ProShares UltraPro QQQ (NASDAQ:TQQQ – Get Rating) was the target of a large growth in short interest in the month of June. As of June 15th, there was short interest totalling 21,900,000 shares, a growth of 20.9% from the May 31st total of 18,120,000 shares. Based on an average trading volume of 157,782,400 shares, the days-to-cover ratio is presently 0.1 days.

A number of hedge funds have recently modified their holdings of TQQQ.

- Morgan Stanley raised its holdings in ProShares UltraPro QQQ by 1,810.9% during the 3rd quarter. Morgan Stanley now owns 100,495 shares of the exchange traded fund’s stock valued at $12,519,000 after acquiring an additional 95,236 shares during the period.

- Captrust Financial Advisors purchased a new position in shares of ProShares UltraPro QQQ during the 3rd quarter valued at $61,000.

- IFP Advisors Inc grew its position in shares of ProShares UltraPro QQQ by 755.0% during the 4th quarter. IFP Advisors Inc now owns 1,710 shares of the exchange traded fund’s stock valued at $285,000 after purchasing an additional 1,510 shares in the last quarter.

- MADDEN SECURITIES Corp grew its position in shares of ProShares UltraPro QQQ by 119.4% during the 4th quarter. MADDEN SECURITIES Corp now owns 20,306 shares of the exchange traded fund’s stock valued at $3,377,000 after purchasing an additional 11,051 shares in the last quarter.

- Finally, Spire Wealth Management grew its position in shares of ProShares UltraPro QQQ by 67.4% during the 4th quarter. Spire Wealth Management now owns 2,815 shares of the exchange traded fund’s stock valued at $468,000 after purchasing an additional 1,133 shares in the last quarter.

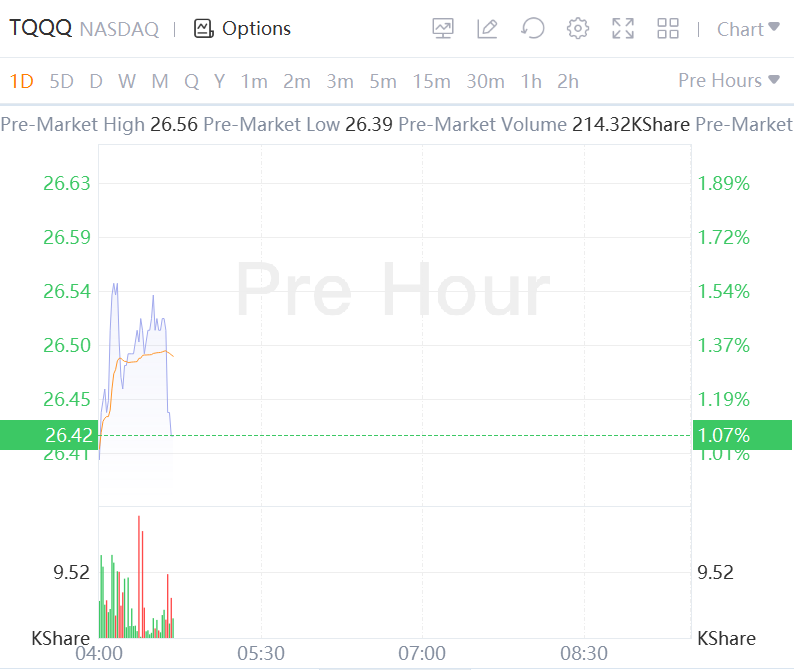

Shares of TQQQ stock opened at $26.14 on Thursday. The company’s fifty day simple moving average is $29.51 and its two-hundred day simple moving average is $48.13. ProShares UltraPro QQQ has a 1 year low of $21.32 and a 1 year high of $91.68.

Proshares UltraPro QQQ ETF (the Fund) seeks daily investment results, before fees and expenses that correspond to triple (300%) the daily performance of the NASDAQ-100 Index (the Index). The Fund invests in equity securities, derivatives, such as futures contracts, swap agreements, and money market instruments.