Is the Recession Shock Imminent? Should Investors Buy the Dip After the Market Plunge?

The US stock market is undergoing significant turmoil, with concerns over the economy intensifying. President Trump’s announcement of large-scale tariffs has triggered a wave of panic selling in global markets. Further complicating the market outlook, several economic indicators point toward the possibility of a recession. Experts believe that whether the market will experience another massive sell-off depends largely on whether fears of an imminent economic recession are debunked.

Growing Recession Risk in the US Economy

Economic Data Signals Trouble Ahead

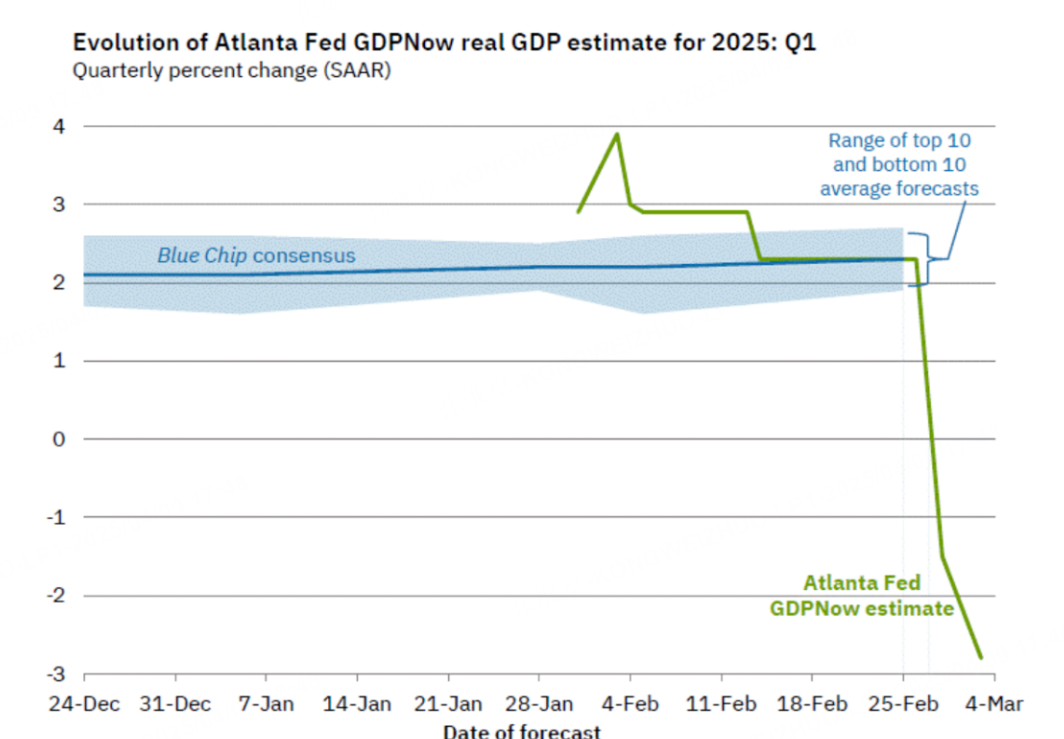

Recent economic predictions paint a grim picture. The Atlanta Fed’s GDPNow forecasting model has downgraded its outlook for first-quarter 2025 US real GDP growth from 2.3% to a contraction of 2.825%, marking the worst quarter for the US economy since COVID-19 pandemic disruptions in 2020. If accurate, this would represent the most significant quarterly GDP decline since the second quarter of 2020.

JPMorgan also predicts that the US economy will contract by 0.3% in 2025, a steep downward revision from earlier forecasts of a 1.3% growth. Michael Feroli, the bank's chief economist, anticipates a recession in the second half of 2025, with a projected 1% GDP contraction in the third quarter and a further 0.5% decline in the fourth quarter.

Adding to the apprehension, recession indicators from JPMorgan signal alarming probabilities: the Russell 2000 index suggests a 79% chance of a recession; the S&P 500 index points to a 62% likelihood; and base metals data indicate a 68% probability. These figures are stark warnings for the market.

Tariff Policies Driving Market Volatility

The Trump administration's aggressive trade and tariff policies are at the heart of market disruptions. On April 2, President Trump’s announcement of large-scale tariffs stirred fears of a full-scale trade war and global economic recession. The policy shift caused US stock indices to nosedive—on April 3, the S&P 500 dropped 4.8%, erasing $2 trillion of market capitalization, alongside a 4% drop for the Dow Jones and a 6% decline for the NASDAQ.

Later, on April 8, the White House unveiled an additional 84% tariff on imported Chinese goods. Although the stock market initially showed signs of recovery, it reversed course to close 1.57% lower, briefly entering bear market territory. The extreme volatility underscores the uncertainty surrounding the economic outlook.

Economists caution that prolonged tariff efforts could exacerbate inflation and suppress growth. Even within the White House, officials have acknowledged potential economic disruptions, albeit insisting that the overall impact would remain manageable.

Historical Context: Mild vs. Deep Recession

Examining US Recession Trends

UBS research highlights that over the past century, the US economy has endured 17 recessions, categorized into mild recessions (GDP declines of less than 3%) and deep recessions (GDP declines exceeding 3%). Given the relatively healthy current state of consumer and bank balance sheets, any upcoming recession is more likely to be mild rather than deep.

Historically, classic recession signals include halts in mortgage refinancing, stagnation in stock appreciation, and rising housing prices amidst falling sales volumes. Many of these indicators are already visible today—for example, the US 30-year mortgage rate has reached nearly 7%, and consumer confidence has plunged to a 15-month low.

Market Response Patterns During Recessions

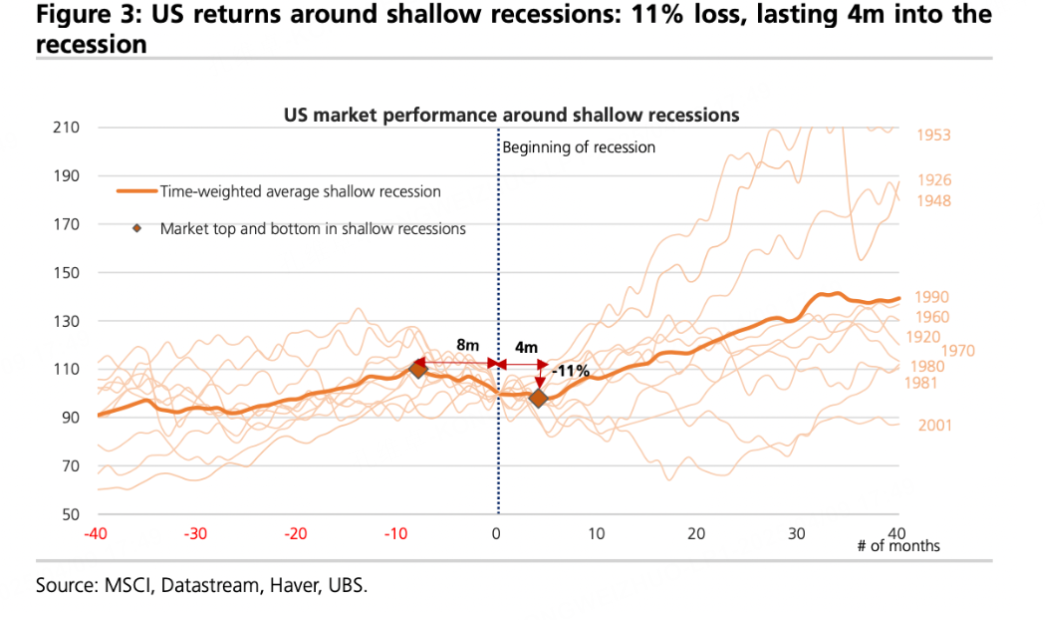

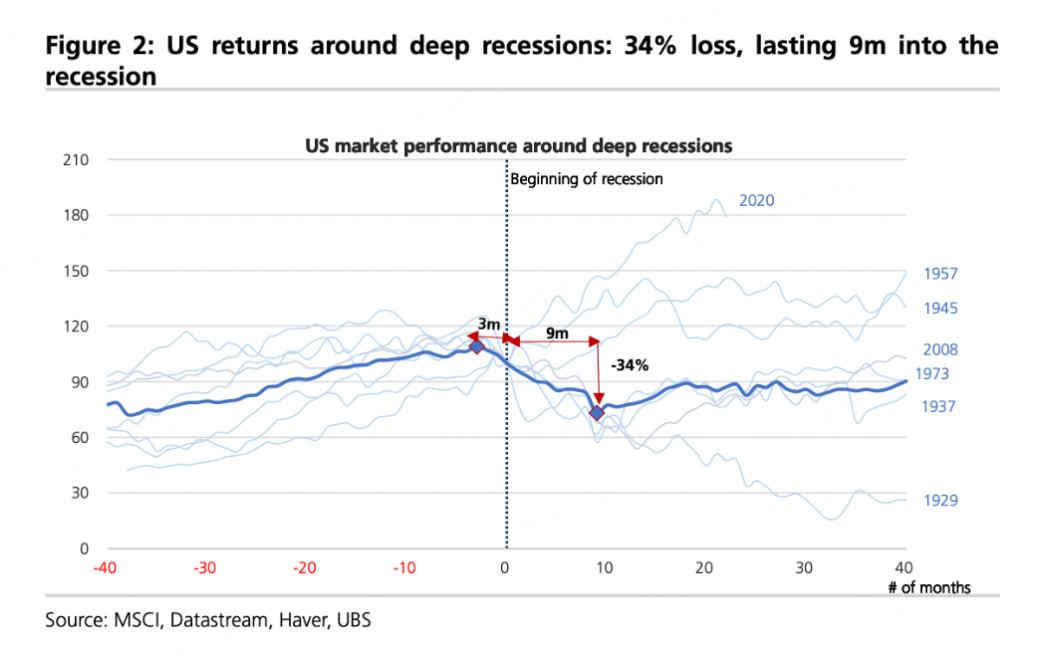

UBS data reveals divergent market behaviors during mild versus deep recessions. In mild recessions, the average market decline has been limited to 11%, while deep recessions have historically led to an average drop of 34.4%. Moreover, market declines tend to last approximately 12 months in both cases but vary significantly in timing.

In mild recessions, market sell-offs typically begin up to eight months before the recession starts and subside about four months after the recession begins. This pattern suggests that much of the downside risk is absorbed in the early stages, leaving the remaining recovery period for the market to rebound.

The S&P 500 index has already fallen close to 20% from its February peak, indicating that a portion of the recession fears may have been priced in. If the US ultimately faces a mild recession, historical trends suggest a potential bottoming-out followed by market recovery.

Sector Sensitivities and Recovery Potential

Certain sectors react differently to economic recessions. UBS research finds that finance, industrials, and consumer discretionary sectors are the most sensitive to recession severity. In deep recessions, these sectors experience the sharpest declines; in mild recessions, they may outperform.

Additionally, historical data shows financial and consumer stocks often slightly surpass broader market performance during mild recessions. This insight could influence current investment strategies if a mild recession is anticipated.

Goldman Sachs emphasizes technology companies capable of converting AI advancements into concrete revenue streams, primarily in software and services, may thrive despite the challenging economic climate. They predict that the ‘Magnificent 7’ (Amazon, Apple, Google, Meta, Microsoft, NVIDIA, and Tesla) will continue outperforming the S&P 500 index in 2025, though the excess returns may narrow to 7%.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2506(GCmain)$ $WTI Crude Oil - main 2505(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.