Every investor in Singapore Airlines Limited (SGX:C6L) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. We also tend to see lower insider ownership in companies that were previously publicly owned.

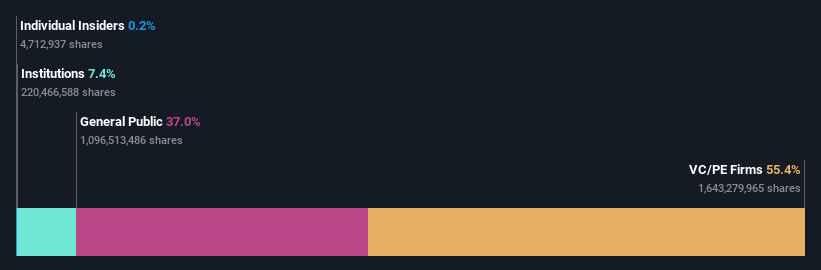

Singapore Airlines has a market capitalization of S$14b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about Singapore Airlines.

What Does The Institutional Ownership Tell Us About Singapore Airlines?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

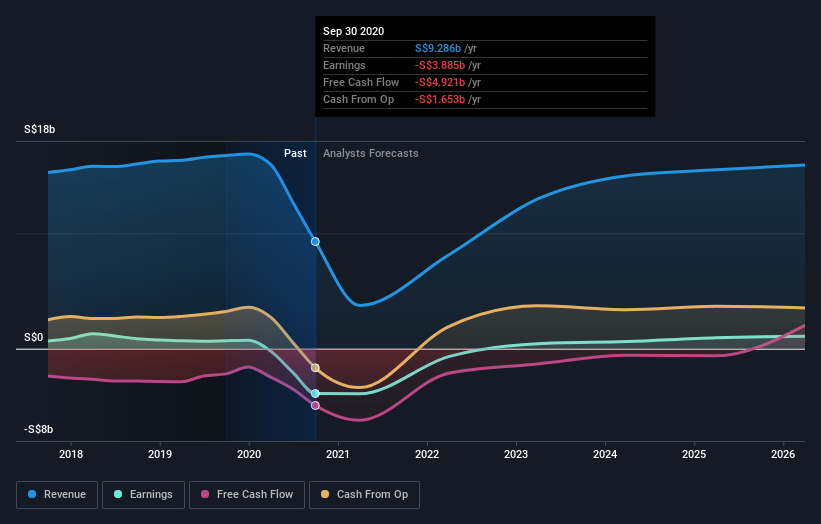

We can see that Singapore Airlines does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Singapore Airlines' historic earnings and revenue below, but keep in mind there's always more to the story.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Singapore Airlines

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that Singapore Airlines Limited insiders own under 1% of the company. Being so large, we would not expect insiders to own a large proportion of the stock. Collectively, they own S$22m of stock. Arguably recent buying and selling is just as important to consider.

General Public Ownership

The general public holds a 37% stake in Singapore Airlines. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With an ownership of 55%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.