Unity Soars 30% Post-Earnings: Can It Match AppLovin’s 700%+ Surge?

On Thursday, $Unity Software Inc.(U)$ , a global leader in game engine development, saw its shares surge 30%, ranking third on the NYSE, after reporting better-than-expected results.

This performance has raised eyebrows, especially considering Unity’s 45% decline in 2024. So far in 2025, $Unity Software Inc.(U)$ ’s shares have risen by 24%.

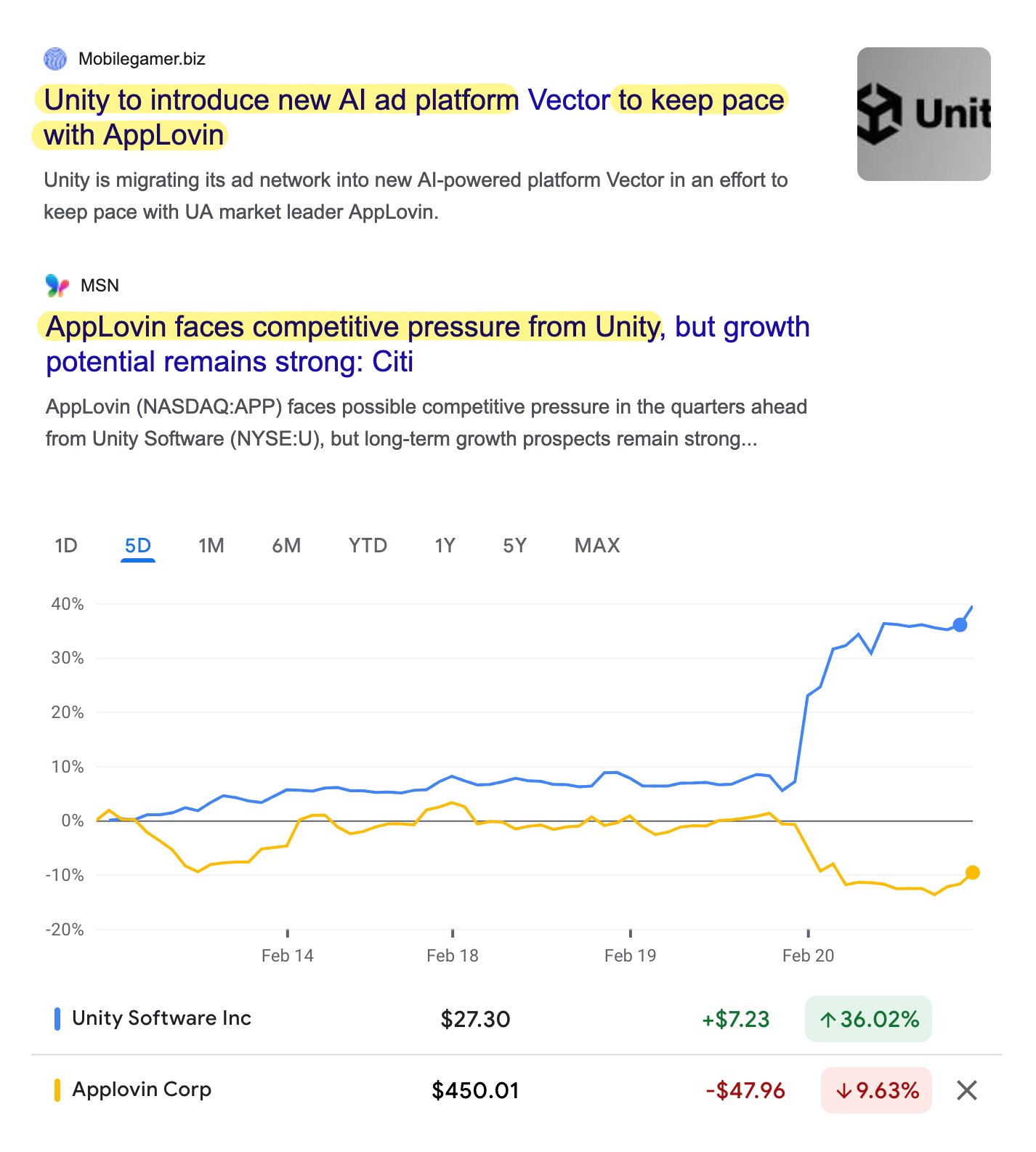

This significant rally in Unity’s stock price inevitably invites comparisons with $AppLovin Corporation(APP)$ which saw a staggering 744% increase in its share price in 2024, making it one of the brightest stars on the $NASDAQ(.IXIC)$ . Following AppLovin’s Q4 earnings release on February 12, 2025, its shares soared by 36%, reflecting the market’s high recognition of its advertising technology and business expansion.

Both $Unity Software Inc.(U)$ and $AppLovin Corporation(APP)$ are in the tech industry, with a focus on mobile applications and game development.

Both companies are seen as having growth potential, but which one is stronger?

Will $Unity Software Inc.(U)$ ’s efforts in AI-driven advertising put pressure on $AppLovin Corporation(APP)$ ?

With these questions in mind, I’ve done some comparisons to explore the business connections and competitive advantages of both U and APP.

1. What Do Unity and AppLovin Do, and How Are They Connected?

Business Models:

$Unity Software Inc.(U)$ : Primarily offers game development engines and related tools. Its business is divided into Create Solutions, Operate Solutions, and other strategic partnerships.

$AppLovin Corporation(APP)$ : Focuses on mobile game advertising, with a business scope that includes ad tech stacks and a portfolio of hyper-casual mobile games.

Unity, as a global leader in game engine development, has a broad application prospect in game development and the metaverse. By acquiring IronSource, Unity expanded its capabilities in ad monetization and game publishing.

AppLovin, on the other hand, specializes in mobile game advertising and publishing, offering full-stack services. It has excelled in AI-driven ad technology and data analytics.

Many game developers in Unity’s large developer ecosystem also use AppLovin’s ad services. However, Unity’s attempt to require developers to use its LevelPlay platform instead of AppLovin’s services sparked competition between the two.

AppLovin once tried to acquire Unity but was rejected, highlighting its interest in Unity’s vast developer ecosystem.

2. Financial Performance and Market Reaction

Here’s a comparison based on the latest financial data and market performance:

Indicator | Unity (U) | AppLovin (APP) |

|---|---|---|

Total Revenue | $457 million, down 25% YoY | $1.37 billion, up 44% YoY |

Net Income | Net loss of $123 million | $599.2 million, up 248% YoY |

EPS | Loss per share of $0.30 | $1.73 |

Adjusted EBITDA | $106 million | $776.7 million |

Adjusted EBITDA Margin | 23% | 56% |

Ad Business Growth | Ad revenue declined | Ad revenue up 73%, reaching $999 million |

Stock Performance | Relatively flat | Post-earnings surge of 30%, closing at $495.25 |

2025 Q1 Guidance | Revenue expected between $405 million and $415 million | Revenue expected between $1.355 billion and $1.385 billion |

In Q4 2025, Unity attributed its revenue decline to a “portfolio reset,” including downsizing and layoffs. However, subscription revenue grew by 15%, and industry-specific strategic revenue increased by 50%. Despite exceeding market expectations, Unity remains in the red, with challenges in ad business growth. The Q1 2025 revenue guidance is below market expectations, indicating ongoing efforts needed in ad business integration and growth.

As a leader in game engines, Unity’s acquisition of IronSource aimed to create an integrated development and monetization platform, but integration challenges persist. While Unity lags in ad tech, it holds potential to enhance competitiveness through AI.

AppLovin’s Q4 2024 results exceeded expectations, with ad business growth of 73% as the core growth driver. This highlights its strong competitiveness in AI-driven ad technology. The Q1 2025 guidance also surpassed market expectations, further solidifying market confidence in its future growth.

The company plans to divest its app business to focus on ad tech, leveraging its AI-driven ad matching algorithms and predictive bidding models to boost ad conversion rates and developer ROI. Through acquisitions like Adjust and MoPub, AppLovin has strengthened its tech integration and market share, with a clear competitive edge.

Overall, AppLovin currently outperforms Unity in financial results and market response. Unity and AppLovin have distinct differences in business models, profitability, and market positioning. Unity, as a game engine provider, is yet to turn a profit but is widely seen as having strong technical potential and market prospects. AppLovin excels in mobile game ad tech and market expansion, with its AI-driven ad platform and business diversification strategy giving it a significant edge in the mobile ad market.

3. Technology and Market Outlook Comparison

Market Position: Focuses on mobile game advertising, with a strong presence in both iOS and Android markets, ranking first and second in ad share respectively. It is a top-five global mobile ad platform, especially strong in the gaming sector.

AI-Driven Ad Tech: AppLovin’s AXON 2.0 AI engine automates and optimizes ad placements, enhancing ROI for advertisers. Its technology has also shown strong effects in non-traditional fields like fintech and healthcare.

Incentive Mechanism: AppLovin’s aggressive incentive mechanism and high target-setting reflect the company’s confidence in its future.

Business Expansion: Plans to divest its mobile game business to focus on ad tech, while expanding into e-commerce and CTV (connected TV) ad sectors.

Market Position: Seen as a core infrastructure provider in game development and the metaverse.

Game Engine Advantage: Unity is a leader in game development, supporting multi-platform deployment with a vast developer ecosystem.

Ad Tech Challenges: Despite expanding its ad business through the acquisition of IronSource, integration has been slow, and its ad intermediation capabilities are relatively weak. The market has low expectations for its ad tech fixes and business growth.

Incentive Mechanism: Unity’s incentive mechanism is seen as less aggressive, with a more conservative PVU (performance vesting unit) design.

Future Outlook: Unity plans to fix its ad tech and enhance AI capabilities, aiming for synergy in game development and ad monetization.

In Summary:

$AppLovin Corporation(APP)$ : Suitable for investors bullish on ad tech, AI applications, and business diversification. Its strong financial performance and market confidence make it a more attractive investment target currently.

$Unity Software Inc.(U)$ : Suitable for long-term investors who are bullish on game development and the metaverse and are willing to tolerate short-term volatility. Its leadership in game engines and potential for ad tech fixes still offer long-term growth potential.

Disclaimer: The information provided is based on publicly available data and market analysis as of the date of this report. Investment decisions should be made based on thorough research and consultation with a financial advisor. Past performance is not indicative of future results.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JD88·02-21the report really not good. people still buy it. speechlessLikeReport

- kookiz·02-21Exciting prospectsLikeReport