Summary

- The volatility of the market opens up opportunities for long-term investments in quality companies.

- Alphabet's premium valuation is vanishing, while still standing strong.

- Value and growth are in the right position to enjoy a better-than-average return on your investment.

Cash is king, but for how long...

Investors who sold their stocks for cash in the beginning of this year have indisputably outperformed investors who have stayed fully invested. Nonetheless, there are risks involved with this strategy. Currencies have the tendency to lose value over time, which particularly has happened more rapidly over the last two years. Money printing was a must to stimulate world economies and to avoid complete chaos. Therefore, holding cash can be unnoticeably dangerous if you hold it for longer than is needed. Furthermore, timing the bottom of a market is extremely difficult and most will miss the train. Dollar cost averaging into the highest quality businesses, which are trading at historical low valuations, could be the play for you.

Large caps are struggling

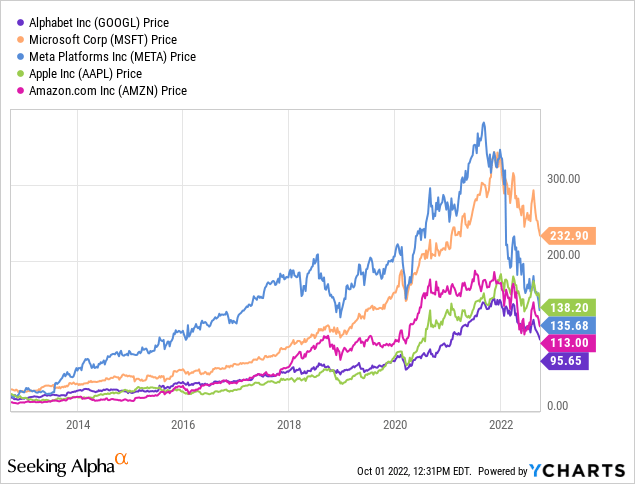

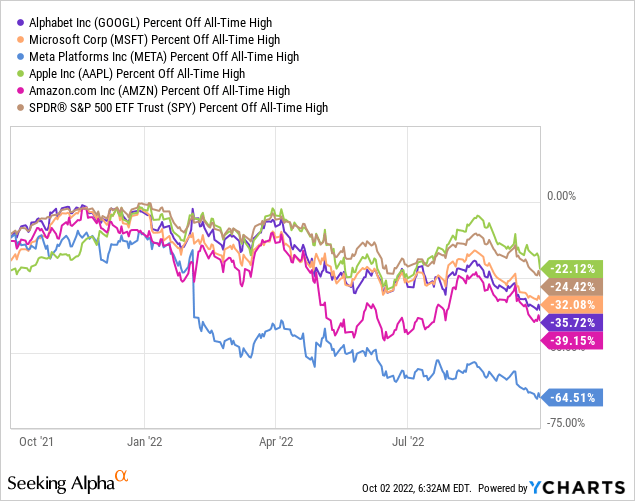

The S&P 500 (SP500) has been faring in bear territory, and as a result the high weighted well-known American companies in the index have also been retracting from all-time highs. Bottom fishing season has begun, therefore it is time to see which fish you favor.

Apple (AAPL) is the only company in the list that has been able to keep up with the S&P 500 and all the others have been underperforming. In this article the focus will lay on one of the underperformers Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), better known for their platform Google.

The best of both worlds: value and growth

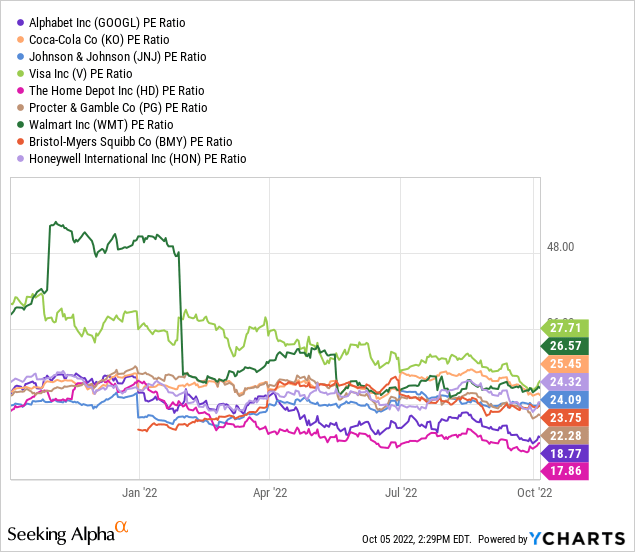

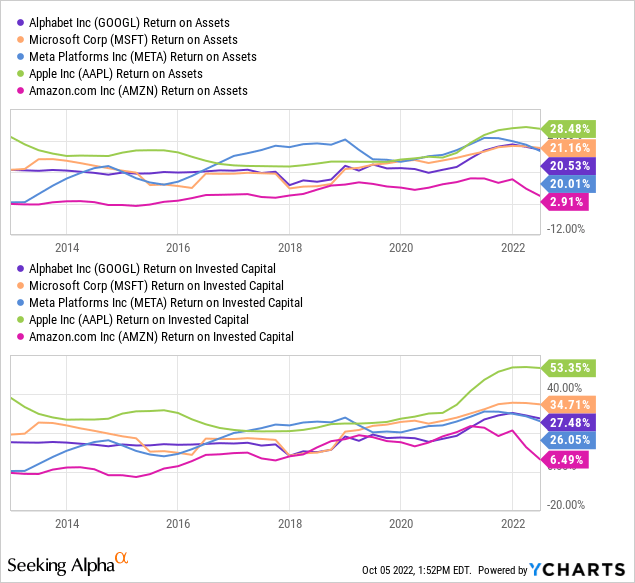

The dream of any investor is buying a growing quality business as cheap as possible, because the price you pay will define your future returns. Historically, the valuation of Alphabet is now down to a 9-year low. If the long-term fundamentals of the business remain strong, this could be a great entry point for a position in Alphabet.

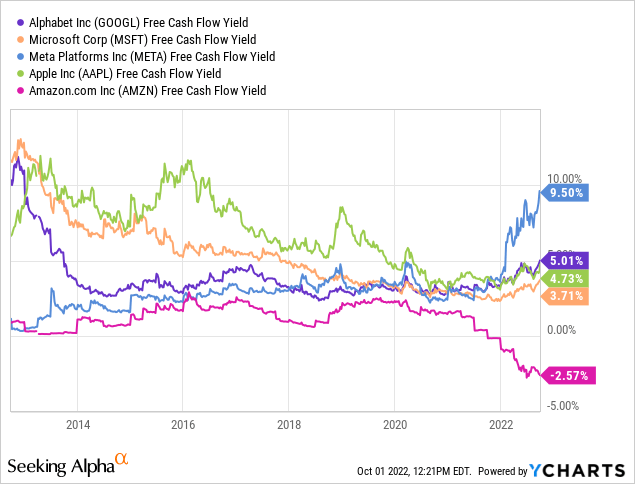

Data by YCharts

Shareholders of Alphabet can now enjoy a higher than normal free cash flow yield of 5.01%. In the past Alphabet has been trading at a premium yield compared to Apple (AAPL) and Microsoft (MSFT). It is likely that the bearish outlook on advertising spending, due to recession fears, has caused the higher free cash flow yield for both Meta Platforms (META) and Alphabet (meaning the price has gone down). On the other hand, Amazon's (AMZN) free cash flow took a deep dive lately as a result of expenses running up to make and transport consumer goods.

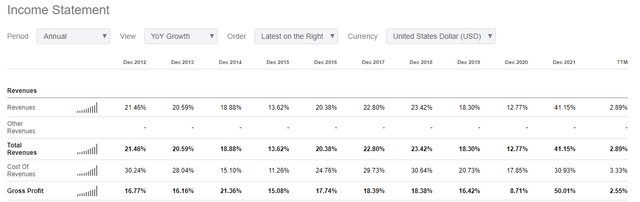

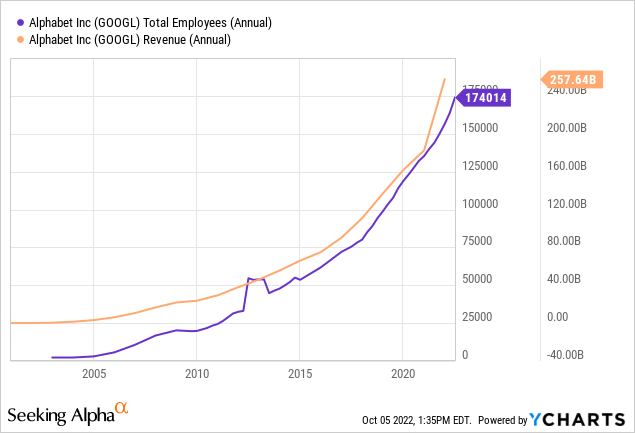

Alphabet has a long standing track record of 20% revenue growth annually. In 2021, the company grew by at least 40% creating an outlier in the track record. Accordingly, it is to be expected to have lower growth into 2022.

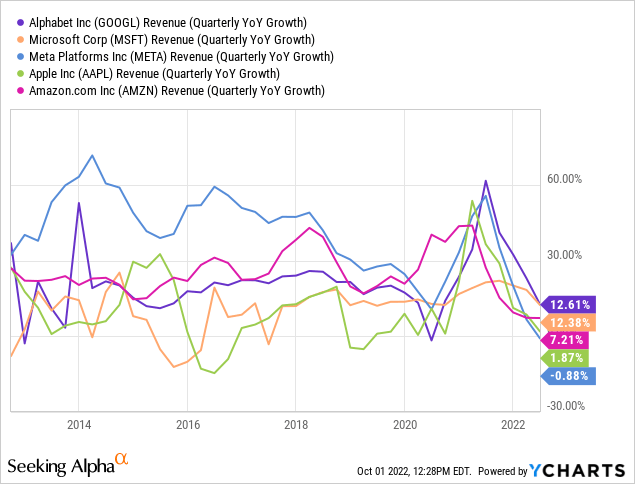

Nevertheless, the company still enjoyed a 12.61% revenue growth in Q2 2022 compared to the same quarter last year, which is very impressive knowing that in Q2 2021 revenues also grew 61%. Alphabet's revenue growth has been outperforming that of the other large caps in the latest quarters.

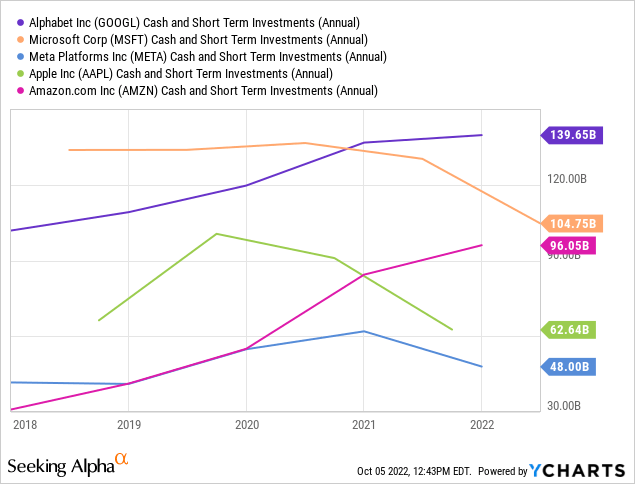

In addition, Alphabet has a fortress balance sheet that should not be ignored. The company can grow through M&A activity, if organic growth must pose a slowdown. Alphabet is well-known for their excellent M&A strategies, look at how successful YouTube, Android, Waze and many more have gotten. Of course, not all acquisitions were a moonshot, even so Alphabet only needed a handful. Together with Apple and Microsoft, Alphabet's capital allocation has been on point.

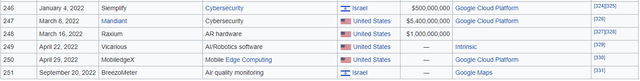

In 2022, Alphabet acquired six companies so far to boost their investment portfolio. The business types in the crosshairs of the company are very interesting. A new century of digitalization is forming and Alphabet wants to be in. The focus is on Cybersecurity, AR hardware, AI/Robotics software, Mobile Edge Computing and Air quality monitoring.

Risks

Advertising is the largest revenue driver of Alphabet, and for that reason a decrease in advertising spending could be a crucial risk. If a recession hits the economy, a decrease in advertising spending will be imminent. Families and businesses will cut costs as jobs and profitability are on the line. Alphabet has been pausing hiring as it tries to get a view over the current economic situation. The company survived multiple economic downturns, has cut the employee head count before, while maintaining solid revenue growth. The decrease of spending is needed when difficult times are around the corner. Nonetheless, Alphabet has shown resilience in the past.

Further, political headwinds all over the world can bring setbacks to the company. Google was fined €2.42 billion (approx. $2.39 billion) for abusing dominance as a search engine. Governments try to keep monopolies in check, and this can damage the growth prospects and the balance sheet of Alphabet.

Takeaway

I rate Alphabet a Strong Buy at $100 a share. In 10 years, people will still be watching YouTube, using Google Maps and everything else. The company is surrounded by a great moat, which makes Alphabet an all-weather buy. Currently, the stock is trading at a discount compared to previous premium valuation. Alphabet feels like a no-brainer compared to others in the S&P 500, and it is time to take advantage before the tide turns around. The high margin of safety present on Alphabet is hard to find elsewhere.