BIG TECH WEEKLY | Microsoft's 2025: Capex Dilemma and OpenAI Divorce?

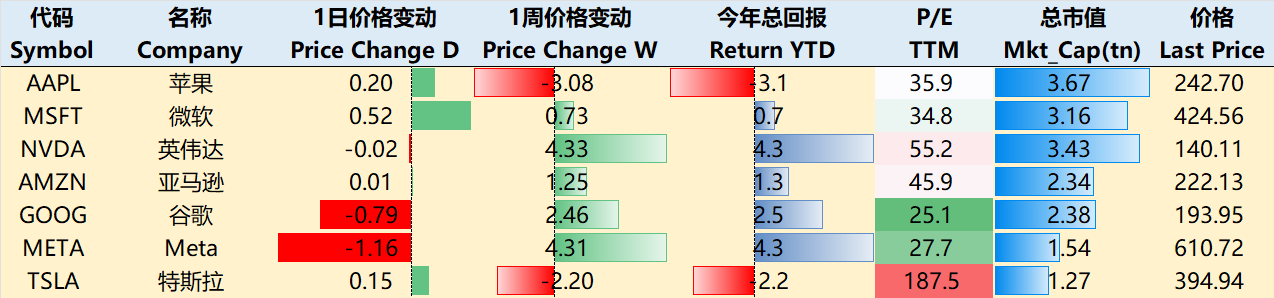

Big-Tech’s Performance

U.S. stocks were closed this Thursday, and it was an unplanned one at that, so the trading day was a little shorter, and even somewhat impacted the pricing of important options.

The most important macro data is the December nonfarm payrolls released on Friday, which may have more impact than the FOMC meeting that follows as the Fed is much more concerned about the job market than inflation.

However, the current market consensus is that the probability of a rate cut this month is essentially zero.As a result the dollar is very strong and the US bond curve continues to STEEPEN.

Valuations of US stocks are also currently at historically high levels, and increased market uncertainty in 2025 is bound to bring greater volatility. trump's policies could be a significant source of uncertainty

By the close of trading on January 8, the big tech companies began to diverge in their movements over the past week (also a reflection of uncertainty). $Apple(AAPL)$ -3.08%, $NVIDIA(NVDA)$ +4.33%, $Microsoft(MSFT)$ +0.72%, $Amazon.com(AMZN)$ +1.24%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +2.45%, $Meta Platforms, Inc.(META)$ +4.31%, and $Tesla Motors(TSLA)$ -2.2%.

Big-Tech’s Key Strategy

Compared to Apple and Nvidia, Microsoft has been the most understated member of the "$3 trillion club" for almost a year now - not only is it less affected by the broader market, but it also has less influence on the market.Why is MSFT becoming less transparent in big tech, and what are the opportunities and risks in 2025?

Highlight 1: Has capex become a 'prisoner's dilemma'?

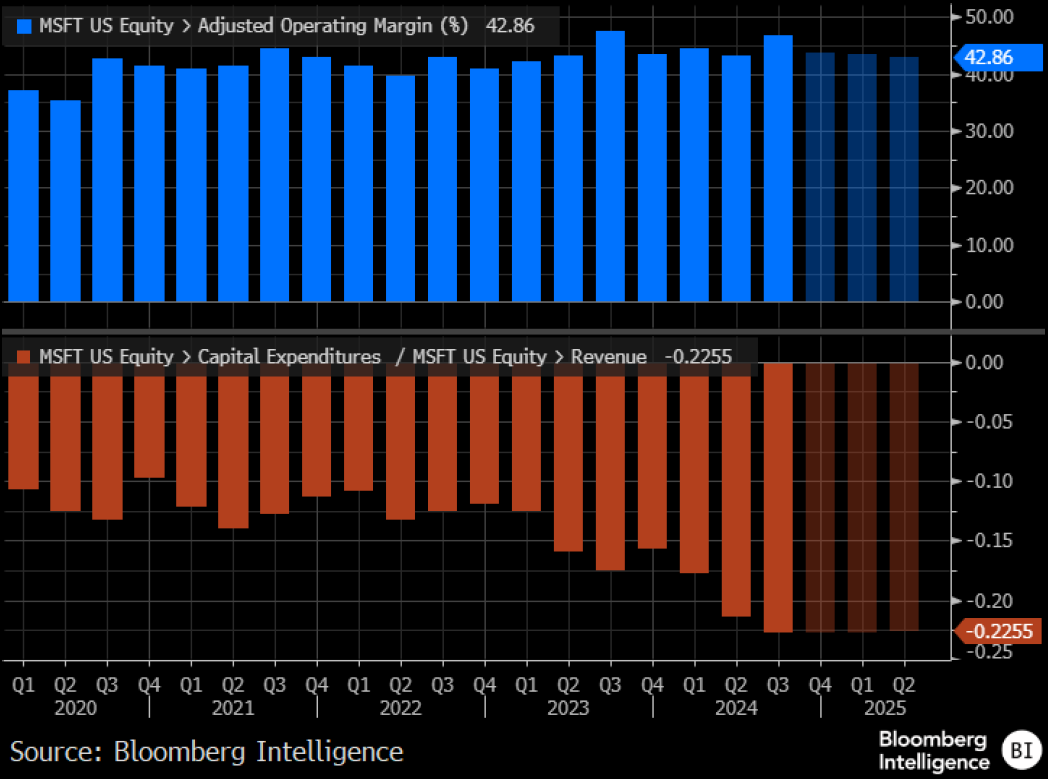

Microsoft plans to invest $80 billion to $90 billion in AI data centers by 2025, marking a shift to a more capital-intensive model.In fact, in 2024, Microsoft was the big chip buyer, purchasing 485,000 Nvidia Hopper chips, almost twice as many as second-place META.

For investors, concerns about profitability and free cash flow have been creeping to the forefront.Massive capital expenditures have already begun to impact depreciation and amortization, which has already manifested itself in the 24Q3 fiscal quarter for Amazon, and it's only a matter of time for Microsoft as well.In addition, the related operating costs will rise accordingly, which will directly affect free cash flow, and even buybacks.

Currently, there is a "Prisoner's Dilemma" in capital expenditures among big techs.

Multiple companies have a choice between "cooperation" and "competition".Each company can benefit from controlling excessive spending; however, if one company chooses to invest heavily while others do not, it may gain a significant market advantage.This leads to a situation where all firms feel pressured to invest more than they might otherwise choose, leading to inefficient investment, excessive competition, and market saturation.

Imagine if the market needed so many AI tools with "similar functionality" but "different brands"?

Highlight 2: What happens after the honeymoon period with OpenAI?

Microsoft was the first to benefit from OpenAI's momentum, but now ChatGPT and Copilot are in direct competition.At the same time, the relationship between Microsoft and OpenAI is not "unbreakable", the latter is also facing cash flow problems, but of course, there are still many companies wanting to invest in OpenAI, OpenAI and Microsoft are negotiating a number of key issues, including the distribution of equity, exclusive cloud provisioning relationship, the duration of the use of intellectual property, and the proportion of revenues.share of revenues.

According to an undisclosed agreement reached between Microsoft and OpenAI, AGI will only be achieved when the systems developed by OpenAI are capable of generating the maximum gross profits due to the earliest investors, such as Microsoft, totaling approximately $100 billion in profits.That is, Microsoft will not be able to use the technology developed by OpenAI after it reaches the AGI stage without the new agreement, which is whatOpenAI's threat to get out of its obligations to Microsoft.

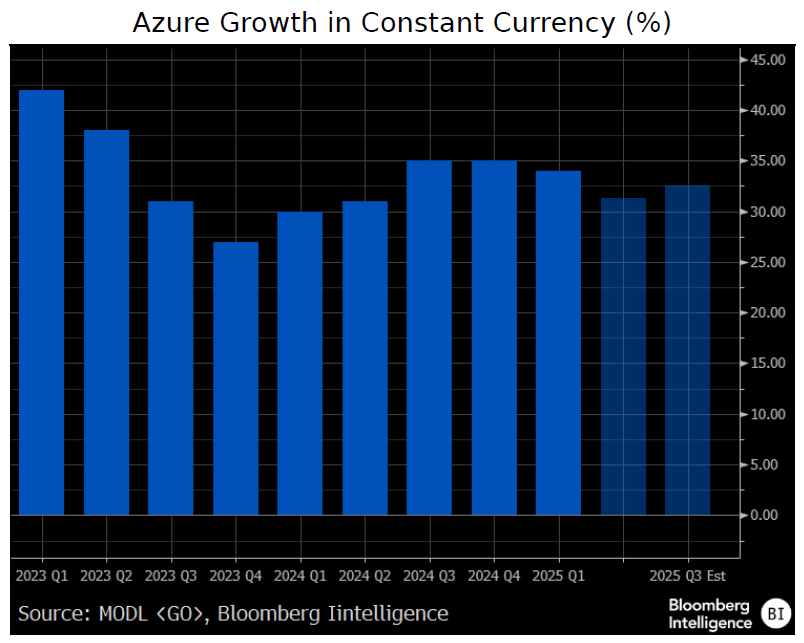

Highlight 3: Can Azure's growth continue to exceed expectations

The increase in AI workload in the cloud infrastructure unit and cloud application business is a key driver.Currently, the market is expected to grow for Azure in the second half of fiscal 2025.This is driven on one hand by Microsoft's progress in procuring more GPUs and increasing cloud capacity, and on the other hand by increased adoption of OpenAI software by enterprise customers and a recovery in non-AI cloud workloads.

Azure 25Q1's expected growth rate of +34% is similar to last quarter's 35%, limited primarily by capacity.

Highlight 4: Copilot's Adoption Rate

Easier to cash in on ad efficiency than Google and META, Microsoft's important way to cash in on AI is Copilot, which is ramping up marketing efforts to increase daily active Copilot users.For Dynamics suite also came out with new features, and then there is a price increase.

Microsoft is forcing the integration of the AI assistant Copilot into the Microsoft 365 consumer subscription service in Australia and several countries in Southeast Asia, and increasing the subscription price at the same time; while at the same time, it is promoting Copilot to enterprise software customers at a price of $30 per person.

In addition, Copilot's add-on rate in the coding space is expected to be high and will drive revenue growth for GitHub.

Highlight 5: FY2025 Key Metrics and Financial Forecasts

Lower EPS from Q2 of FY2025 is likely due to Cruise impairment and OpenAI investment losses, and impacts lower EPS estimates for FY2025 and FY2026 (lower than revenue growth, YoY +10.7%), but unchanged revenue estimates for FY2025 and FY2026 of $278.5 billion (YoY +13.6%) and $318.3Billion Dollars.

Options Observer - Big Tech Options Strategy

This week we focus on: Nvidia's Surge and Run

Due to the lack of a business day, the first two days of options trading this week were relatively concentrated. nvda was the best performing big tech due to CES, rising to new all-time highs at one point, and many of this week's expirations were gaming the new highs of 150-160, with a lot of new orders.But Wednesday's big pullback also left longs with near-unfulfilled expectations, and are currently floating in the red.

If there are no major surprises in Friday's non-farm payrolls data, it may also be difficult to go up nearly 10% in one day.And look at Call next week (due on the 17th), there is not a large number of orders above 150, so now the short-term speculative sentiment began to rise, but also reflects the market's expectations of increased uncertainty.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming the $.SPX(.SPX)$ since 2015, with a total return of 2,490% and a $SPDR S&P 500 ETF Trust(SPY)$ return of 241.67% over the same period, for an excess return of 2,248%.

The big tech stocks pulled back this week, but year-to-date returns are still there to1.2%, outperforming the SPY by 0.58%, with a record high excess return of 41.45%.

The portfolio's Sharpe Ratio over the past year has rebounded to 2.54, the SPY is 1.64 and the portfolio's Information Ratio is 2.19. $Invesco QQQ(QQQ)$ $.IXIC(.IXIC)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.