These tech companies are disrupting the status quo -- that could mean big gains for investors.

As time passes and technology changes, some well-established enterprises will fade from relevance as lesser-known start-ups rise in their place. The tricky part is finding those potentially life-changing investments early on.

Fortunately, companies that achieve great success tend to havecertain traits in common. For instance, they are often first movers in emerging industries. That could mean developing a new product or tackling an old problem with a novel solution.

Enterprises likeLemonade(NYSE:LMND)andArista Networks(NYSE:ANET)check that box. Here's why investing in these two tech companies could make you rich.

1. Lemonade: AI-powered insurance

Lemonade is atech companythat sells insurance. Though its initial focus was on renters and homeowners policies, it entered the pet insurance andterm life insurancemarkets in 2020, and it plans to expand its portfolio again in 2021.

Lemonade's digital approach to insurance differs dramatically from its rivals. While traditional insurers have agents who sell policies and handle claims, Lemonade automates these processes with AI-powered chatbots. In fact, the company uses artificial intelligence to improve virtually every aspect of its business: Marketing, underwriting, fraud detection, and the customer experience.

So far, the results are encouraging. Lemonade's loss ratio dropped to 71% in 2020, meaning the company paid out $0.71 in claims for every $1 in earned premiums. That's a big improvement from its 161% loss ratio in 2017. More importantly, it puts Lemonade roughly in line with the top 20 property and casualty (P&C) insurance companies, which have an average loss ratio of roughly 72% in recent years.

Likewise, Lemonade's sales and marketing expenses actually decreased 9% in 2020, but its customer base grew 56% and its premium per customer grew 20% during the same time period. In other words, Lemonade's AI-powered marketing is becoming more efficient.

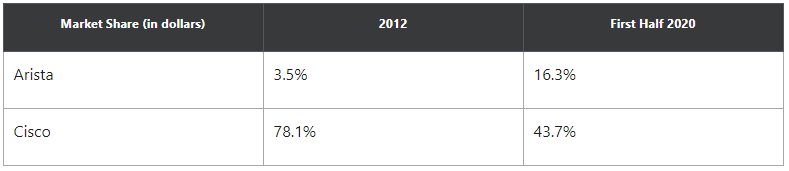

Moreover, the addition of new customers (and the rising premium per customer) have powered impressive growth in gross profit.

Investors should be aware that Lemonade is much smaller than market-leading rivals likeBerkshire Hathaway's group of insurance brands andAllstate. But the insurance industry is enormous, generating over $5 trillion in annual premiums worldwide. That means Lemonade has a massive opportunity, and capturing even a few percentage points of that market would translate into tens of billions of dollars on the top line. Moreover, the company's AI-powered business should give it a long-term advantage over its rivals.

2. Arista Networks: Software-driven networking

Arista provides networking solutions (switches and software) for data centers and enterprise campus environments. Since its inception, the company's software-driven approach to networking has differentiated it fromCiscoandJuniper Networks. For example, rather than selling discrete routers like its rivals, Arista's software allows its R-Series switches to double as advanced routing platforms. This reduces cost and complexity for Arista's clients.

As part of its enterprise portfolio, Arista launched its 750 series campus switch last November. This new product line offers 400 Gbps (gigabits per second) of total bandwidth -- five times more than the closest competitor -- and helps clients create fast, secure WiFi networks. Like all Arista hardware, these new switches are powered by merchant silicon rather than costly proprietary chips used by rivals.

Arista's decision to use merchant silicon has been a big advantage for two reasons. First, it allows the company to launch new products quickly while still incorporating the latest chip technology. Second, it makes Arista more efficient than its rivals, because the company doesn't spend money to develop chips in-house. Ultimately, Arista can pass those savings on to customers, meaning its products come at a better price-to-performance ratio.

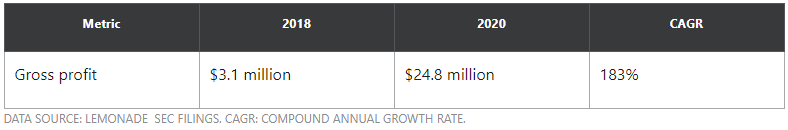

Over the last decade, these advantages have helped Arista take significant market share in the high-speed data center switching market (10 Gbps and above). Meanwhile, Cisco's market share has trended downward, though the company is still the leader.