Summary

- Amazon’s business is seeing a major post-pandemic slowdown.

- The e-Commerce is struggling and not consistently profitable.

- However, if shares fall to this price level, I will consider buying.

Amazon (NASDAQ:AMZN) disappointed in October with its outlook for the fourth-quarter which called for top line growth of just 2-8%. In the near term, there is even the possibility of a further deceleration of revenuegrowth as the company faces multiple headwinds, especially in its e-Commerce business. In November, Amazon also announced major layoffs to prepare for a recession and stop the bleeding in the e-Commerce business. Since it appears to me that more down-side looms in the short term, I will discuss at what price I am going to load up on Amazon!

Amazon: From pandemic winner to problem child

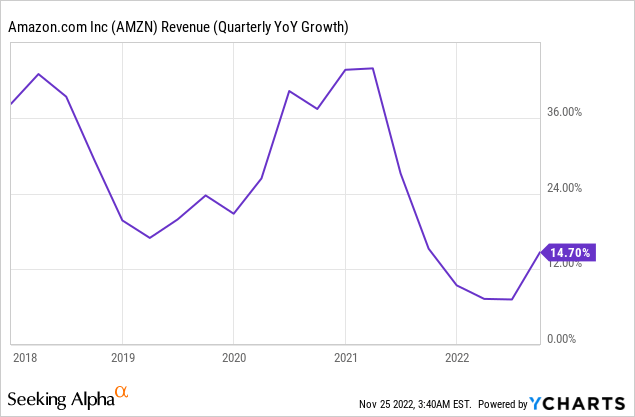

Amazon was one of those companies that benefited tremendously from the COVID-19 pandemic in 2020 and 2021 which resulted inUS e-Commerce volumes soaring. Amazon's net revenues surged 38% year over year to $386.1B in FY 2021 and then another 22% to $469.8B in FY 2021. However, Amazon's revenue growth is going through a post-pandemic normalization period and the firm's outlook for the fourth-quarter showed that the period of hyper-growth is truly over for Amazon.

Amazon's Q4'22 outlook calls for $140B to $148B in revenues which implies that the firm's growth rate could slow to just 2% year over year in the fourth-quarter. It is therefore likely that Amazon will post the slowest growth ever as a public company in the near term, which could push shares of the e-Commerce giant into a new down-leg.

Amazon's core e-Commerce operations have started to struggle last year -- as opposed to AWS which is doing great -- and it is likely the key motivation for Amazon to make major adjustments to its pay-roll. Amazon announced job cuts in November that could include up to 10 thousand jobs as the e-Commerce company readies itself for a recession in FY 2023 and addresses profitability problems in its core business.

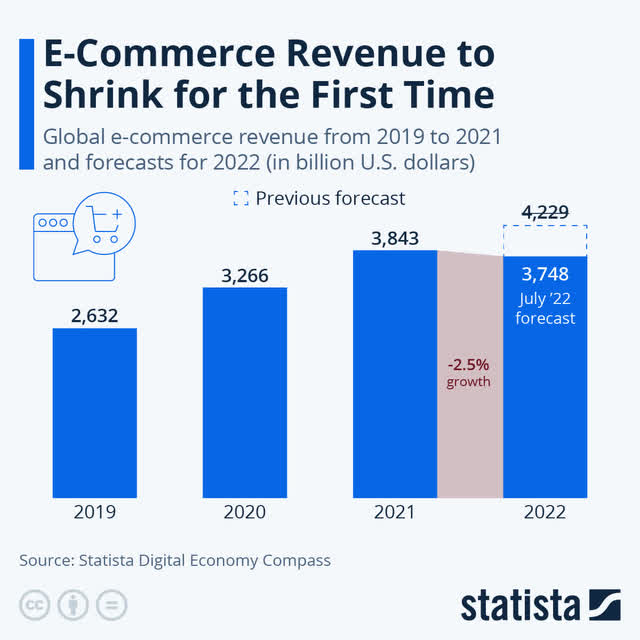

Amazon's Q3'22 e-Commerce revenues in the US totaled $78.8B, showing 20% year over year growth. The third-quarter was the second straight quarter of revenue acceleration after top line growth slowed to just 8% in Q1'22. However, a recession appears to be just around the cornerand some predictions (from Statista Digital Market Outlook) even project a first-ever decline in global e-Commerce sales in FY 2022.

Amazon's e-Commerce business is highly dependent on consumer spending and a US recession could compound Amazon's current problems. Amazon's North American e-Commerce segment generated 62% of consolidated revenues in Q3'22 while the international e-Commerce segment was responsible for 22% of revenues and AWS accounted for 16% top line share.

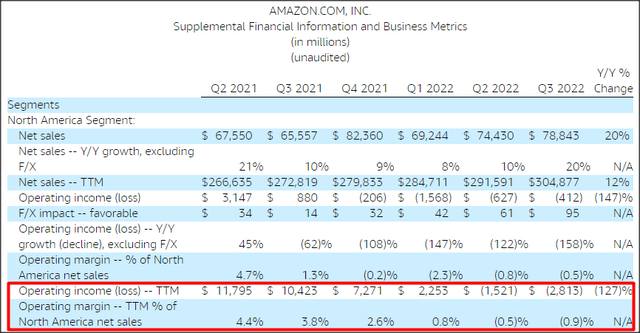

However, the largest segment is profoundly unprofitable for Amazon, a situation which a US recession could make considerably worse and it could result in growing margin pressures in Amazon's core business. Amazon's North American e-Commerce operations generated cumulative operating losses of $2.8B in the trailing 12-month period ending September 30, 2022 which calculates to a negative margin of 0.9%.

The situation is even worse for the international business, but less severe in total dollar terms because the international segment generates much lower revenues than Amazon's North American segment. The international segment generated $27.7B in Q3'22 revenues which is equal to just 35% of revenues in the North American e-Commerce business. International segment operating losses in the last 12-month period totaled $7.1B and reflected a negative operating margin of 5.9%. Both the international as well as the North American e-Commerce segments were consistently unprofitable in each of the last four quarters and losses in the international business escalated to $2.5B just in Q3'22.

The bright spot, as I mentioned in "Amazon: 2 Risks, 1 Opportunity", is Amazon's server business - Amazon Web Services -- which is compensating for the decline in the e-Commerce business. Amazon Web Services generated $20.5B in net revenues in Q3'22, showing 27% year over year growth. The business is also super profitable with a 12-month trailing operating income of $22.9B and a margin of 30%.

Here's the price I will buy Amazon at

Amazon is projected to generate $510.8B in revenues in FY 2022 and $566.6B in FY 2023, implying growth rates of 9% and 11%. However, due in part to the disappointing forecast for Q4'22, forward EPS estimates have started to trend down hard in the last three months and the market now widely expects the business to continue to slow down in FY 2023. Unfortunately, there is also a real possibility that Amazon's top line will contract for the first time ever in FY 2023… it certainly is possible considering that the e-Commerce business is already struggling and margins don't look great either.

Currently, shares of Amazon are priced at a P-E ratio of 1.7 X and a P/E ratio of 54.5 X. Amazon, on a consolidated level, is profitable, but the P/E ratio is rather high considering how slowly the top line is growing now. Although shares of Amazon have already lost 44% of their value in 2022, I don't consider shares of Amazon attractively priced yet. Amazon has high top line and estimate risks that are possibly at their highest in years right now, if not decades. To reflect those risks accurately, I would be willing to pay an 30-33 X P-E ratio for AMZN which translates to a price range of $52-57. This would be a very attractive price range to buy AMZN, if the stock price ever declines this much. A P/E ratio of 30-33 X would be a fair price to pay for Amazon's fast-growing AWS business.

Risks with Amazon

The biggest risk for Amazon, as I see it, is that revenue growth in the first half of FY 2023 will continue to decelerate as the global economy slows down and consumers become more careful of how they spend their money. In the worst case, Amazon's top line growth could even turn negative although I believe Amazon will continue to grow over the long term, chiefly because of AWS. What I also see as a risk is a compression of margins (especially in the e-Commerce business) and Amazon may have to lay off more people going forward to boost profitability.

Final thoughts

Amazon has built a formidable enterprise in the last two decades but there are core problems that I feel are not yet fully addressed. The e-Commerce business is slowing down hard and its margins are set to come under further pressure from a recession. AWS is providing a strong offset for Amazon, but e-Commerce, due to its large size within Amazon, should be expected to remain a drag on Amazon's commercial performance in FY 2023.

I will back up the truck with shares of Amazon between $52-57 which implies a drawdown of 39% to 45% from current pricing and the growing possibility of a recession is what could drive shares down to this level. While there is no guarantee that Amazon's share price will drop this low, I believe this price level would reflect a valuation at which investors get a very decent discount on the firm's long term growth prospects!

This article is written by The Asian Investor for reference only. Please note the risks.