Summary

- Nvidia stock crashes as much as 12% after the semi company disclosed that the U.S. government ordered a restriction on a selected portfolio of high-margin.

- Nvidia has estimated the impact of the export restriction at $400 million in potential sales for its third fiscal quarter.

- Although Nvidia stock is down almost 60% from all time highs, the valuation is still very expensive.

- Personally, I would not buy Nvidia at a valuation above 30x EV/EBIT and/or 10x EV/Sales, which are still very proud multiples.

- Accordingly, I see 20 - 30 percent more downside before the risk/reward for investors becomes justified.

Thesis

Nvidia (NASDAQ:NVDA) stock crashed 7.5% -- and intermittently more than 12% -- after the semi company disclosed that the US government ordered a restriction on a selected portfolio of high-margin AI chips to China. The announcement comes after Nvidia has already warned a slowing business environment for its chips with regards to both the company's gaming and data-center segment.

In my opinion, Nvidia stock has for a long time been overhyped and overvalued. And although NVDA stock is down approximately 60% from all time highs, I argue there is still some excess valuation premium that need to be corrected in order for investors to enjoy an attractive risk/reward.

Seeking Alpha

U.S. Government Restricts Chip Sales

The filing

On August 31, Nvidia filed a disclosure with the Securities and Exchange Commission saying that the company has been notified about an export restriction of certain AI chips to China and Russia.

...the U.S. government informed NVIDIA Corporation that the USG has imposed a new license requirement, effective immediately, for any future export to China (including Hong Kong) and Russia of the Company’s A100 and forthcoming H100 integrated circuits.

The restriction specifically names Nvidia A100 and H100 chips, but also extends to any chips that may match the technology.

The license requirement also includes any future NVIDIA integrated circuit achieving both peak performance and chip-to-chip I/O performance equal to or greater than thresholds that are roughly equivalent to the A100, as well as any system that includes those circuits.

What's The Impact

Nvidia has estimated the impact of the export restriction at $400 million in potential sales for its third fiscal quarter. Accordingly, the impact could be expanded to about $1.6 billion annually. If we apply Nvidia's 26% net income margin, and further apply the stock's currentx81 one-ear forward P/E multiple, the impact on valuation loss could be estimated at about $33.7 billion of equity value.

Investor Implication

The export restriction highlights a risk that the market arguably has ignored so far: the possibility that Nvidia's leading chip technology becomes an instrument of politics. In the filing, Nvidia cited 'the risk that the covered products may be used in, or diverted to, a military end use or military end user' as the main reason for the export restrictions. But arguably, this step is just the latest episode in the technology war.

Arguably, the selected restriction of Nvidia's 'A100 and H100' exports could only be the first wave of regulations to hit the US Semi industry.

Moreover, even if the US government does not extend restrictions to more of Nvidia's chips, it is highly likely that Nvidia will lose market share in China regardless. Investors should consider that the Chinese government will take restrictions of chips exports as a warning signal; and the response is that China will push to 'replace' exposure to the US' chip industry.

Still Very Stretched Valuation

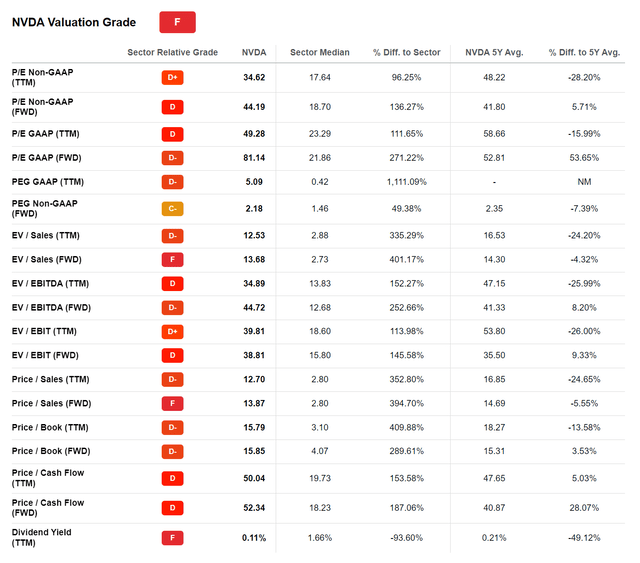

Although Nvidia stock is down almost 60% from all time highs, the valuation is still very expensive. Investors should consider that Nvidia's one-year forward GAAP P/E of 81x implies a 270% premium to the U.S. technology sector. Nvidia's P/B of 15.8x and P/S of 13.9x imply a 290% and 395% premium respectively. Given a slowing business cycle for semiconductors, paired with fading investor confidence in US growth stocks, these multiples are highly vulnerable to a valuation contraction.

Seeking Alpha

Paying too much for a 'hyped' investment can be very dangerous. Arguably, Cisco's (CSCO) growth story and equity performance in the early 2000 is very similar to the current situation surrounding Nvidia, from my viewpoint.

In the late 90s and early 2000, Cisco stock boomed from $5/share to about $80/share (stock-split adjusted). Investors were excited buying into the company's growth story that was driven by the World Wide Web adoption. Valuation did not matter, until it suddenly did. Then, in less than 24 months, Cisco stock lost almost 90% of its value. Interestingly, little changed for Cisco's fundamentals. In fact, the bull thesis of the World Wide Web taking over the world was correct. But investors simply paid way too much. Today, more than 20 years later, Cisco stock still trades approximately 50% below the stock's all time high.

Seeking Alpha

Conclusion

No doubt, Nvidia is a great business. But the company's stock is dangerous. After a weak June quarter, driven amongst others by a slowing semi demand in the gaming and data-center vertical, now investors must also price the negativity of heightened regulatory risk.

Personally, I would not buy Nvidia at a valuation above 30x EV/EBIT and/or 10x EV/Sales, which are still very proud multiples. Accordingly, I see 20 - 30 percent more downside before the risk/reward for investors becomes justified(but arguably still not attractive given the regulatory risk and slowing business cycle). Sell.