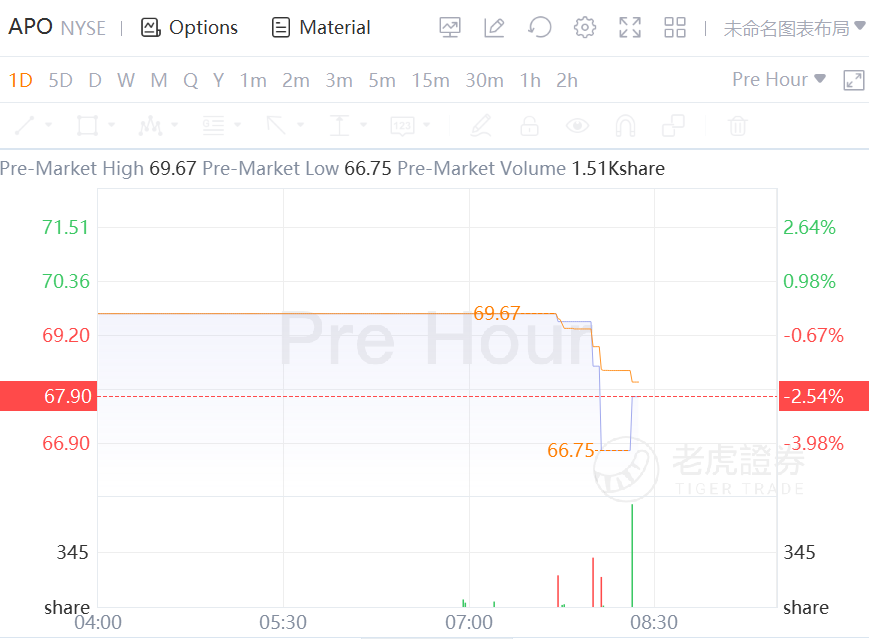

Apollo Global Management stock dropped 3% in premarket trading after Q4 earnings missed consensus, falling from Q3's level, and the private equity firm cut its dividend by 20%. On a Y/Y basis, earnings from its Credit segment rose 33% and from its Private Equity business jumped 76%.

Q4 distributable EPS of $1.05 trailed the consensus of $1.10 and decreased from $1.71 in Q3 and $0.72 in the year-ago quarter.

Fee-related earnings of $309.1M, or $0.67 per share rose from $300.6M, or $0.68 per share, in Q3 and $275.8M, or $0.63 per share, in the year-ago quarter. The Y/Y growth was driven by higher advisory and transaction fees, as well as higher management fees, partly offset by an increase in compensation and non-compensation expenses, primarily due to headcount growth.

Management fees of $519.1M increased from $474.5M in Q3 and $446.8M in the year-ago quarter.

Total investment income of $573.8M grew from $536.5M in Q3 but fell from $768.2M in Q4 2020.

Total assets under management of $497.6B at the end of Q4 rose from $481.1B at the end of Q3, driven by growth of retirement services clients and strong third-party fundraising.

Inflows were $23.6B during the quarter, and $67.5B for the year; Dry powder was $47.2B at quarter-end, of which $26.3B was dry powder with future management fee potential.

Deployed $34.6B during Q4 and recorded realizations of $4.2B.

Q4 performance fee-generating AUM of $92.9B vs. $92.5B in Q3.

Credit segment distributable earnings were $302.5M, up 33% Y/Y.

Private Equity segment distributable earnings of $144.4M jumped 76% Y/Y.

Real Assets segment distributable earnings of $38.3M increased 15% Y/Y.

Conference call at 8:30 AM ET.

Earlier, Apollo Global Management non-GAAP EPS of $1.05 misses by $0.05, revenue of $1.2B