The stock market, as measured by the S&P 500 Index, has continued to rise slowly this month, but the overhead resistance at or just below 4200 has proven to be formidable. There is another resistance level, at 4300.

The bears seem to be timid at the moment, but if the market can’t break through 4200, the bears will surely gain some strength. Below current levels, there is support in the 4050-4070 area, and further support near 3970. But a decline below 3950 would be negative and probably bring in some serious selling.

Net daily changes in SPX and other major indices have been small and decreasing of late, and that has caused a marked decrease in realized volatility. The 20-day Historical Volatility of SPX is now down to 11% — its lowest level since November 2021. The McMillan Volatility Band (MVB) buy signal is still in effect (although we have rolled spreads up a couple of times). Its target is the +4σ Band, which is currently nearing 4200 and rising slowly. That lends even more credibility to the idea of resistance at 4200.

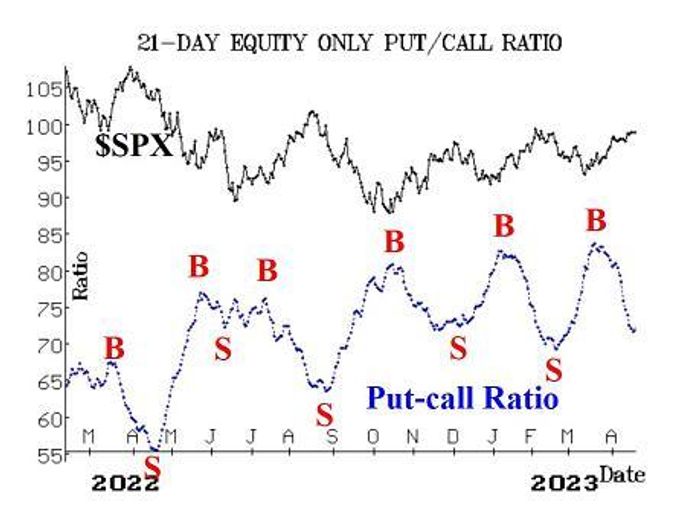

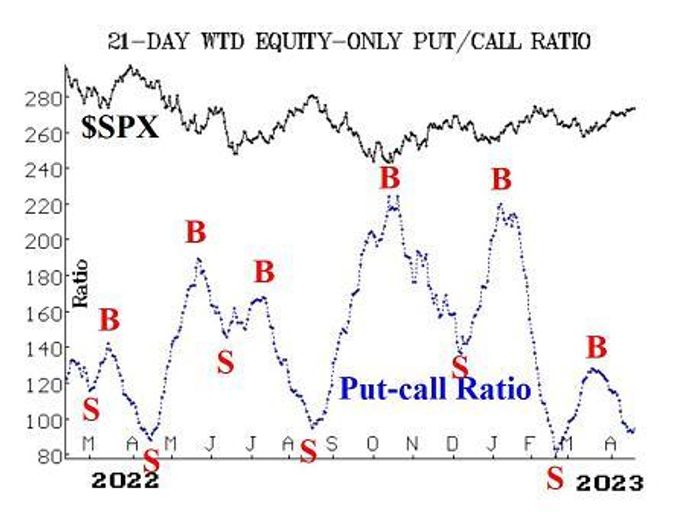

Equity-only put-call ratios have curled upward over the past day or two, but they remain on buy signals according to our computer programs that analyze these charts. They will remain on buy signals until they roll over and begin to rise steadily. The weighted ratio is nearing the lower regions of its chart once again, and thus can be considered to be in overbought territory.

“ Breadth has begun to deteriorate again, although the breadth oscillators are clinging to buy signals at this time. ”

Breadth has begun to deteriorate again, although the breadth oscillators are clinging to buy signals at this time. A strong day of negative breadth will roll them over to sell signals, however. As we’ve noted before, though, we require further confirmation of breadth signals because of their tendency to whipsaw back and forth.

The number of new 52-week highs on the NYSE has been running just slightly ahead of the number of new 52-week lows. Thus, this indicator continues to be in a neutral state, with neither a buy signal nor a sell signal in place.

VIX, on the other hand, continues to be a positive indicator for stocks. The “spike peak” buy signal that was generated back in March has “expired” for a nice profit. However, the trend of VIX buy signal remains in place (it began in the circled area of the accompanying VIX chart). The only caveat here is that VIX seems quite low, and that is an overbought condition. However, as noted above, with realized volatility at 11%, VIX is not really going to be too far from that. So, at its current price of 17.50, it’s already got a big premium built in.

The construct of volatility derivatives also remains a positive factor for stocks. The April VIX futures expired yesterday, so May VIX futures are now the front month. The term structure of the VIX futures slopes upward out through September, so that is modestly bullish. The term structure flattens out after that. As for the CBOE volatility Indices, their term structure slopes upward throughout. The warning sign here would appear if May futures were to rise above the price of June futures, but that it is not a real possibility at the current time.

In summary, we are continuing to hold positions in line with the signals generated by our internal indicators. Those are buy signals so far, as we do not have any confirmed sell signals yet. It is possible that some of the current overbought conditions would produce sell signals in the near future, but we do not anticipate that (“overbought does not mean sell”).