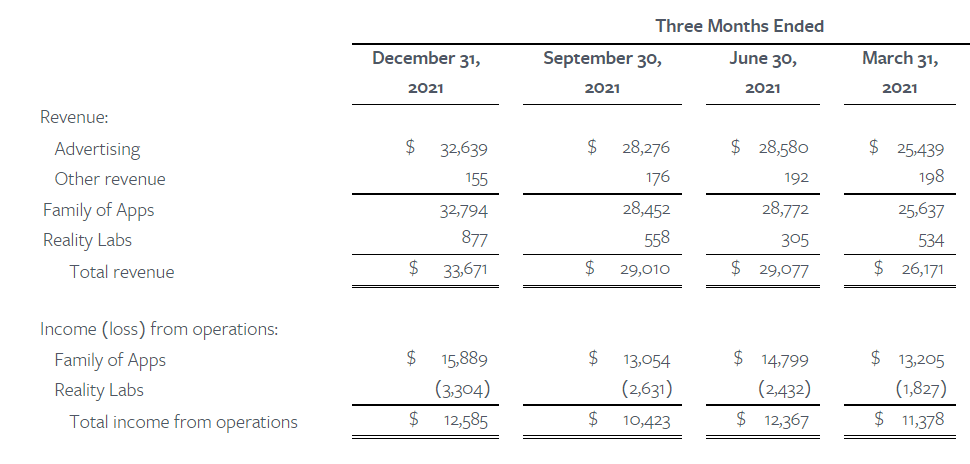

But let's move on to the other sore point of the quarterly report: profitability. In the quarter reported, the last quarter of 2021, Meta lost some of its marginality.

While increasing revenue, we see how FB has been investing in Reality Labs, which is the part of the Business that has been gnawing away at the margin. The investments amount to about $2.5B in Q2 and Q3 and $3.3B in Q4. Indeed, we see that the ads segment maintains a margin in line with Q3.

There is always a trade-off between continued growth and marginality in a company's choices. Old-style value investors will probably prefer cash flows now; growth investors will appreciate the choice of FB. However, the reality is that a priori, it is difficult to judge these investments. Only once cash flows will begin to reach the FB balance sheet we will understand whether the investment made sense or not.

Buybacks

FB, however, gives us a sort of dividend, while we wait for the delivery of the Metaverse and the return to even higher margins (hopefully). Indeed Meta continues to reward us with new shares purchased at an acceptable valuation.

FB bought back just under $20 billion worth of stock last quarter and nearly $45 billion worth of stock in 2021. This allows us, shareholders, to receive an increasingly large slice of the company's cash flows without the fiscal inefficiency of a dividend.

For 2022 Meta has an active repurchase authorization of $39 billion, and I'm sure again in the first quarter, it will hoard shares, seeing the market price movement.

Pricing

But let's talk about price. At the time writing, FB has a price-to-earnings ratio for the trailing 12 months of about 17.

The chart shows that this level was only touched at the end of 2018, in a totally different market situation.

So is FB a gift? Not really, because the maturity of FB's business is also increasing year after year, and therefore the market prices within the multiple a lower probability of growth. In addition, FB's earnings in 2022 will most likely be shaky given the premise of the latest quarterly, and I personally expect a year of slightly negative growth on that front. In 2018, the forward multiple was even lower, while today, we can probably expect a flat or even negative earnings growth year.

Playing with FB's numbers a little bit, assuming revenues of 130 billion and expenses of 92.5 billion, we have an operating income of 37.5 billion. Taxes must be subtracted from this, so we can use a tax rate of 19%, as announced by FB in the call. That leaves about 30 billion, down from 39 billion this quarter, which brings the forward multiple to 23.5x. At this price the stock is certainly not expensive, but not a gift either.

The S&P 500(NYSEARCA:SPY)is now priced at a P/E (2022E) of 20x. I think the small difference of multiples does not convey the huge opportunity that Meta has and I believe that with a 5-year horizon, the growth in EPS for FB will outperform the growth in the EPS for the S&P 500.

We know the market reacts much more to numbers than to a company's prospects with a long-term time horizon. With an annual investment of more than 12 billion in the Reality Labs part, I don't expect FB to significantly appreciate in 2022. The investment in the metaverse is substantial and will continue to be so for years to come. That will inevitably lead to slower EPS growth for the next year. From 2023, the trajectory may change with FB going to more appropriate comps, and eventually with an improved situation regarding inflation and IDFA.

Conclusions

While this deterioration in profitability and the slowdown in Meta growth by 2022 give downsides, FB is fighting against a transition to a mature state of its business and has the economic strength to lead in a new industry, delivering to users and investors, not a metaverse, but THE Metaverse.

However this is pure speculation, as I am way more comfortable with a long-term investing strategy. If you think this money invested in Reality Labs is a good long-term investment for FB, I believe that Meta, priced lower than the S&P 500, became a value play.