U.S. equity exchange-traded funds reversed losses from prior weeks as investors flocked to U.S. stock ETFs despite a market downturn.

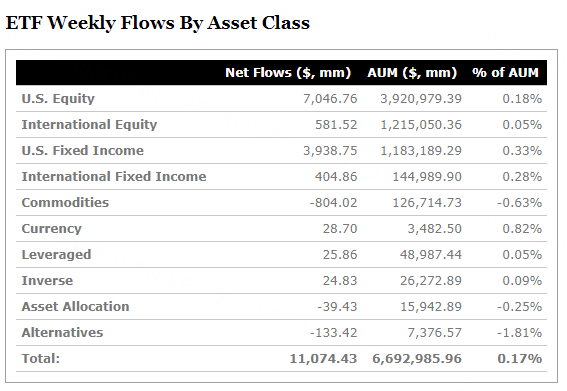

U.S. equity funds pulled in just over $7 billion in the week ending March 10, according to etf.com data. That’s a shift from the $9 billion that left the asset class the week prior.

The top asset gatherer of the week was the SPDR S&P 500 ETF Trust (SPY), which lured in $5.2 billion, compared with the $8.8 billion that exited the fund the week before. Other funds that attracted the most inflows included the iShares Core S&P 500 ETF (IVV) and the Invesco QQQ Trust (QQQ), which collectively pulled in nearly $1.6 billion.

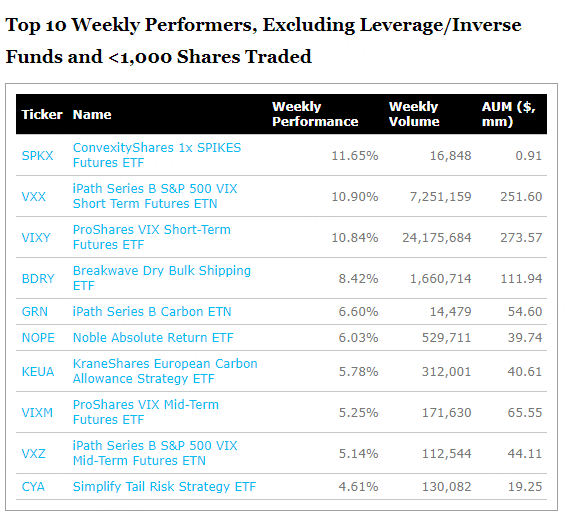

The uptick in interest in U.S. equity ETFs comes despite a rough week for stock markets. The S&P 500 dipped 4.5% during the trading week, its worst performance in nearly six months, as fears reverberated through markets that bank stress following the closure of SVB could send more firms under. The Nasdaq slumped 4.7% during the same period.

Meanwhile, U.S. fixed income ETFs brought in nearly $4 billion during the week. That’s a 15% drop from the $4.6 billion that the asset class drew in the previous week. Bond funds that saw the greatest inflows included the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), the iShares 20+ Year Treasury Bond ETF (TLT) and the iShares Core U.S. Aggregate Bond ETF (AGG).

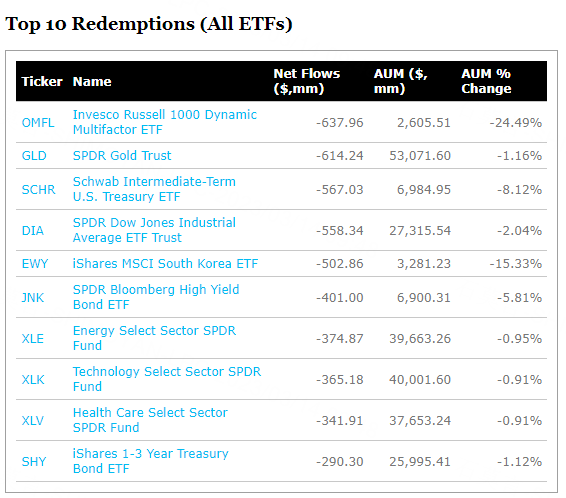

On the other side of the ledger, ETFs with the greatest outflows included the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL) and the SPDR Gold Trust (GLD).

For a full list of last week’s top inflows and outflows, see the tables below: