Summary

- Tesla stock is down 6.25% after the company reported slightly worse-than-expected Q3 results.

- I am not convinced that the move is reasonable, or sustainable.

- Firstly, investors should consider that Q3 delivery numbers - which were presented a few weeks earlier - indicated already a challenging environment.

- Secondly, Tesla's Q3 results were actually not that bad with automotive revenues jumping by 28% quarter over quarter, and 56% year over year.

- Thirdly, Tesla is clearly still a high-growth company. So, trading TSLA shares based on one quarter might not be the best strategy for (long-term) investors.

Thesis

Tesla stock is down 6.25% (after-hours trading reference) after the company reported slightly worse-than-expected Q3 results. But I am not convinced that the move is reasonable or sustainable.

Firstly, investors should consider that Q3 delivery numbers - which were presented a few weeks earlier - indicated already a challenging environment. And the respective headwinds have arguably been priced in, given that the stock is down by about 20% since the news. Accordingly, the stock price reaction following Q3 seems more like a mechanical response to headlines, than to changes in fundamental value.

Secondly, Tesla's Q3 results were actually not that bad, with automotive revenues jumping by 28% quarter over quarter.

Thirdly, Tesla is clearly still a high-growth company. So, trading TSLA shares based on one quarter might not be the best strategy for (long-term) investors.

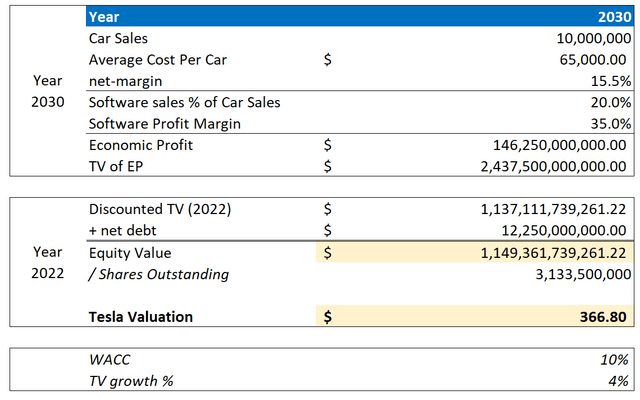

Following my previous analysis that Tesla's fair implied value per share should be around $367, I remain 'Buy' rated and see the 6% dip as an enhanced buying opportunity.

Tesla's Q3 Results

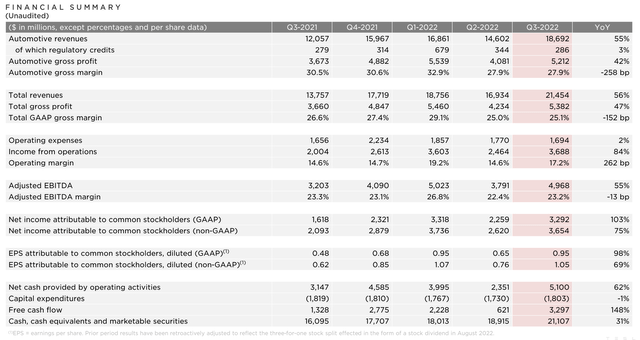

Personally, I disagree with the market consensus that Tesla's Q3 results are bad. From July to end of September, Tesla generated total revenues of $18.69 billion, which compares to $12.06 billion one year prior, and to $14.6 billion in Q2 2022. Thus, Tesla managed to increase revenues by 55% year over year and 28% quarter over quarter. What other company can post such results amidst a clearly slowing global economy?

Net income attributable to shareholders surged 103% year over year to $3.29 billion for the September quarter ($0.95/share). Free cash flow jumped even more, by $148%. I can't stress enough that these excellent numbers should be put in relation to the current macro environment.

Moreover, investors should note that Tesla's growth is high-quality growth, driven by (1) increased volume, (2) higher average selling prices, and (3) non-OEM manufacturing business initiatives. Meanwhile, FX headwinds are estimated to have impacted the business by $250 million in Q3.

Growth Outlook Remains Bright

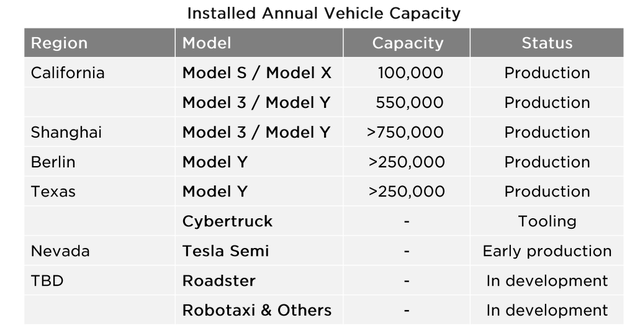

Tesla's growth outlook clearly remains strong: In the Q3 earnings presentation, the company confirmed that over a 'multi-year period', growth is estimated to touch 50% CAGR. Moreover, Tesla continues to affirm that growth challenges remain exclusively related to supply constraints, naming 'equipment capacity, factory uptime, operational efficiency, and supply chain stability' as the key factors for continued high-growth.

During the analyst call, Musk said:

I can't emphasise enough we have excellent demand and we expect to sell every car we can make as far in the future as we can see.

Tesla clearly also has the cash to fund expansion. By end of the September quarter, Tesla had $21.1 billion of cash and cash equivalents (including short-term investments), and generated about $3.3 billion of free cash flow during the quarter.

The EV maker also said that 'Tesla Semi' is expected to deliver first units by end of December 2022 and industrialization for the 'Cybertruck' is 'making progress'.

Going into Q3 earnings, some analysts speculated that Tesla could soon announce a share-buyback program - the company's first effort to distribute value back to shareholders. In the analyst call, Musk confirmed that the company 'generally believes a buyback makes sense' and commented that a buyback program in the range between $5 billion and $10 billion could be likely, even if conditions worsen going into Q3. However, nothing official has been announced yet.

Thoughts On Valuation

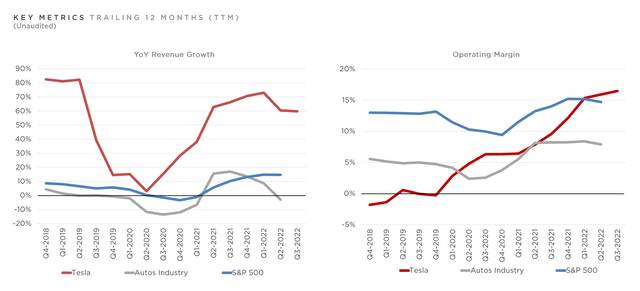

Tesla is clearly trading at a premium valuation - this is no secret. Post Q3, the carmaker is valued at a x8 EV/Sales and x46 EV/EBIT. This implies a valuation premium of about x2 - x3 to the S&P 500 (SPY).

But accounting for Tesla's future outlook, an analyst could argue that the valuation premium is justified. With regard to growth, Tesla is clearly outperforming peers and the broad market. But also profitability is strong, despite the growth expensing: Tesla's operating profitability is almost double the respective metric for peers and now also higher than the respective metric for the S&P 500. Moreover, Tesla's metrics are still up trending, supported by higher production efficiency and software related profits:

while we continue to execute on innovations to reduce the cost of manufacturing an operations, over time, we expect our hardware related profits to be accompanied with an acceleration of software related profits.

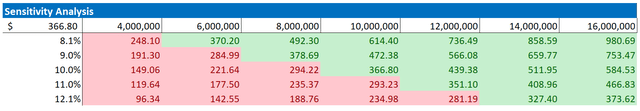

- Upside case $980/share +325% gain

- Downside case $96/share -70% loss

Risks

As I see it, there has been no major risk-updated since I last covered Tesla stock. Thus, I would like to highlight what I have written before:

Although Tesla has proven to be more resilient than what investors thought, both in relation to a challenging macro-economy and fading risk-sentiment, I believe the major risk for Tesla stock remains that a worsening macroeconomic backdrop will pressure investors risk-sentiment to such a degree that Tesla stock's growth multiples compress. Or in other words, investors should acknowledge that much of Tesla's share price performance remains driven by general sentiment towards stocks (Tesla's beta vs the S&P 500 (SPX) is about 1.7). Accordingly, investors should be prepared to stomach volatility, even though Tesla's fundamental outlook remains unchanged.

Personally, I do not believe that increasing competition in the race for electrification will influence the demand for Tesla -- like "other" smart phone makers do not influence the demand for iPhones. The increased competition could, however, exacerbate Tesla's supply challenges, as more competition chases for a limited supply of raw materials and key manufacturing components.

Conclusion

Tesla stock is down by about 50% YTD (including post-Q3 after-hours trading), and I don't deny that some of the price depreciation has been necessary to give investors an improved risk/reward setup. But personally, I do not see how the 6.25% sell-off post Q3 is a value trade. In my opinion, it looks more like a mechanical response to negative news headlines surrounding Tesla's Q3 results.

But personally, I do not think Tesla's Q3 results were bad. And I surely do not see any change in the long-term outlook for Musk's ambitions with the EV maker. Accordingly, I view the 'dip' as an enhanced investment opportunity and reiterate my 'Buy' rating on TSLA stock.