Apple Inc. (NASDAQ:AAPL) has strong fundamentals with a great cushion for a possible upcoming recession. However, the industry is seeing major pullbacks from its bull run and is facing supply chain issues that could lead to massively higher costs than usual. However, a recession may not be all bad for Apple as it could mean the company will face less competition.

Apple has Great Fundamentals and Continues to Grow

As most already probably know, Apple is a strong company with great fundamentals. Despite the company already being worth trillions of dollars, it continues to grow rapidly and see success as the years go by.

The Company can Generate Revenue and Earnings Effectively

From 2017-2021, Apple grew revenues from $229.23 billion to $365.82 billion. This represents an average annual increase of about 13.15%. Furthermore, the company has a great gross margin, sitting at 38.93%. Also, the company's profit margin is a healthy 22.31% and the company continues to grow its earnings.

It is important to mention the 5 categories Apple has to generate revenue. The first is iPhone, which accounts for the majority of Apple's revenue at 52.5%. Next is services, which includes products such as Apple Music, AppleCare, and others. This segment accounts for about 18.7% of the company's revenue. Third is accessories, which includes products such as AirPods, Beats, and Apple TV. This segment accounts for 10.5% of revenue. The final 2 segments are Mac and iPad and account for 9.6% and 8.7% of revenue, respectively.

Apple also recently reported Q2 2022 earnings and delivered a great report. The company's iPhone, Mac, and iPad segments outperformed expectations. The company also raised its dividend and increased its share buyback program. Overall, the company's income statement is strong and shows Apple is in a great position to generate revenue and earnings.

The Balance Sheet is Strong, but the Current Ratio Could be Worked on

Apple has a generally strong balance sheet, but could work on its current ratio. The company has a current ratio of 0.9, mostly because of a high Accounts Payable value at about $52.68 billion. The company's current assets are mainly made up of cash and receivables with about $51.51 billion and $45.4 billion, respectively. This large cash position puts the company in a great position with its debt, with the company having a net debt of -$72.75 billion and a Net Debt/EBITDA ratio of -0.5. The company also has a growing retained earnings account, sitting at about $12.71 billion. This is due to the company continuously posting higher profits.

The Cash Flows are Strong and Apple Continues to Issue Debt Over Equity

From 2017-2021, Apple's operating cash flows have increased from $64.23 billion to $104.04 billion. This calculates to an average annual growth rate of 13.85%. The company's capital expenditures have stayed consistent over the past 5 years. The lowest this account hit was $7.31 billion in 2020. The highest value this account hit was $13.31 billion in 2018.

The company has been issuing debt and repurchasing shares consistently over the past 5 years. As long as management continues to stay responsible with this program and keeps cash holdings high, investors could see increased value by holding shares without worrying about debt becoming overwhelming.

The Tech Industry is Slowing Down After Years of a Strong Bull Run

One of the weakest parts about Apple is the current state of the tech industry. The NASDAQ is down over 20% YTD and continues to fall. With some tech companies like Spotify (SPOT) and Zoom (ZM) being down over 60% over the past 6 months, and even Netflix (NFLX) being down over 70% since November, many are wondering if the tech industry is starting to lose its steam.

A major talking point about the tech industry currently is the slowdown, or in some cases complete freeze, in hiring. Meta (FB) has stated that it is going to cut back on hiring due to lower revenue caused by Apple's changes to privacy. Other companies such as Amazon (AMZN), Zoom, and Robinhood (HOOD) are overstaffed due to increased need for software during the pandemic. Now that the pandemic is starting to fade, the demand for the products from these companies is starting to decrease, meaning slowed hiring, or even layoffs, are likely imminent.

Another thing to note is the valuations that many tech companies are trading at. Tesla (TSLA) is currently worth over 6 times the combined value of General Motors (GM) and Ford (F). As for Apple, it took decades for the company to reach $1 trillion in value. However, the company has been able to triple from that in less than 4 years. With valuations at all-time highs, many are saying a large pullback is coming in the near future.

If a Recession Does Happen, it May Not be All Bad for Apple

About 2 weeks ago, Deutsche Bank was the first major bank to warn that a recession is coming. They claimed that the federal reserve is behind the curve with inflation and that it will need to take aggressive actions to keep it from going vastly higher. With more and more predicting that a recession is coming soon, Apple may become a haven for investors. When a recession hits, investors are much less likely to buy speculative assets and companies and usually shift their capital into safe companies while they are at cheap prices. This means that assets such as cryptocurrencies, NFTs, and start-ups will see money pour out of them and into companies like Apple.

Also, Apple's previously mentioned cash position gives them a great cushion if a recession comes. The company can continue to invest and innovate while many of its smaller competitors struggle to survive. With less competition being in the picture, Apple's already recession-resistant products will continue to do well. Apple's two largest segments, iPhone and Services, are recession-resistant as many are still willing to buy a new phone or not cancel their music subscription even when money is tight. As competition starts to dwindle during a recession, especially in the Services segment, Apple will likely see stable or even growing fundamentals during a recession.

Supply Chain Issues Continue to Cause Trouble

A continuous theme in the market has been ongoing supply chain issues. Recently, Apple executives warned that issues with the supply chain could cause up to $8 billion in increased costs in the current quarter, mainly due to shortages and factory shutdowns in China.

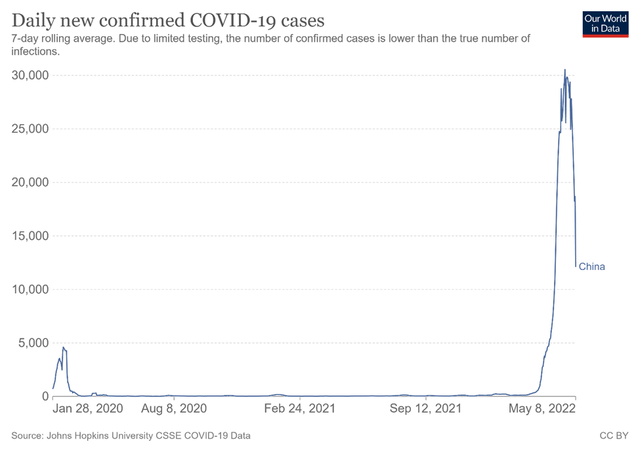

China's zero tolerance policies could mean trouble for Apple if the country shuts down. China saw a huge spike in cases in March that continued into late April. However, cases are now on the decline.

Covid-19 Cases in China (Our World in Data)

If cases continue to decrease, the risk of a shutdown in China is also going to decrease. This means Apple may actually incur costs of only about $4 billion or less due to supply chain issues.

Valuation

When valuing Apple stock, a DCF and relative valuation don't point in good directions. Using the company's WACC of 10.83% as the discount rate in a DCF, a fair value of $98.05 per share can be calculated. This could mean that Apple is overvalued by about 36%. If one wanted to use a discount rate of 9.5%, which is about a 5% premium over corporate bonds, the company's fair value would calculate to $117.34 per share. This would mean the stock is overvalued by about 23.4%.

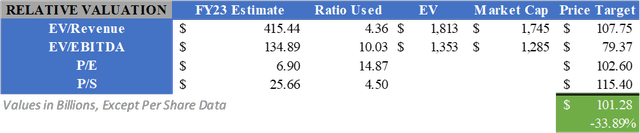

A relative valuation points to slightly better news than a DCF with the WACC as the discount rate, but it is still not ideal. By using the industry average ratios for EV/Revenue, EV/EBITDA, P/E, and P/S and multiplying them by 2023 analyst estimates, a fair value for Apple stock can be calculated as $101.28 per share. This would mean that the stock is overvalued by about 33.89%.

Relative Valuation for Apple (Created By Author)

What Should Investors do?

With the likelihood of an even bigger tech pullback and recession coming in the future, many may want to sell Apple's stock. Although, it is important to note the strong fundamentals and big cushion Apple has in the case these events occur. Since Apple's products are fairly recession-resistant and many investors will likely look for safe places to put their money, the company will likely be attractive for many investors if Deutsche Bank is correct. However, the company's stock is clearly overvalued and could see pullbacks in the upcoming future. Therefore, I believe applying a Hold to Apple is appropriate at this time.