We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn't mean that they don't have occasional colossal losses; they do (like Melvin Capital's recent GameStop losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Square, Inc. (NYSE:SQ).

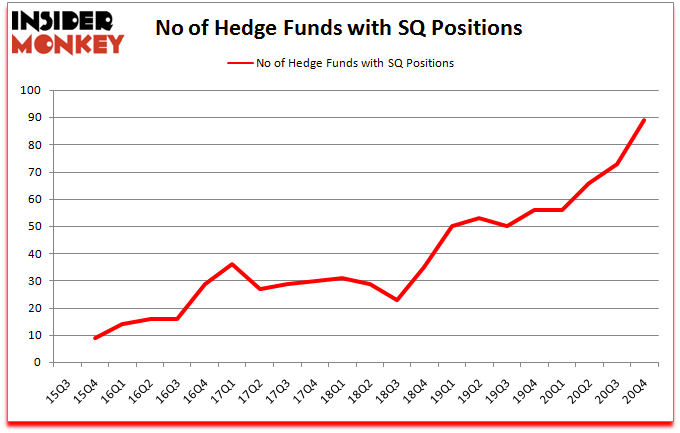

Is Square, Inc. (NYSE:SQ) stock a buy or sell? Prominent investors were getting more bullish. The number of bullish hedge fund positions increased by 16 in recent months. Square, Inc. (NYSE:SQ) was in 89 hedge funds' portfolios at the end of the fourth quarter of 2020. The all time high for this statistic was previously 73. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that SQ isn't among the 30 most popular stocks among hedge funds.

Do Hedge Funds Think SQ Is A Good Stock To Buy Now?

At Q4's end, a total of 89 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from one quarter earlier. By comparison, 56 hedge funds held shares or bullish call options in SQ a year ago. With hedge funds' sentiment swirling, there exists an "upper tier" of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Square, Inc. (NYSE:SQ) was held by ARK Investment Management, which reported holding $1541.4 million worth of stock at the end of December. It was followed by Coatue Management with a $1335.2 million position. Other investors bullish on the company included Bares Capital Management, Lone Pine Capital, and Whale Rock Capital Management. In terms of the portfolio weights assigned to each position Bares Capital Management allocated the biggest weight to Square, Inc. (NYSE:SQ), around 21.35% of its 13F portfolio. Tekne Capital Management is also relatively very bullish on the stock, designating 16.68 percent of its 13F equity portfolio to SQ.

As aggregate interest increased, specific money managers have jumped into Square, Inc. (NYSE:SQ) headfirst. Tiger Global Management LLC, managed by Chase Coleman, initiated the biggest position in Square, Inc. (NYSE:SQ). Tiger Global Management LLC had $88.9 million invested in the company at the end of the quarter. Renaissance Technologies also made a $59.9 million investment in the stock during the quarter. The following funds were also among the new SQ investors: Christopher Lyle's SCGE Management, Paul Marshall and Ian Wace's Marshall Wace LLP, and Michael Kharitonov and Jon David McAuliffe's Voleon Capital.

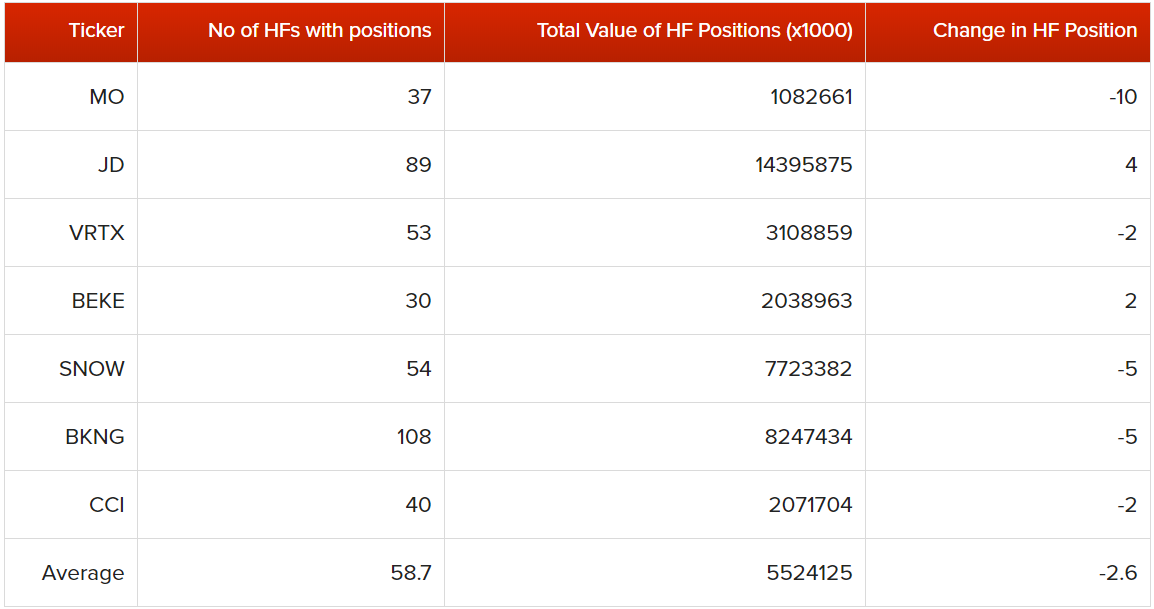

Let's now review hedge fund activity in other stocks similar to Square, Inc. (NYSE:SQ). These stocks are Altria Group Inc (NYSE:MO), JD.Com Inc (NASDAQ:JD), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), KE Holdings Inc (NYSE:BEKE), Snowflake Inc (NYSE:SNOW), Booking Holdings Inc. (NASDAQ:BKNG), and Crown Castle International Corp. (REIT) (NYSE:CCI). This group of stocks' market caps are closest to SQ's market cap.

As you can see these stocks had an average of 58.7 hedge funds with bullish positions and the average amount invested in these stocks was $5524 million. That figure was $8819 million in SQ's case. Booking Holdings Inc. (NASDAQ:BKNG) is the most popular stock in this table. On the other hand KE Holdings Inc (NYSE:BEKE) is the least popular one with only 30 bullish hedge fund positions. Square, Inc. (NYSE:SQ) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SQ is 77.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7% in 2021 through March 12th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on SQ as the stock returned 11.2% since the end of Q4 (through 3/12) and outperformed the market. Hedge funds were rewarded for their relative bullishness.