- NIO stock has a strong buy consensus among Wall Street analysts.

- In the last five days, amid two bullish ratings, NIO stock has soared nearly 30%.

- Deutsche Bank's analysts have named NIO its top Chinese EV pick.

The Wall Street Consensus on NIO

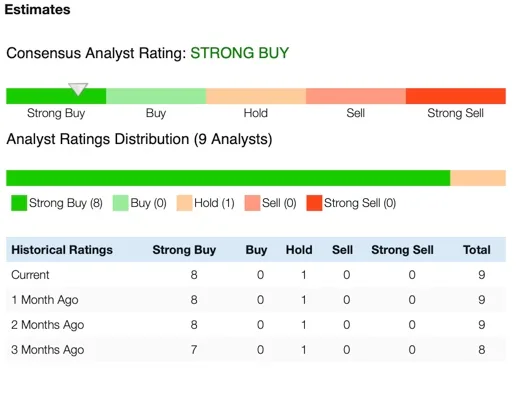

There is not a single Wall Street analyst who is bearish on NIO (NIO) stock. Among the nine analysts who have covered the stock over the past three months, all but one have a buy recommendation:

With a median target price of $31.84, this implies an upside potential of about 47% in NIO shares, considering the last share price of $21.5 per share.

NIO Is Deutsche Bank's Top Pick

A few days ago, Deutsche Bank analyst Edison Yu named NIO his top pick among Chinese electric vehicle (EV) makers. According to Yu, sales of NIO's older models continue to be healthy. And NIO's premium ET5 sedan is also selling well, based on early feedback.

In a note to his clients, Yu also said that the time has finally come for NIO stock to "shine bright."

With that, the Deutsche Bank analyst revealed his bullish price target on NIO of $39 per share — which implies an upside potential of over 80% from the current price of $21.40 per share.

Thanks to this new price target, plus another bullish rating from Bank of America analyst Ming-Hsun Lee, NIO shares soared 12% during the September 12 trading session.

Focusing on NIO's Strong Volume Growth From Q4 Through 2023

Analyst Bo Pei of US Tiger Securities recently lowered his price target from $35 to $32 after NIO's second-quarter (Q2) results, although he kept his buy recommendation on the stock.

Pei noted that NIO's Q2 results were largely in line with expectations. But its guidance for the third quarter was below the consensus due to external factors that should ease in the fourth quarter, when he expects volume to rebound.

With Q2 deliveries being pre-announced, investors are focused on Q2 margins and the second-half outlook. The analyst pointed out that the drop in vehicle margins of 16.7% was due to increased battery costs.

In addition, the Tiger Securities analyst pointed out that NIO is still hoping to deliver 100,000 vehicles in the second half, implying that at least 67,000 will be delivered — which is already double the Q3 guidance.

Even though it's an ambitious goal, the new ET5 and ES7 models should drivegrowth volume and make this goal achievable. Finally, the analyst also wrote that he thinks that, in Q3, vehicle margins should also increase due to the improved mix shift, along with price hikes.

Our Take

Based on the macroeconomic backdrop and the latest Consumer Price Index (CPIDas ) data, it's likely higher interest rates will persist.

Thus, growth stocks like NIO should continue to be impacted in the near term, because their future earnings are less attractive than bonds, which pay more competitive yields in periods like the present.

This year alone, NIO's shares have already lost about 34% of their value. This is also due to the influence of delisting risks amid the regulatory conflicts between the U.S. and China.

In any case, the path for NIO should continue to be bumpy. But Wall Street thinks the future still looks bright for this stock. Analysts expect NIO's sales growth to be 78% next year, versus an industry consensus of 34% for the broader EV market.

In addition, its innovative fast-charging swapping battery technology puts NIO one step ahead of its European and U.S. competitors. NIO's entry into the European market — including the launch of a manufacturing facility in Europe — are also further indications of exponential growth in the long term.