Summary

Tesla faces significant risks in 2025, including declining sales in Europe and China, and potential U.S. market challenges due to policy changes.

President Trump's tax and emission policy changes, along with halted charging network expansion, pose a triple threat to Tesla's U.S. market.

Tesla's ambitious 20-30% growth forecast for 2025 is likely unrealistic given its history of missed targets and current market conditions.

With a $1 trillion market cap and weak FCF growth, Tesla is overvalued, making it a strong sell recommendation.

Tesla is our top short recommendation of 2025, discussed here. The company has already underperformed the market by 15%, and we discussed how its 2024 revenue turned the company into officially a shrinking company. Given recent data out of Europe, we now think the company will come nowhere near meeting its sales targets.

Note: The aim of this article is to be a-political. We understand that Elon Musk has become linked to President Trump; however, our attempt is to focus solely on quantifiable facts and their impacts.

Tesla and Europe

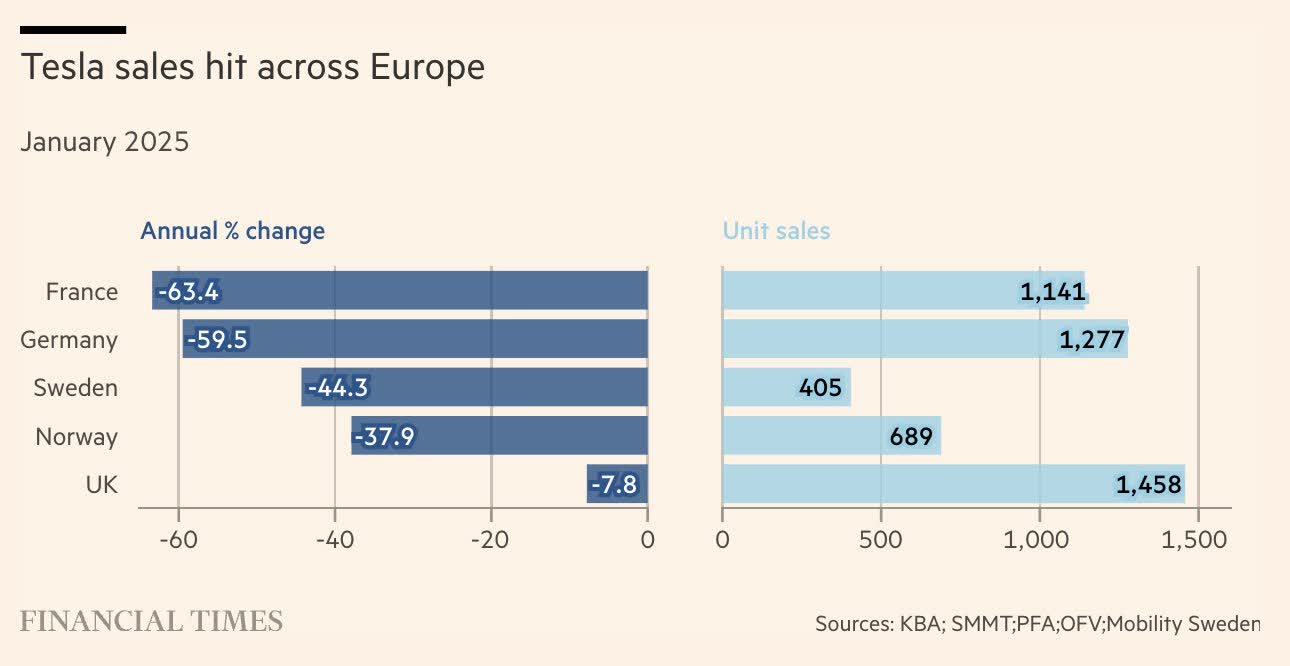

January sales data coming out of Europe has indicated that Tesla has seen a dramatic decline in sales.

Tesla has seen substantial sales declines in January 2025 across Europe. That's enormous news because Europe, with a de-facto sales ban on non-electric vehicles starting in 2035, is one of the most important markets for Tesla. The exact reasons are debatable, some would argue it's because of Elon Musk's alignment with the political right over the past few weeks.

The minister of Poland, for example, has encouraged Poles to no longer purchase Teslas, due to Elon Musk's comments.

However, what's clear is that from a European perspective, Tesla is just as foreign as major Chinese EV makers. The company won't receive domestic support, and it's clearly declining in popularity. Elon Musk has projected 20-30% growth, but when one of your markets is declining 50%, that's tough.

President Trump and Tax Credits

Another major risk in the U.S. market is President Trump and the tax cuts that have helped electric vehicles out.

President Trump has already slowed building out the U.S. charging network, pausing $3 billion earmarked dollars. At the same time, there are discussions that his proposed tax plan, which will involve Congress, would remove the EV tax credit. Lastly, he's rolling back emission standards, which earns Tesla substantial revenue and profit from selling excess vehicle credits.

This is a triple whammy for the company in its home market, the United States. Less charging, more expensive vehicles, and a lack of value for credits. California is the biggest market for EVs in the United States by a wide-margin (35% of EVs sold in the United States). Yet, Tesla's market share declined from 60% to 52%.

Combined with the stagnant growth for EVs in California, that could hurt the company's strength in its strongest market.

Tariff Tesla Pressure

At the same time, on top of the above two factors, Tesla will potentially face pressure from tariffs.

While the tariffs on Canada have been paused, before that happened, the company was threatened by 100% tariffs on vehicles sold in Canada. This was a Tesla-specific threat, solely because of CEO Elon Musk's association with the Trump administration.

Given that tariffs are a central part of many of President Trump's goals and discussions with other countries, we wouldn't be surprised to see retaliatory measures against Tesla from other countries. This could be especially true in countries with their own homegrown EV industries, such as China or Europe, that they'd want to promote.

Tesla's Own Forecasts

Tesla's forecast is for 20-30% sales growth in 2025.

Yet, Tesla is known for incredibly ambitious goals. In 2020, reiterated in 2021 and 2022, the company's 2030 target was 20 million vehicles per year. The company removed that from its goals in 2024. As late as December 2024, the company was still targeting sales growth in 2024, although as we discussed with the company's 4Q 2024 earnings, it missed that as well.

Elon Musk has announced the target for 20-30% growth in 2025; however, we expect that to be another missed estimate like so many of Tesla's prior ones. The takeaway here is that Tesla does not have a history of accurately forecasting its own growth.

Our View

Our view is that Tesla has no remaining growth drivers:

In China, one of the company's most competitive markets, sales declined 33% from December.

2 million Cybertruck reservations at YE 2023, have been completely exhausted. That's evident because customers can now order one for immediate delivery. Only 40k were sold in 2024.

At the same time, the company has a number of major risks.

Declining Europe and China sales from increased competition from traditional protected carmakers.

Declining U.S. sales from a government that's against EVs that's taking tangible steps to change things.

Elon Musk's association with President Trump, leading to potential retaliatory tariffs or boycotts from other nations / groups against political views.

Tesla Investor Presentation

At the same time, Tesla saw a 6% revenue decline from 2023 to 2024. The company only managed to earn $3.5 billion in FCF and $15 billion in net operating cash flow despite a $1.13 trillion market cap (0.3% FCF yield). The company is obviously overvalued without an ability to drive FCF growth, and January 2025 data was already weak.

We don't see a way for the company to achieve any revenue or FCF growth at all in 2025. And without achieving revenue or FCF growth, we don't see how the company can justify a valuation of more than $1 trillion, more than most of its peer carmakers combined.

The largest 5 carmakers by vehicles sold collectively sold 40 million vehicles. Together, they hold 60% of the market. Together, they're worth $475 billion, or roughly 35% of Tesla. We simply don't see a path for Tesla to justify its valuation even at 20 million vehicle sales, which the company, with super lofty goals, has moved away from.

Thesis Risk

The largest risk to our thesis is decreasing competition. Traditional carmakers had been rapidly building up their portfolios of EVs, anticipating that was where the market was headed. A lack of administrative pressure could cause them to back up, enabling Tesla to regain market share and improve its positioning in what is still a valuable market.

Conclusion

The numbers are in for January 2025, 8% of the year gone, and the numbers for Tesla are coming in quite weak. We don't expect the company's 1Q 2025 earnings to be particularly impressive as a result, and we actually expect the company to underperform in terms of what the company managed to do in the 1Q 2024.

Yet, the company's valuation is incredibly high. The company's market cap is more than $1 trillion, and the company's FCF yield is a fraction of a %. The company, which shrank from 2023 to 2024, and that we don't expect to grow into 2025 from the above discussion, would need 20-30x the FCF multiple to justify its valuation.

That re-affirms the short thesis and makes the company a strong sell in our view.