Summary

- Coinbase intends to open the financial system for the world through the use of cryptocurrency. Coinbase expects to democratize the crypto-economy like Google democratized access to knowledge.

- Analysts are expecting that the cryptocurrency market size will grow at a CAGR of 11.2%. Under the best-case scenario, I included sales growth of 5%-10% from 2023 to 2030.

- I also assumed net debt of -$2.59 billion and a share count of 250 million.

- With CFO/Sales of 27%-31% and capital expenditures of $348 million, I obtained future free cash flow of $1.49-$3.49 billion.

- Noteholders accepted to receive 0.50% per year and a conversion price of $370.45. This means that most convertible noteholders may believe that the fair value is close to $370.45.

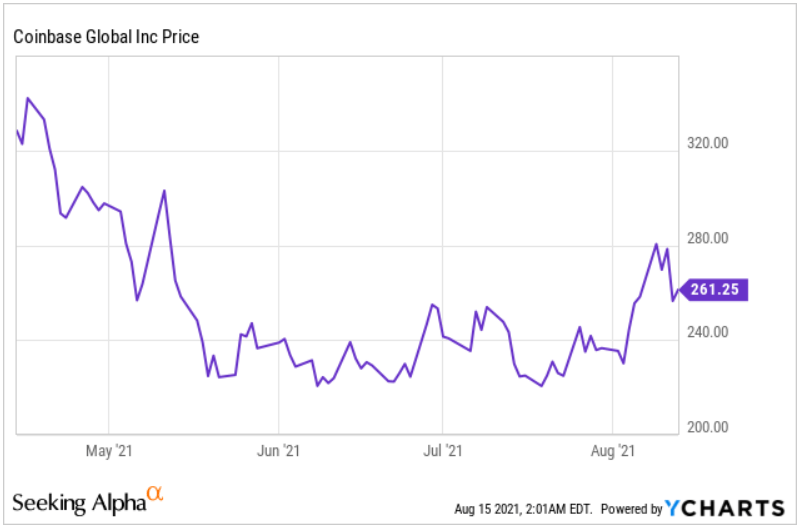

Most market analysts expect significant free cash flow from Coinbase(NASDAQ:COIN). The company also expects to report a large amount of cash in hand growth. I used market estimates and my own assumptions to design a DCF model. With a WACC of 6%, FCF of approximately $17.3 billion, and EV/FCF of 40x, the result is a stock price of $316. The implied stock price that I obtained is significantly higher than the current valuation of Coinbase. Notice that Coinbase is currently trading at $230-$280.

Coinbase’s Business Model

Incorporated in Delaware, Coinbase intends to open the financial system for the world through the use of cryptocurrency:

The company expects to create a system that is fair, efficient, and transparent in the new internet age. Coinbase explained its activities and recent business growth with the following words:

We started in 2012 with the radical idea that anyone, anywhere, should be able to easily and securely send and receive Bitcoin, the first crypto asset. We built a trusted platform for accessing Bitcoin and the broader crypto economy by reducing the complexity of the industry through a simple and intuitive user experience. Today, we are a leading provider of end-to-end financial infrastructure and technology for the crypto economy. Source:S-1

Coinbase expects to democratize the crypto-economy like Google democratized access to knowledge. I don’t know whether Coinbase will be successful or not. With that, right now, a significant number of users and countries accept the company’s operations. Notice that more than 68 million users use Coinbase:

Best Case Scenario

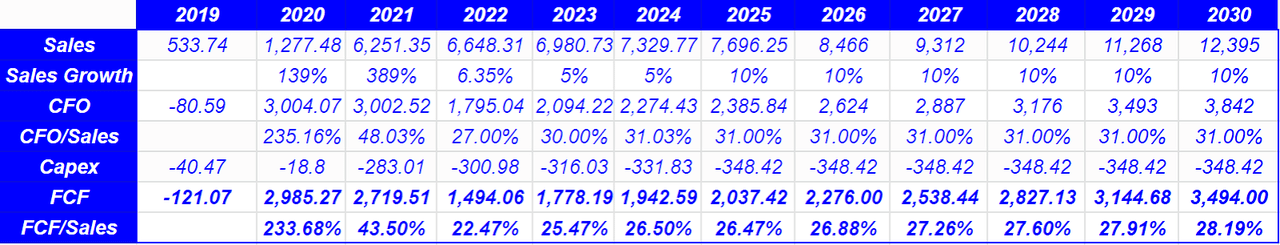

In the best-case scenario,sales estimates are expected to be equal to $6 billion in 2021-2023. The company will most likely not have debt, and FCF will be close to $1.7-$2.7 billion from 2021 to 2023:

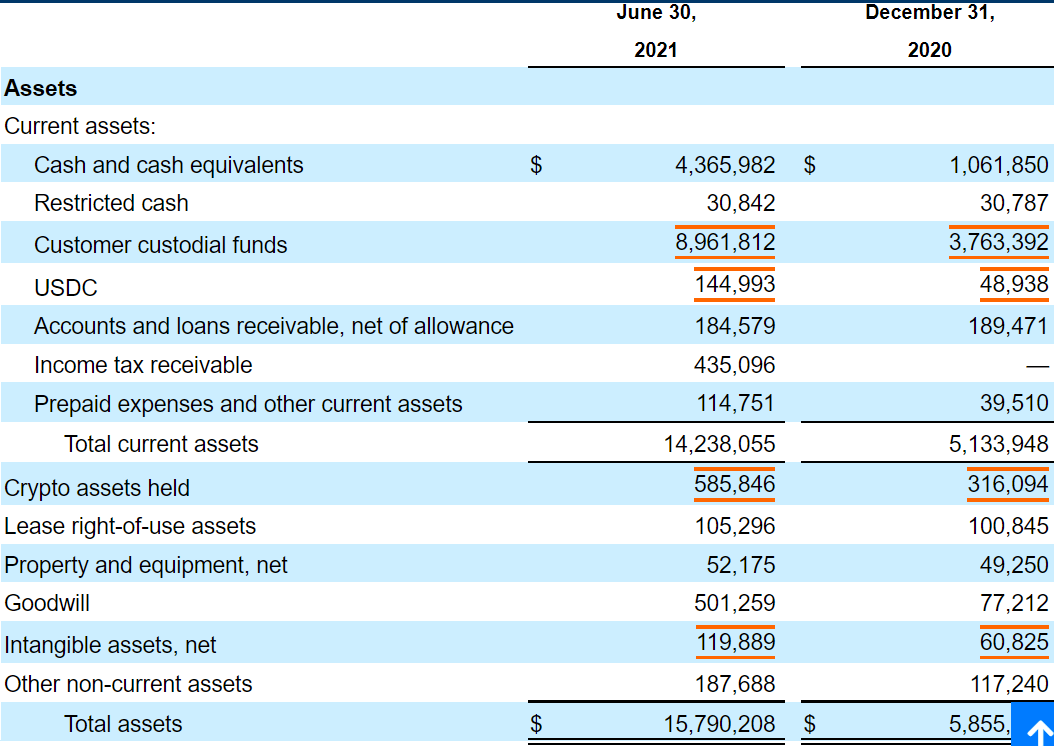

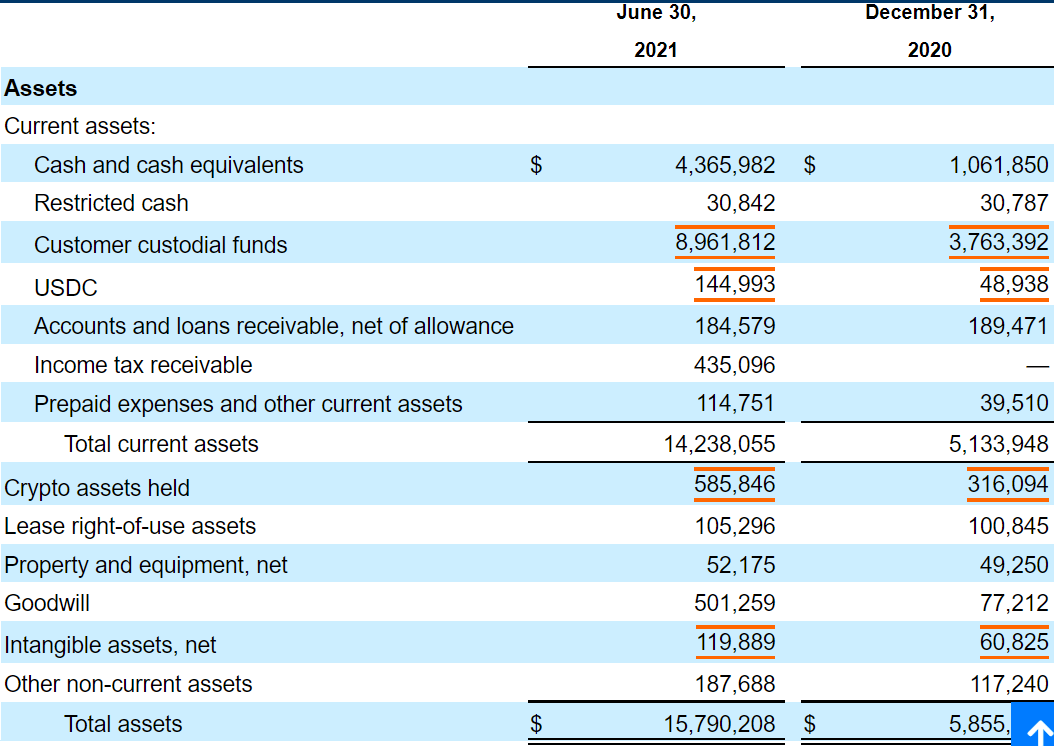

Notice that in 2021, Coinbase reported a significant growth in its cash in hand. Cash in hand increased by 311%, from $1.061 billion to more than $4.365 billion. Like other analysts, I believe that the company’s net cash position will increase until 2023. Market estimates expect the company to report cash in hand of $6.39 billion in 2023.

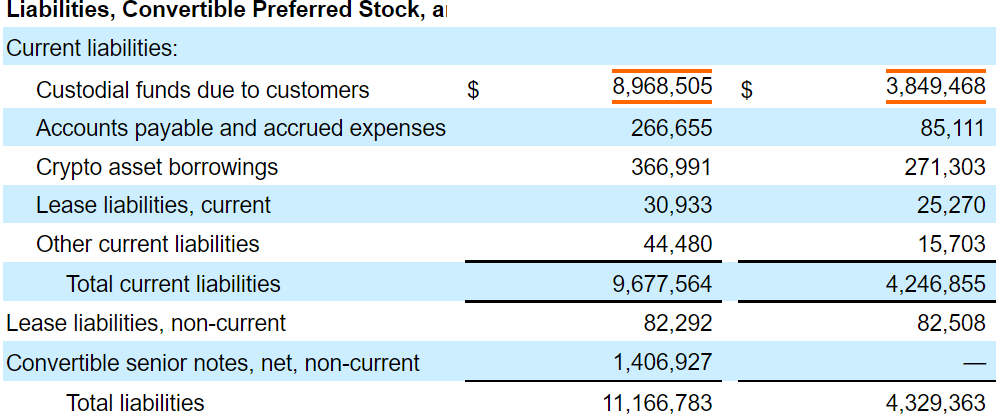

I am not worried about Coinbase’s financial obligations. Take into account that the company’s net debt is equal to -$2.5 billion, so there is cash in hand to pay the financial debt:

Analysts are also expecting that the cryptocurrency market size will grow at a CAGR of 11.2% until 2027. I used a different sales growth rate in my financial models. However, I need to note what market experts are expecting:

The worldwide cryptocurrency market size is anticipated to arrive at USD 1,758.0 million by 2027, displaying a CAGR of 11.2% during the estimated time frame. Source:Cryptocurrency Market Rising at 11.2% CAGR to Reach USD

Under the best-case scenario, I included sales growth of 5%-10% from 2023 to 2030. My sales growth is a bit more conservative than the sales growth of market analysts. With CFO/Sales of 27%-31% and capital expenditures of $348 million, I obtained future free cash flow of $1.49-$3.49 billion:

If we use a WACC of 6%, the sum of the free cash flow from 2021 to 2030 is equal to $17.3 billion. With an EC/FCF of 40x, the terminal value is $59 billion. I assumed net debt of -$2.59 billion and a share count of 250 million. The implied result is a stock price of $316. Coinbase is currently trading at $230-$280, so I believe that the company’s valuation could grow in the coming years:

Worst Case Scenario

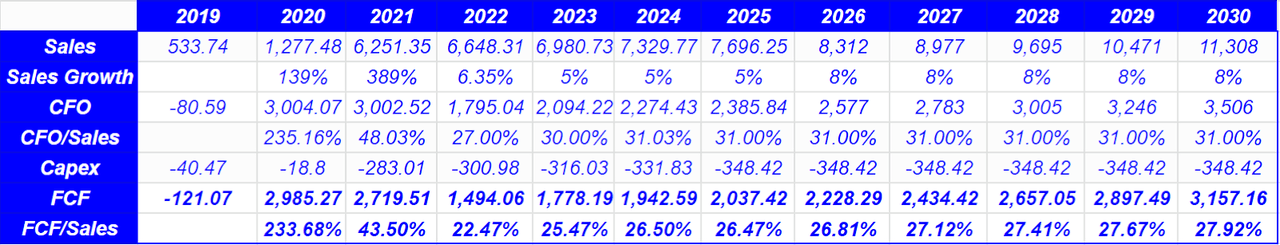

In the worst-case scenario, from 2022 to 2030, Coinbase’s sales would grow at 5%-6.35%, and the free cash flow would grow from $1.4 billion in 2022 to $3.1 billion in 2030:

With a WACC of 7%, the sum of the FCF from 2021 to 2030 is equal to $16.3 billion. With a terminal FCF of $2.8 billion and an EV/FCF of 35x, the terminal value is equal to $49 billion. Finally, the implied price stands at $272, which is close to the current valuation of the market.

Convertible Notes Were Priced At $370.45 Per Share

In my view, the agreement with convertible noteholders offers significant information about the valuation of Coinbase. Noteholders accepted to receive 0.50% per year and a conversion price of $370.45. This means that most convertible noteholders may believe that the fair value is close to $370.45.

On May 18, 2021, the Company entered into a purchase agreement with Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC, as representatives of the several initial purchasers named therein, to issue and sell the Notes. The Notes accrue interest of 0.50% per year payable semi-annually in arrears. Source:Prospectus

The conversion rate for the Notes will initially be 2.6994 shares of the Class A Common Stock per $1,000 principal amount of the Notes, which is equivalent to an initial conversion price of approximately $370.45 per share of the Class A Common Stock. Source: Prospectus

Risks From Cryptocurrency Volatility and Regulatory Issues

Coinbase makes business with cryptocurrency assets, which are very volatile. I would expect the company to suffer significant volatility in the coming years. With this in mind, I expect some investors to use a weighted average cost of capital that may be larger than my WACC. In this case scenario, the valuation of Coinbase would be less significant than the figure obtained in my financial model:

Due to the highly volatile nature of the crypto economy and the prices of crypto assets, our operating results have, and will continue to, fluctuate significantly from quarter to quarter in accordance with market sentiments and movements in the broader crypto economy. For example, the average three-month Crypto Asset Volatility supported on our platform increased by 73% from the fourth quarter of 2019 to the first quarter of 2020. Source:S-1

In my opinion, Coinbase will most likely suffer a significant amount of regulatory changes both in the United States and the European Union. I am talking about anti-money laundering regulations among other changes in the law. According to the prospectus, the Financial Crimes Enforcement Network is willing to collect personal information from owners of wallets and the E.U. Fifth Money Laundering Directive intends to regulate crypto-related activities. These changes in the law may reduce the public interest in cryptocurrency, which may lead to a decline in the valuation of Coinbase:

More recently, in December 2020, FinCEN released a proposed rule that would require us to collect personal information from the owners of self-custodied wallets that transfer cryptocurrencies to or receive cryptocurrencies from Coinbase, and report certain transactions to the federal government. There are substantial uncertainties on how these requirements would apply in practice, and we may face substantial compliance costs to operationalize and comply with these rules. We may be further subject to administrative sanctions for technical violations or customer attrition if the user experience suffers as a result. As another example, the recent extension of anti-money laundering requirements to certain crypto-related activities by the E.U. The Fifth Money Laundering Directive has increased the regulatory compliance burden for our business in Europe and, as a result of the fragmented approach to the implementation of its provisions, resulted in distinct and divergent national licensing and registration regimes for us in different E.U. member states. Source: S-1

My Takeaway

Most market estimates about Coinbase include significant free cash flow from now till 2030. With sales growth and FCF from other market analysts, I designed a DCF model, which provided an implied result of $316 per share. Coinbase is currently trading at $230-$280, so I believe that the stock has upside potential. In my view, as soon as more analysts learn about the expected free cash flow, the demand for the stock will increase. As a result, we will most likely see an increase in the stock price.