Stop us if you've heard this one before -Wall Street prime brokers allowed hedge funds to dance while the music was playing with ever greater leverage in off-exchange and unregulated derivatives... until the first sign of trouble and the whole house of cards comes crashing down in a potentially systemic manner.

The bloodbath in various media stocks on Friday has brought light back to one of the dark corners of the equity trading business -so-called contracts-for-differences (CFDs).

As Bloomberg reports, much of the leverage used by Hwang’s Archegos Capital was provided by banks including Nomura and Credit Suisse -who have most recently admitted huge losses- asCFDs, which are made off exchanges, allow managers like Hwang to amass stakes in publicly traded companies without having to declare their holdings(far in excess of the 5% stakes that require regulatory reporting).

Crucially,as Bloomberg notes,this meansArchegos may never actually have owned most of the underlying securities - if any at all- as the CFD is akin to a privately-arranged (i.e. off exchange and bespoke) futures contract where the differences in the settlement between the open and closing trade prices are cash-settled (there is no delivery of physical goods or securities with CFDs).

What makes the situation worse is thatArchegos reportedly took positions in these CFDs with various prime brokers- and because these positions are by their nature not centrally cleared or aggregated, this left prime broker X unaware of their client's exposures with prime broker Y... which in this case was huge.

The leverage Hwang was given made him look like a trading genius as the various positions he took were pumped and pumped (and helped by gamma-squeezers) but now look like a reckless gambling fool as the bets collapsed.

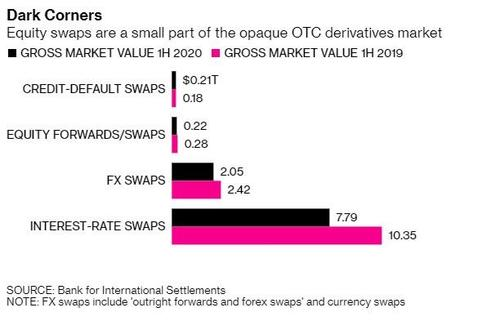

CFDs linked to stocks (with a gross market value of around $282 billion at end June 2020) are among bespoke derivatives that investors trade privately between themselves, or over-the-counter, instead of through public exchanges.This is exactly the kind of hidden risk that amplified the losses during the 2008 financial crisis.

But,banks still favor them because they can make a large profit without needing to set aside as much capital versus trading actual securities(driven to this opaque market as an unintended consequence of heavy regulation following the 2008 financial crisis).

In the case of Archegos, there is very little transparency about Hwang’s trades, but market participants suggest his assets had grown to anywhere from $5 billion to $10 billion in recent years withtotal exposure topping $50 billion. And bear in mind,this is not 'leverage' in the old-fashioned sense(i.e. banks allow you buy X-times the amount of stocks relative to your capital); this ispurely synthetic- the firm has no actual underlying asset to fall back on, but is linearly exposed to losses (and gains) on a margined basis.

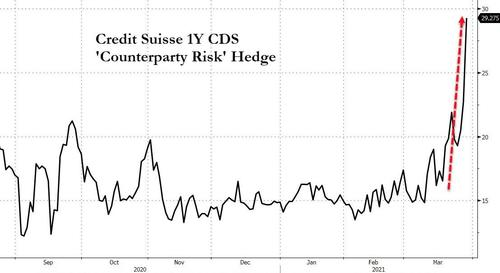

And as we noted at the beginning,this has the potential to be much more systemicas the losses created by Archegos' margin calls trigger more margin calls and more potential losses for the prime brokers. Think we are exaggerating, then explain why the costs of counterparty risk hedging for Credit Suisse for example, has exploded in the last few days...

Mohammed El-Erian told CNBC this morning that"It seems to be a one-off ... for now, it looks contained. And that's a good thing." But added "what we don't want is a pile-up."

We look forward to the Congressional hearings on this.