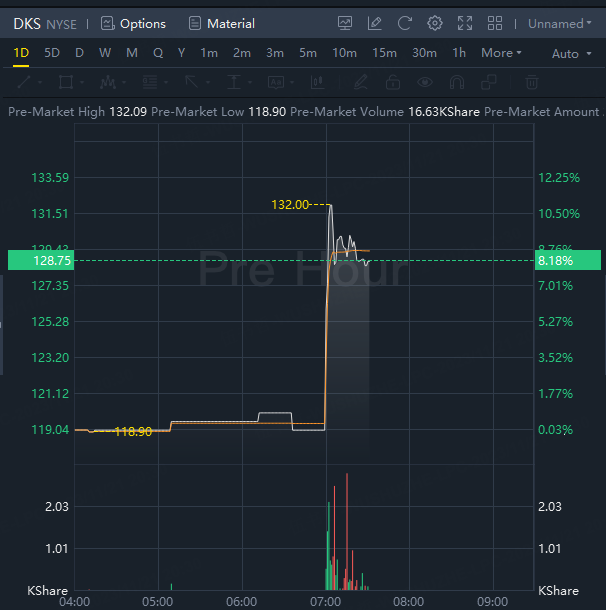

Dick's Sporting Goods (NYSE: DKS) reported better-than-expected earnings for the third quarter, sending its shares about 9% up in pre-market Tuesday.

Adjusted earnings per share were $2.85, easily beating the analyst consensus of $2.46. The reported revenue for the quarter was $3.04 billion, exceeding the consensus estimate of $2.95 billion.

The gross margin for the period was 34.9%, slightly below the estimated 35.4%. Notably, the company demonstrated a -2% decrease in inventory, and comparable sales showed a positive trend with a growth of +1.7%. Analysts were looking for a same-store sales decline of 1.9%.

Ed Stack, Executive Chairman, said "We are pleased with our third quarter results. With our best-in-class athlete experience and differentiated assortment, we had a very strong back-to-school season and continued to gain market share as consumers prioritize DICK'S Sporting Goods to meet their needs.”

“As a result of our strong Q3 performance, we are raising our full year outlook, which balances the confidence we have in our key strategies with an acknowledgment of the uncertain macroeconomic environment. We're excited for the upcoming holiday season and the product, service and experience we are providing to our athletes."

Looking ahead, Dick's Sporting Goods sees EPS in the range of $12.00-$12.60, compared to the consensus estimate of $11.79. Comparable full-year sales are seen rising between 0.5% and 2%.

Shares soared over 8% in premarket trading.