Top 10 Picks 2025, by Seeking Alpha

Seeking Alpha's 2024 Best of the Top 10 stocks performed 124% overall, outperforming the $S&P 500 (.SPX)$ by 25%.Among them was selected the bullish $AppLovin Corporation (APP)$.

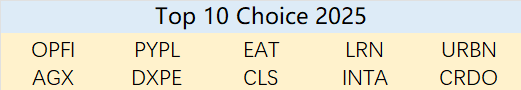

And the Top 10 for 2025 are as follows:

$OppFi Inc.(OPFI)$

Market capitalization: $651.78 million.

Quantitative rating: Strong Buy.

Sector: Financial.

Sector: consumer finance.

Powered by AI-driven underwriting, OppFi Inc (OPFI) leverages its scalable technology platform to provide access to credit for underserved middle-income consumers.The company reported outstanding third quarter 2024 earnings results, with revenues reaching a new high of $136 million.Meanwhile, net income under GAAP more than doubled year-over-year, driven by improved credit performance, higher yields, and operational efficiencies.The company boasts select earnings metrics, with gross margins and ROE returns well above the industry median.

Given the stock's incredible 90% price return over the past three months, the company's expected price-to-earnings ratio (FWD PE) is down more than 25%, and its rolling price-to-earnings growth ratio (TTM PEG GAAP) is discounted by more than 95% relative to the financial sector.OPFI is positioning itself as a broader digital financial services platform, as evidenced by its investment in small business lenderinstitution Bitty is evidence of this.

With solid fundamentals and positive time-sensitive metrics such as EPS revisions and price momentum, OPFI, a small-cap stock, is poised for further gains if the sector sees a sustained rebound.

$PayPal(PYPL)$

Market capitalization: $89.76 billion

Quantitative Rating: Strong Buy

Sector: Financials

Sector: Transaction and Payment Processing Services

Paypal Inc. is a leading financial technology company providing global digital payment solutions and financial services.With more than 400 million active accounts and a massive reach, it offers a comprehensive range of products to complement its flagship peer-to-peer money transfer capabilities.

The company drove growth through a number of initiatives, including its new "fast track" checkout solution and strategic partnerships with major players such as Shopify (SHOP).These efforts have resulted in forward-looking revenue growth that is 25% higher than the broader financials segment.

PYPL has an "A" earnings grade, driven by its incredible $7.67 billion operating cash flow and 22% return on equity, which is more than 100% above the segment median.

Solid growth, superior profitability, and price momentum have resulted in an astounding 38 FY1 upward revisions and no downward revisions over the past 90 days, demonstrating Wall Street's unanimous optimism for the stock.

While the company's recent performance has weakened its valuation somewhat, PYPL trades at a discount to the sector in terms of its price-to-sales and price-to-cash flow ratios.Despite increased competition, PayPal's brand recognition, strong financials, and focus on innovation make it well-positioned for future growth in the increasingly popular digital payments space.

$ Brink's International (EAT)$

Market capitalization: $6.26 billion

Quantitative Rating: Strong Buy

Sector: Non-Essential Consumer Goods

Sector: Restaurants

Despite a challenging restaurant environment in 2024 that continues to be plagued by inflation, Brink's International achieved a remarkable turnaround in 2024.As the parent company of Chili's, Brink's doubled down on its commitment to value-driven marketing and operational improvements, with its "3 for Me" value packages and social media-driven Triple Dipper promotions helping to drive 14% sales growth and 6.5% traffic growth in the first quarter of fiscal 2025.growth.

Other growth highlights included incredible year-over-year diluted EPS growth of 32% and forward-looking EBITDA growth of 19%, compared to a segment average of 2.7%. EAT's efforts resulted in strong profitability metrics, including $425 million in operating cash flow.

EAT's solid strategy execution was reflected in its strong price momentum, which delivered an impressive 244% growth over the past year.Wall Street's optimism is reflected in the company's rating revisions.Over the past 90 days, EAT has received 19 Q1 FY2025 upgrades and no downgrades.

$Stride(LRN)$

Market capitalization: $4.56 billion

Quantitative Rating: Strong Buy

Sector: Non-Essential Consumer Goods

Industry: Educational Services

is a technology-based education company that provides innovative online and blended learning solutions for K-12 students, career learners, and adult education.The company offers a comprehensive suite of products and services, including proprietary and third-party courses.LRN is focused on meeting the demand for flexible, customer-centric virtual learning solutions, with a particular emphasis on career-oriented skills.During the first quarter of fiscal 2025, the company increased enrollment by 18.5 percent to total a record 222,000 students, grew revenue by 15 percent, and increased adjusted operating income by 295 percent.

The company's tremendous growth translated into solid profitability.LRN's EBITDA margin for the last twelve months was 16%, a staggering 40% above the industry median, and cash per share was an incredible $7.41, compared to the industry average of $2.42.LRN's EBITDA margin for the last twelve months was 16%, a staggering 40% above the industry median.

Relative to the Non-Essential Consumer Goods segment, LRN trades at a 50% discount to the last twelve months' price-to-earnings growth ratio (PEG GAAP) and a 22% discount to expected enterprise value/earnings before interest and taxes (FWD EV/EBIT).The company's virtual learning platform is well-positioned to capitalize on growing market demand as families and individuals increasingly seek alternatives to traditional education.

$Urban Apparel (URBN)$

Market capitalization: $5.39 billion

Quantitative Rating: Strong Buy

Sector: Non-Essential Consumer Goods

Sector: Apparel Retail

Lifestyle retailer Urban Traveler operates a range of retail brands including Anthropologie, Free People, Urban Outfitters and FP Movement, targeting a range of consumer segments.The company launched Nuuly in 2019, aiming to capitalize on the growing apparel rental market in order to attract younger, sustainability-minded customers.The company's efforts have been a huge success.During the third quarter, Urban Traveler achieved record results, with total sales up 6% and earnings per share beating estimates by $0.23 over the prior year.Growth was driven by strong performance from its premium brands Anthropologie and Free People, while Nuuly sales increased 48% year over year.

Its solid quantitative growth ratings, which include expected GAAP-EPS growth of 35% on a mark-to-market basis, compared to the industry's 4%, and expected operating cash flow growth of 51%, up 490% compared to the industry median.URBN has been able to enhance profitability through increased marketing spending, reduced markdowns, and effective inventory management.

The company has an incredible $412 million in cash from operations and a solid 6% net profit margin.The company's stellar growth and above-average profitability have contributed to an excellent revised rating, and URBN is currently in-line with the sector in terms of valuation; however, certain metrics are significantly undervalued, such as its expected GAAP P/E of 15x versus the sector's 19.3x.

URBN is a top U.S. urban retailer that offers investors solid fundamentals along with considerable optimism about its 2025 trajectory.

$Argan Inc.(AGX)$

Market capitalization: $2.12 billion

Quantitative Rating: Strong Buy

Sector: Industrial

Sector: Construction & Engineering

AGX is the highest quantitatively rated engineering and construction stock, providing services to the power, industrial buildings and telecommunications infrastructure sectors.As a service provider to traditional gas-fired power plants and renewable energy facilities, AGX is uniquely positioned to take advantage of the continued growth in U.S. energy demand driven by data centers, the return of manufacturing and the popularity of electric vehicles.

In the third quarter of 2024, AGX recorded its second highest quarterly earnings ever, with revenues increasing 57 percent to $257 million.It delivered a positive adjusted EPS surprise of $0.74, contributing to the company's overall "B" growth grade.Other growth highlights included 26% expected EBITDA, up 263% versus the sector, and AGX's extraordinary price momentum has outpaced the sector over the past four quarters, returning more than 200% on a year-over-year basis.

AGX's valuation has improved since the beginning of December, with the company outperforming on key metrics such as its GAAP P/E to earnings growth ratio for the past twelve months of 0.33x versus 1.1x for the sector.

With a large project backlog and the ability to service both conventional and renewable energy projects, AGX is poised for future growth opportunities in 2025.

$DXP Enterprises (DXPE)$

Market capitalization: $1.3 billion

Quantitative rating: Strong Buy

Industry: Industrial

Sub-industry: Trading Companies & Distributors

DXP Enterprises is a Houston-based company that supplies critical industrial equipment to a variety of industries.The company's largest division is its service center division, which sells pumps, bearings and power transmission products.Its service centers also provide maintenance and repair services to industrial customers.During the third quarter, DXP drove growth through a number of acquisitions, which have long been at the core of its growth strategy, but at the expense of short-term margins.

Despite prioritizing growth over margin optimization, DXP maintains healthy profitability with a 17% return on equity (more than 25% higher than the industry) while delivering excellent growth metrics, including 45% year-over-year EPS growth.Trading at an attractive valuation with an expected price-to-sales ratio of 0.8x versus the industry's 1.5x, DXP offers investors the opportunity to participate in the growth of industrial services at an attractive multiple.

In 2024, the technology sector soars, driven by advances in artificial intelligence and innovations in quantum computing.Certain tech stocks may continue to grow in 2025 as cloud adoption and artificial intelligence applications continue to expand.

$Technology (CLS)$

Market capitalization: $11.5 billion.

Quantitative rating: Strong Buy.

Sector: Information Technology.

Sector: Electronics Manufacturing Services.

Celestica has become a standout Electronics Manufacturing Services stock and has been named an Alpha Pick twice.The company's success has been driven by its strategic shift to AI infrastructure manufacturing, particularly through a focus on network switches for data centers.The company's Connectivity & Cloud Solutions segment accounted for 67 percent of total revenue, up 42 percent year-over-year, driven by demand for AI computing power in hyperscale organizations.

During the third quarter, Skyhigh reached new heights in financial performance, with total revenues totaling $2.5 billion (up 22 percent year-over-year) and record adjusted earnings per share of $1.04, which has driven strong price momentum in recent months.Despite returning nearly 250% over the past year, Tianhong Electronics maintains an attractive valuation, which is one of the stock's most compelling selling points.The company trades at a significant discount to the sector on a number of the metrics listed below.

TIH's 'A' modified rating supports the view that the stock has further upside, with fourth-quarter earnings per share expected to grow 37% year-over-year.With solid execution in artificial intelligence data center hardware, expanding operating margins, and attractive valuation characteristics, TIH offers investors strong exposure to a huge growth market in 2025.

$Intapp, Inc.(INTA)$

Market capitalization: $4.85 billion.

Quantitative rating: Strong Buy.

Sector: Information Technology.

Industry: Application Software.

Intapp is at the forefront of business-critical modernization, providing cloud-based software solutions designed to manage customer relationships, transaction processes and compliance requirements for professional services firms.The company doubled its net income to $15.1 million in the first quarter of fiscal 2035, driven by enterprise customer expansion and new artificial intelligence offerings, contributing to the company's 'B' profitability rating.INTA also demonstrated other strong fundamentals, particularly in terms of industry-leading revenue growth (17% above the industry's 5%) and 123% year-over-year operating cash flow growth.

The company ranks extremely highly in terms of price momentum and earnings revisions relative to the sector.INTA has returned nearly 75% on a trailing basis over the past year, with 10 upward revisions to FY1 forecasts and no downward revisions over the past 90 days.Intapp's vertically-specific AI solutions and growing enterprise relationships allow for continued success through 2025.

$Credo Technology Group Holding Ltd (CRDO)$

Market capitalization: $12.82 billion.

Quantitative rating: Strong Buy.

Sector: Information Technology.

Sector: Semiconductors.

Niche vendors and service providers for AI infrastructure needs had exceptional success in 2024 and will likely continue this trend in 2025.Credo Technology Group, founded in 2008, is the #2 quantitatively ranked semiconductor stock and the #3 overall quantitatively ranked technology company.The company focuses on developing innovative products optimized for Ethernet applications, including integrated circuits and active electrical cables (AECs).

CRDO's outstanding A+ growth rating was driven by strong demand for its AECs for artificial intelligence data centers.Key highlights include forward-looking EBITDA growth of 129% versus 5% for the sector, and forward-looking long-term EPS growth (3 - 5 year CAGR) nearly 500% above the sector median.This phenomenal growth has contributed to the company's impressive price momentum; CRDO has delivered triple-digit returns over the past four return cycles and over 300% over the past year.

Notably, CRDO is still trading at a small discount, offering a forward-looking price-to-earnings (non-GAAP) ratio of 1.5x, which is 17% below the IT sector median.With the market generally optimistic about the company, analysts are expecting a staggering 359% year-over-year EPS growth in the next quarter, making this stock a must-have in 2025.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?