We've heard multiple arguments regarding the valuation of Tesla (NASDAQ:TSLA) stock. Some argue that it is overvalued, others say that the current price is a steal. Reputable institutions also can't seem to agree on the valuation of this absolute wild card of a stock. At the time of writing this article, Credit Suisse and Berenberg have price targets of $1025 and $900 respectively, while JPMorgan and Barclays both have price targets of $325. There is a huge difference in how people and institutions value this stock; much more so compared to other company stocks. In this article, I take a deeper dive into Tesla's business model and future prospects, after which I will be concluding with my personal valuation analysis for Tesla stock.

Why Tesla can be a front-runner in the future

The company itself is on a very optimistic trajectory, and could expand at an impressive rate in the near future. We must also consider the rapid expansion of the EV market in general.

Explosive growth in financials

Tesla has shown explosive growth in multiple areas. Its first-quarter earnings results, which were reported this month, showed an 87% YoY increase in automotive revenue ($16.9B) and a 68% surge in deliveries (310048). In addition, its net cash flow from operating activities saw an increase of over 143%, and it currently stands at just under $4B. It is no question that the company is on an upward trajectory in terms of its growth. The statistics reflect that the company is producing and selling more vehicles at an alarming pace. Its operating cash flows are also increasing massively, which indicates that the company's core business activities (in this case, the manufacturing of electric vehicles) are doing extremely well.

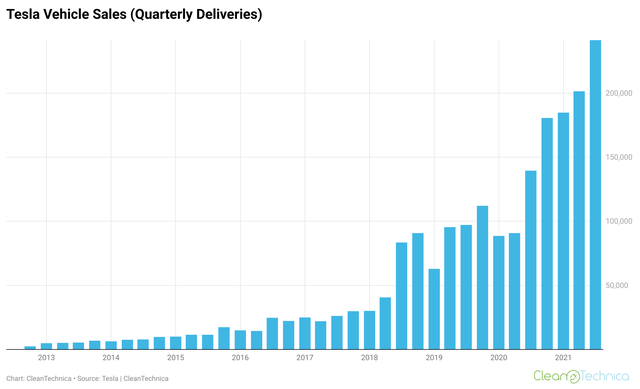

Tesla's quarterly vehicle sales growth (2012-2021) (CleanTechnica, Tesla)

We can see from the chart above that the growth in vehicle sales over the past few years has been on a strong and consistent upward trajectory. There is no doubt that the company's growth rates in revenue and deliveries indicate that it will remain a huge player in the vehicle industry. Another good point to make is that the company's free cash flow has been up tremendously - the company has turned a negative free cash flow of ($221.71m) in 2018 to a whopping $4.98b in 2021. This is due to the substantial increase in operating cash flows over the years. An article on NASDAQ has suggested that based on analyst estimates of future sales and free cash flow margins, we could see free cash flow reach $17.86b by the end of 2023 - that's over three times of what it did last year.

Self-developed chips

One extremely impressive quality of Tesla is that the company develops its own chips. It is known that Tesla writes its own software through the company's competent engineers, and hence, does not need to source its chips from external suppliers. This gives the company a huge competitive edge over its counterparts. An article from CBS News stated clearly that despite the global chip shortage, Tesla reported record Q4 and FY2022 earnings due to a huge rise in deliveries. Tesla's self-sufficiency in this area is a good reason to believe in the company, especially in the long run where chip shortages may get worse. In comparison, many Chinese EV makers and well-known vehicle companies like General Motors (GM) and Ford (F) have been hit hard by the chip shortage due to their over-reliance on global chip supply, with some of them having to close down their factories. Tesla's ability to create its own computer chip supply chain puts it in a significantly more advantageous position as compared to its competitors.

Concerns about Tesla

While the company has many merits, there are several factors which need to be considered before investing in Tesla stock.

Vulnerable to supply chain constraints

Although Tesla makes its own chips, we need to acknowledge that any EV company is still extremely vulnerable to supply chain issues, especially after the Russia-Ukraine crisis took the world by storm. According to a recent article by Barron's,

A basket of metals that go into lithium-ion batteries was up about 40% year to date before Russia invaded Ukraine. It has risen another 13% since then as the war makes inflation worse."

The drastic increase in price of such factor inputs means horrible news for the EV industry, especially for major players like Tesla. The same article also highlights a more serious problem about this supply chain - its over-reliance on China, which is responsible for the global production of about 80% of such inputs. Elon Musk himself has said that supply chain issues would be affecting output numbers to a significant extent in 2022. The company has even delayed two vehicle releases (namely the Cybertruck and the Roadster) as a result of such constraints. As such, one cannot underestimate supply chain concerns which arise for EV companies, and it is evident that Tesla has been affected by these issues. The most recent report about Tesla's sales in April this year is further justification that the supply chain issue cannot be neglected. Whether the company navigates these roadblocks remain something to be proven, and persistence of such issues could lead to a bump in the current exponential growth that the company is experiencing, possibly resulting in lower forecasted sales, revenue, and free cash flows. These considerations will be made in the valuation section of this article.

Financial ratios and metrics

While Tesla boasts explosive growth numbers, there are a few metrics and ratios we may need to be concerned about.

Price-to-earnings in comparison to competitors

According to a report by Barron's, Ford and General Motors beat Tesla significantly (in sales) in the fourth quarter of 2021, having sales of $37.7 billion and $33.5 billion respectively, compared to Tesla's $25 billion. Yet, we see that Ford and General Motors are currently trading at lesser than 10 times earnings. In comparison, Tesla trades at about 90 times earnings. However, analysts do expect the P/E ratio to be 46.86 in 2024, which is much more reasonable. Some may also argue that Tesla has an edge over normal car companies for the fact that they have their own software architecture, and should hence be valued at a higher multiple.

Share dilution

Tesla has been consistently issuing shares over the past few years - The company has gone from 852.63m diluted shares outstanding in 2018 to 1.13b diluted shares outstanding in 2021, reflecting a net overall change of 32.5%. There also seems to be no sign of a share buyback, even after a Tesla investor famously demanded for one and got featured on CNBC. The rationale behind this was sound - the stock price has tanked a lot relative to its all-time high. It was even flirting with the low $600s not long ago, yet we have yet to see any action on the company's part. The constant issuing of shares dilutes investors by reducing their stake in the company.

Competition from China

The EV industry is highly competitive, especially in China. In particular, NIO (NIO), Li Auto (LI), XPeng (XPEV), and BYD (OTCPK:BYDDY) have taken the EV market by storm and are all growing at exponential rates.

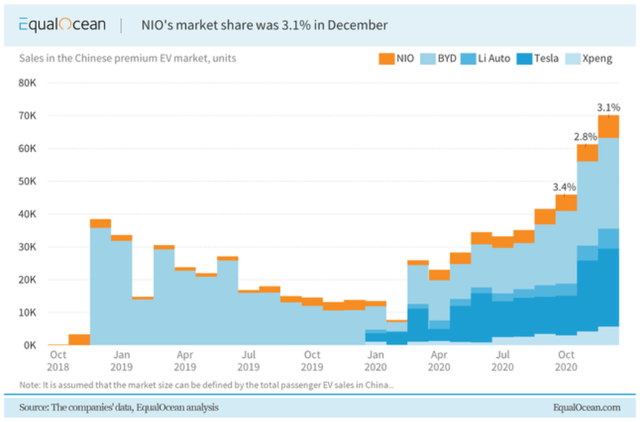

Sales in the Chinese premium EV market (EqualOcean)

We can see from the chart above that Tesla is attempting to break into the Chinese market, with a good amount of growth in sales in this particular area. Understandably, with China's growing middle class and rising demand, it is indeed a lucrative decision to get a share of this pie. However, we cannot overlook the strong competition presented by the other Chinese EV giants. We can see that BYD leads the race in sales, with Tesla as a close second. However, NIO, Li Auto, and XPeng are also on a strong upward trajectory. We need to take into account that these three up-and-coming companies have huge room to grow in market share and sales compared to Tesla, and their performance in terms of deliveries and financials over the past few years have been impressive.

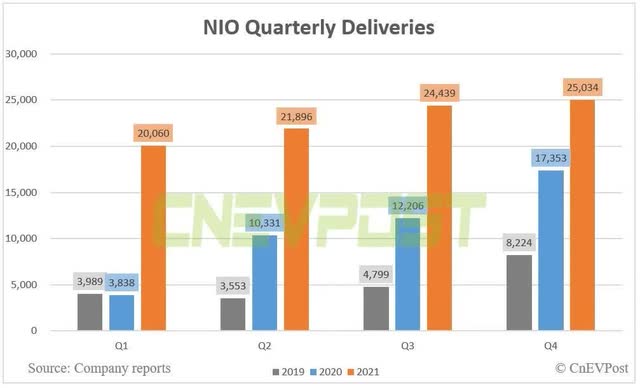

NIO's quarterly deliveries (CNEVPOST)

Let's take a look at NIO and their quarterly deliveries. We can see that year-over-year deliveries are up tremendously, which is a good indicator of the growth potential of an EV company. In addition, NIO still has much room for growth if it continues producing high-quality electric cars and expanding into different markets. To put things into perspective, Tesla's market capitalization is about 27 times more than NIO's - yes, it's that much bigger. The point is that Tesla is not the only player in the market, though it is undoubtedly one of the biggest, and most well-known. The company faces strong competition from its Chinese counterparts, and their exponential growth could seriously threaten Tesla's future profitability. Tesla has yet to show that the ability to capture majority of the Chinese market, despite it being one of the biggest EV names in the world.

Valuation analysis

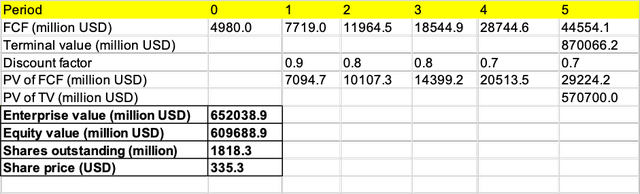

I will be using a discounted cash flow model, with a weighted average cost of capital of 8.8%, to estimate the intrinsic value of Tesla's stock price. I will also introduce three scenarios: Bear, Base, and Bull.

Financials and forecasts

Before we go into the analyses, let's analyze a few metrics. Firstly, let's look at Tesla's free cash flows. The company's free cash flow growth numbers in 2018, 2019, 2020, and 2021 were 94.65%, 538.85%, 178.62%, and 83.81% respectively. Next, let's observe Tesla's diluted shares outstanding. The company has gone from 852.63m diluted shares outstanding in 2018 to 1.13b diluted shares outstanding in 2021, reflecting a net overall change of 32.5%. This is an approximate average 10% increase in diluted shares outstanding every year. Note that the analyst consensus is for Tesla to reach free cash flow numbers of $17.86 billion in 2023, as stated earlier in this article.

Bear case

For our Bear case, I've used a perpetuity growth rate of 3.5%, a 55% average annual growth in free cash flow and a 10% annual growth in shares outstanding. This growth rate leads to an approximate $12b in free cash flows in 2023, which is significantly lower than analyst estimates. I've set these conditions based on a bearish scenario where Tesla would continue encountering the supply chain issues I've mentioned, which would significantly slow down deliveries. In addition, big Chinese EV names could seriously rival Tesla in the Chinese market. As such, I've gone below analyst estimates (by quite a bit), and expect a much slower but consistent growth in sales, operating cash flow, and free cash flow. As for the shares outstanding, I've decided to assume that it will grow similar to its average growth rate in recent history.

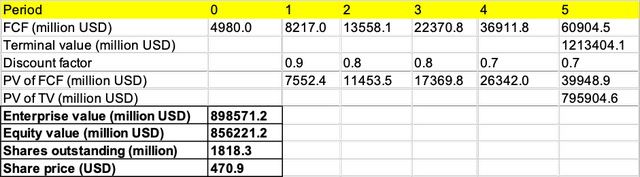

Discounted Cash Flow Model for Tesla (Bear) (Prepared by author)

We've come to a price target of about $335.30, putting this estimate on par with the price targets issued by JPMorgan and Barclays, which are both $325.

Base case

For our Base case, I've used a perpetuity growth rate of 3.6%, a 65% average annual growth in free cash flow and a 10% annual growth in shares outstanding. This is my personal projection of the company. These metrics would still lead to a significantly lower free cash flow in 2023 compared to analyst estimates (about $13.56b compared to a forecasted $17.86b). I've gone lower because I expect the supply chain issue to persist over the next few years. While Tesla is able to make its own chips, I've yet to be convinced that it is able to smoothly overcome the other supply shortages plaguing the market, especially after its April deliveries. Yet, I do believe that it would see decent growth in sales, operating cash flows, and free cash flow, and there is a good chance that it will maintain its competitiveness in China. As for the shares outstanding, I've decided to assume that it will grow similar to its average growth rate in recent history.

Discounted Cash Flow Model for Tesla (Base) (Prepared by author)

We've come to a price target of about $470.90. I consider this estimate to still be on the conservative side, but it's definitely significantly more optimistic than the Bear case.

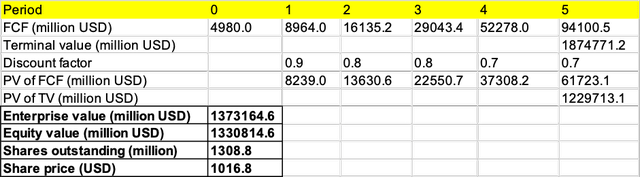

Bull case

For our Bull case, I've used a perpetuity growth rate of 3.6%, an 80% average annual growth in free cash flow and a 3% annual growth in shares outstanding. This would lead to $16.14b in free cash flow in 2023, which is much closer to the analyst estimate of $17.86b. This case assumes that Tesla is able to perfectly continue on its upward trajectory, and is also able to withstand the Chinese competition and maintain or increase its share in the Chinese EV market. However, it's important to note that I have still gone slightly lower than analyst estimates, factoring in the supply chain issues that the company is currently facing. However, this case assumes that this issue is a short-term one that the company will be able to resolve through other methods of sourcing, a change in global supply chains or its own innovation. I've gone on to assume that the company, having earned a tremendous amount of free cash flow, would either issue lesser shares or use it to buy back shares to benefit Tesla investors. As such, I believe that the company would issue shares at a slower rate.

Discounted Cash Flow Model for Tesla (Bull) (Prepared by author)

We've come to a price target of about $1016.80, putting this estimate on par with the price target issued by Credit Suisse, which is $1025.

Conclusion

I've taken the average of the above three cases to arrive at a price target of $607.66, similar to Cowen's price target of $660. This is lower than the current price at which Tesla is trading at, though the price was near this level not too long ago. I believe that this company can be described as a wild card - it could bring huge returns if things go to plan, but if they don't, it could be ridiculously overvalued. It's imperative that you do further due diligence and invest with caution, as there's huge uncertainty when it comes to such companies. I will conclude my analysis with a price target of $607.66, and a 'Hold' rating.