A pledge among European Union leaders to curb oil purchases from Russia lifted crude prices, while U.S. stock futures fell, reigniting volatility in the markets during the last trading session of the month.

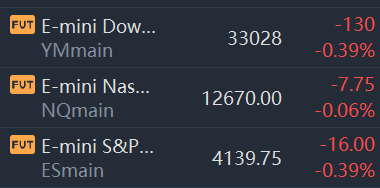

Futures for the S&P 500 fell 0.4% Tuesday, a day after U.S. markets were closed for Memorial Day. The benchmark index had risen 0.6% for the month through Friday, putting it on track to steady after April’s 8.8% loss. Contracts for the Dow Jones Industrial Average shed 0.4%, while those for the technology-focused Nasdaq-100 declined 0.1%.

Crude prices rallied after EU leaders said for the first time that they would impose anoil embargo on Russia over Ukraine war. The embargo would include an exemption for oil delivered from Russia via pipelines, an amount that makes up one-third of EU oil purchases from Russia.

Futures for Brent crude, the global benchmark, rose 1.8% to $119.69 a barrel. West Texas Intermediate, the U.S. marker, rose 3.3% to $118.86 a barrel, playing catch-up after the market was closed Monday.

Tuesday’s session will cap another volatile trading month, during which stocks around the world swung wildly as traders tried to assess the outlook for global economies. In the U.S., stocks tumbled shortly after the month began and continued falling amid a slew of worrisome earnings results and worse-than-expected economic data. Profit warnings from companies ranging from Snap to Target intensified worries among investors that inflation is weighing more on corporations than once anticipated.

By mid-May, it seemed the S&P 500 was bound to close in a bear market, defined as a drop of 20% or more from a recent high. But a late-month rally sent stocks racing higher and helped the benchmark index trim its losses. The S&P 500 is now down 13% from its January high.

Professional and individual investors alike have waded into the recent rally in the U.S. markets, finding opportunities to scoop up stocks that have seen their valuations fall. However, many investors remain aware that the issues that sent stocks falling earlier this month have yet to abate.

Many traders remain worried that the Federal Reserve’s plans to raise interest rates aggressively could tip the U.S. economy into a recession. Meanwhile, concerns about an economic slowdown in China and sustained supply-chain disruptions due to the pandemic and the war in Ukraine have continued to weigh on investors’ minds.

“There’s a bit of market uncertainty just about the pretty rapid rally we’ve had,” said Brooks Macdonald Chief Investment Officer Edward Park, “and whether that can be sustained in a world where inflation is clearly still a factor.”

In the bond market, the yield on 10-year Treasury notes rose to 2.822% from 2.748% Friday. Yields have fallen from their 2022 high of more than 3.1% in recent weeks as investors dialed down expectations of how far the Federal Reserve will raise interest rates to curb inflation. Bond yields and prices move in opposite directions.

International stock markets were mixed. The Stoxx Europe 600 fell 0.6%, on pace to snap a four-session winning streak after eurozone inflation rose faster than expected and reached a record. Consumer prices rose 8.1% on the year in May after climbing at a 7.4% rate in April. The inflation report will likely factor into the European Central Bank’s upcoming interest-rate decisions. Earlier this month, ECB President Christine Lagarde indicated that the central bank could increase its key interest rate in July for the first time in 11 years.

Declines during the European session were broad. Shares of banks, travel stocks and retailers were among those to decline. In contrast, Tuesday’s gainers included Norway’s Equinor, Spain’s Repsol and London-listed Shell–energy companies which stand to benefit from the advance in oil prices.

In Asia, the Shanghai Composite Index rose 1.2% after the city’s government said a two-month lockdown would be lifted Wednesday. The shutdown, designed to limit Covid-19 transmission, had slowed the Chinese economy and added to inflationary pressures elsewhere in the world by gumming up supply chains. Hong Kong’s Hang Seng rose 1.4%. Japan’s Nikkei 225 bucked the trend, falling 0.3%