Bargain hunting Tesla? This strategy helps you lock in risks

Tesla shares closed down 1.67% on Monday at $259.16. Last week, Tesla shares rose 6%, ending a nine-week streak of record losses and recording their first weekly gain since Trump's inauguration.

However, Tesla's stock price has fallen nearly 32% year-to-date. In contrast, the S&P 500 fell more than 4% over the same period.

Gengaro wrote in a note to clients,The bank expects Tesla stock price to continue to fluctuate in the short term, but he remains optimistic about the medium and long-term prospects for Tesla's stock price with the sale of low-priced cars and the launch of a fully autonomous driving service in Austin, Texas later this year.

Gengaro also lowered its forecast for Tesla's first-quarter deliveries by 23%, from 458,672 to 353,418 vehicles.He blamed the timing of increased production of new Model Y vehicles, as well as protests against Musk, for the downward forecast.

He also said that Tesla's highly anticipated low-priced model expected to launch at the end of June could cause some consumers to delay their purchases.

Tesla will report first-quarter delivery and production data on Wednesday.Market expectations for Tesla's first-quarter deliveries have been slipping amid concerns about Tesla CEO Musk's role in the Trump administration and the impact of Trump's auto tariffs.

Due to the fierce competition in the electric vehicle market and the "anti-Tesla" wave in the European and American markets,Tesla's Q1 deliveries expected to record their worst performance since Q4 2022。

According to Visible Alpha analysts' forecasts,Tesla will deliver approximately 373,000 vehicles in the first quarter, down 3.6% from 386,810 in the same period last year。

Gengaro is the latest bull analyst to slash his Tesla delivery forecast.

Last week, Wedbush analyst Dan Ives, Tesla's largest bull on Wall Street, also said he expects Tesla's first-quarter deliveries to be "very weak", possibly between 355,000 and 360,000 vehicles.

He pointed out that although Tesla's electric vehicles will be relatively less affected by Trump's auto tariffs because they are mainly produced in the United States, Tesla will still be hurt by tariffs and forced to raise prices because many of the components used to make electric vehicles are imported.

Earlier last month, Ben Kallo, an analyst at Baird, another U.S. investment bank, lowered his forecast for Tesla's first-quarter deliveries from 369,400 to 315,400.

In addition, UBS analyst Joseph Spak recently lowered Tesla's first-quarter delivery forecast from 437,000 to 367,000; Morgan Stanley analyst Adam Jonas lowered Tesla's first-quarter delivery forecast from 415,000 to 351,000; JPMorgan analyst Ryan Brinkman lowered Tesla's first-quarter delivery forecast to 355,000 vehicles from 444,000.

Investors who want to buy Tesla at the bottom in the negative market can use the bull market put spread strategy.

Bull Put Spread Strategy

A bull put spread involves selling a put option while buying another put option with the same expiration but a lower strike price (for the same underlying asset). Since the premium of selling put options is higher than the premium of buying put options, investors usually net earn premium.

When investors expect the market price to rise, but the increase is limited, and investors do not want to bear the consequences of a sharp market drop, they can use the bull market put spread strategy.

What are the functions of the bull spread strategy?

1. Earn premium with low risk: When investors want to earn premium income, the bull put spread strategy is ideal, and the degree of risk is lower than selling put options.

2. Buy stocks at lower prices: A bull put spread is a great way to buy a desired stock at an effective price below the current market price.

3. Make a profit in a volatile market: When the market falls, due to the huge risk of selling put options, by limiting the downside risk, the bull market put option spread can make a profit in a volatile market.

Strategy Overview

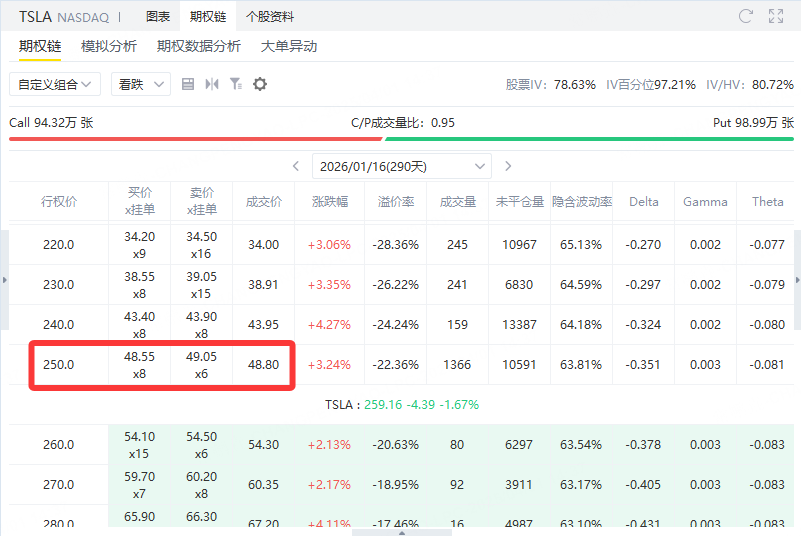

Sell a put option with a strike price of 250 (expires 1/16/26): Get premium = 4880.

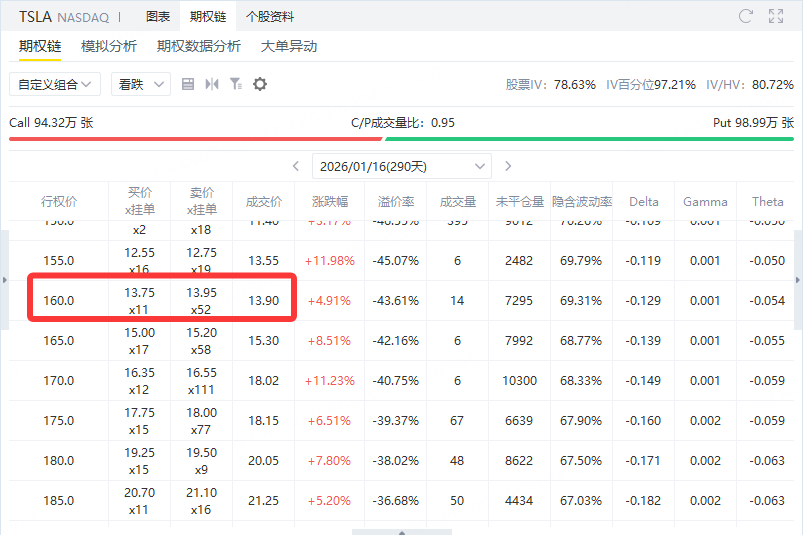

Buy a put option with a strike price of 160 (expiring 1/16/26): Pay premium = 1390.

Transaction composition

Sell a put option at 250 strike price

Get premium: 4880

Buy a put option at 160 strike price

Pay premium: 1390

Net premium Income = 4880-1390 =3490

PROFIT AND LOSS

Maximum profitWhen the underlying price at expiration is ≥ 250, both options lapse, and you will get the full net premium, that is, the maximum profit is3490。

Break-even pointThe break-even point is calculated as follows:

Equilibrium = 250 − Net premium Multiplier per contract = 250 − 34.9 = 215.1

That is to say, when the underlying price is about215.1At that time, investors' profit and loss are just balanced.

Maximum lossWhen the underlying price at expiration is ≤ 160, both options are in real value, and the loss reaches the maximum value. The maximum loss is calculated as:

Maximum loss = (250 − 160) × 100 − Net premium = (90 × 100) − 3490 = 9000 − 3490 = 5510

Thus, the maximum loss is5510。

sum up

Maximum profit:3490

Break-even point: about 215.1

Maximum loss:5510

This combination belongs to the credit spread strategy (credit spread). premium is obtained by selling put options with higher strike prices, and then buying put options with lower strike prices for risk hedging. The upper limit of profit is the net premium, and the upper limit of loss is the two strike spreads multiplied by the contract multiplier and then subtracted the net premium.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.