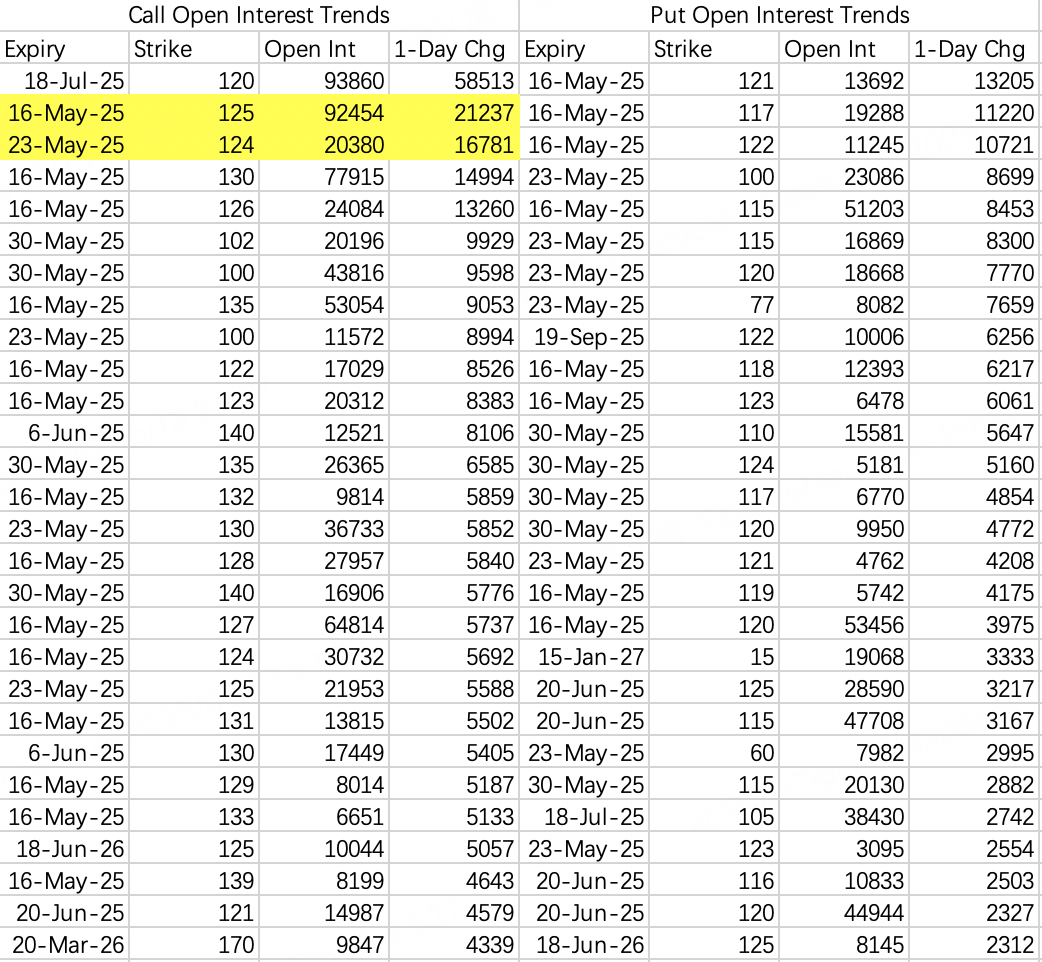

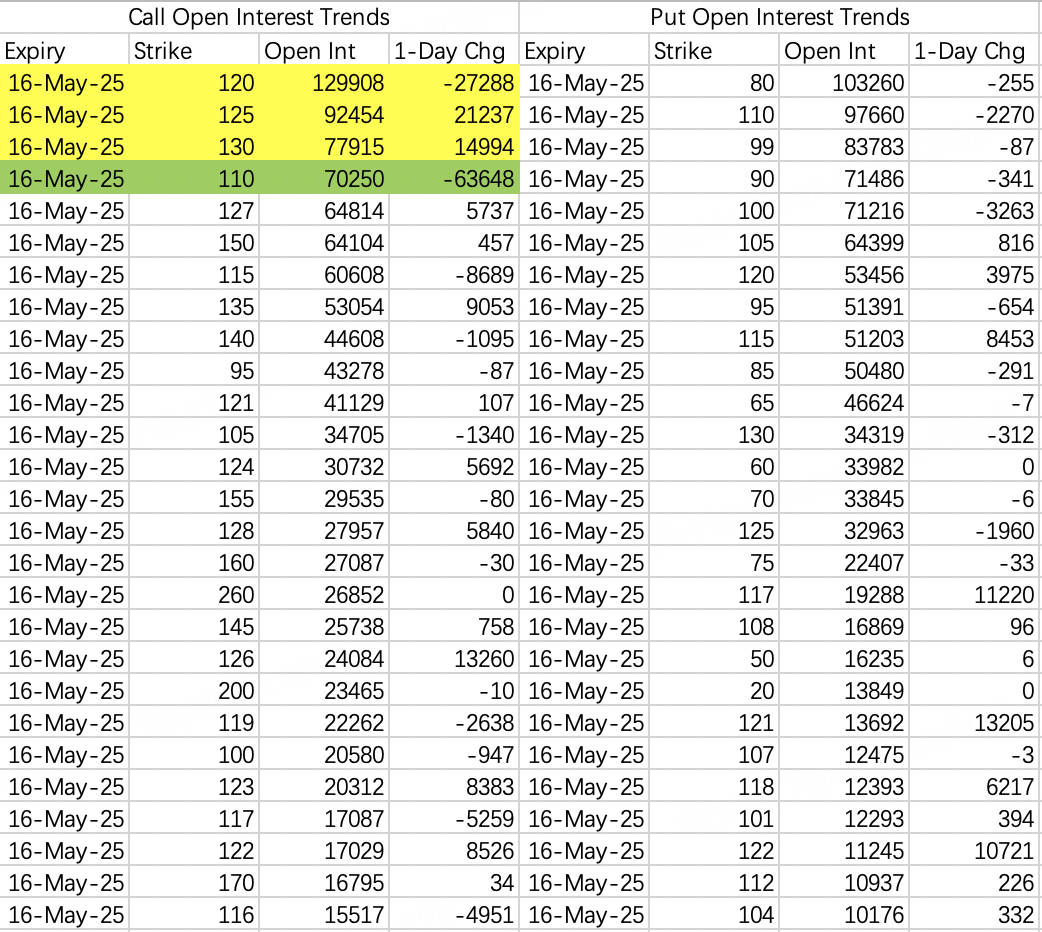

The Saudi order triggered a short squeeze. On Monday, the largest new open interest for this week’s expiring call options was at the 125 strike, but institutions didn’t roll their sell call positions in time. As a result, the stock price broke through the 127 hedge point and surged to 130.

Based on open interest data, 130 appears to be the extreme price for this week. Institutions have rolled their sell call positions to $NVDA 20250516 132.0 CALL$ , hedging with 137 calls. I followed along to recover some losses.

I must admit, Trump’s bullish comments had a surprisingly strong impact.

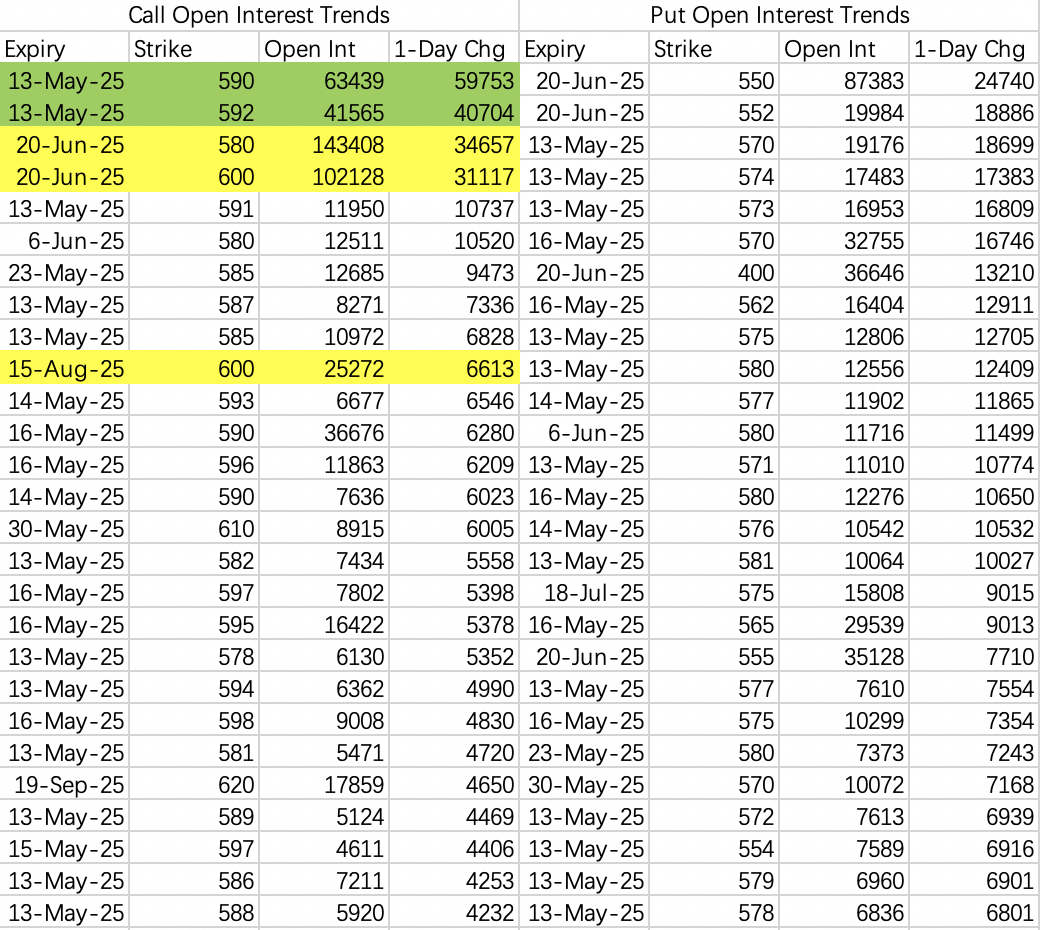

SPY could reach 600 by the June 20th triple witching day.

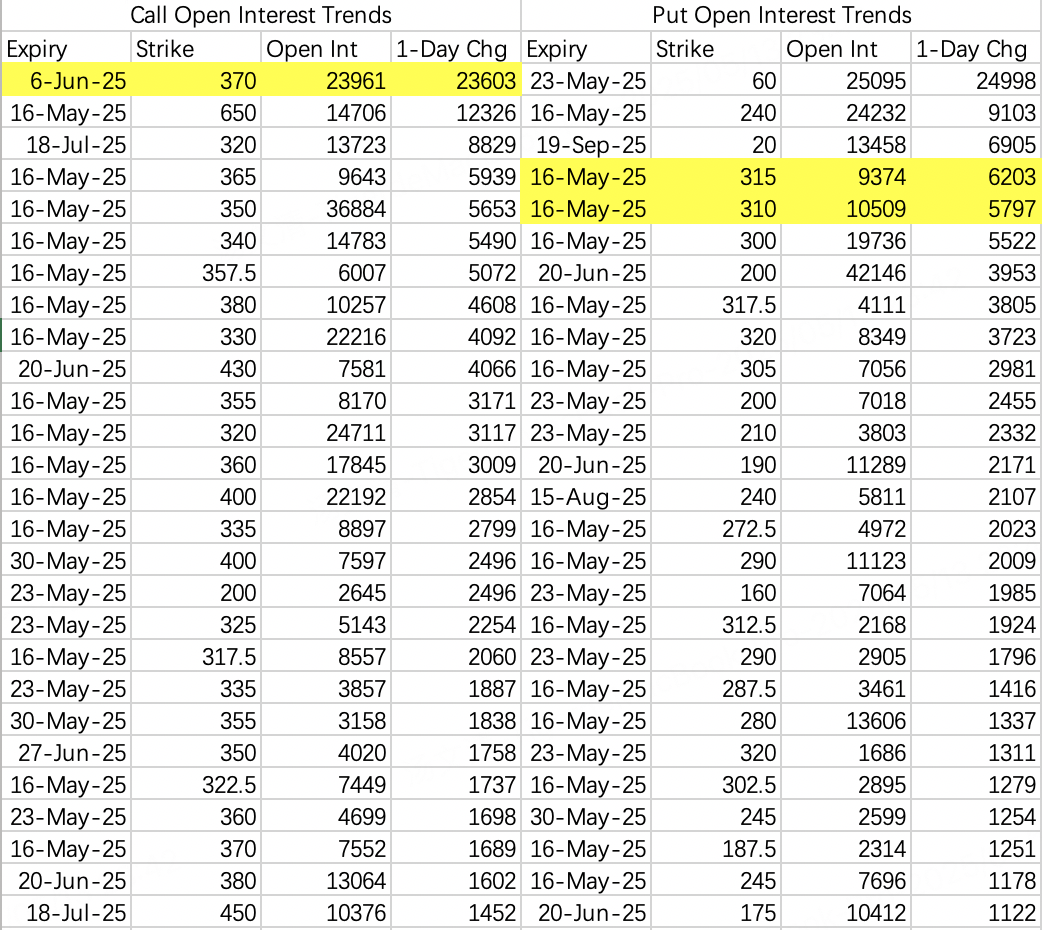

If SPY touches 600, Tesla’s stock price is likely to follow a similar trend. On June 6th expiration, the 370 call $TSLA 20250606 370.0 CALL$ saw 23,600 new contracts opened.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.