Nvidia's financial report is here! What strategy should I use to be steady and bullish?

$Nvidia (NVDA) $It will announce its highly anticipated first-quarter financial report for fiscal year 2025 after U.S. stocks close on Wednesday, which may be the most watched results release this earnings season.

Nvidia's stock price has fluctuated wildly since the beginning of the year, due to including the Trump administration's ban on exports of its H20 chips to China and market concerns about new tariffs on semiconductors. However, thanks to the Biden administration's last-minute "delay strategy" on the new regulations on AI chip exports and Trump's large investment commitments during his visit to the Middle East, Nvidia's stock price has been basically flat this year, and has risen by about 40% in the past 12 months.%.

According to analyst consensus estimates compiled by Bloomberg, Nvidia is expected to report adjusted earnings per share (EPS) of $0.88 and revenue of $43.3 billion for the quarter.In the year-ago quarter, the company reported adjusted EPS of $0.61 on revenue of $26 billion.

Wall Street expects Nvidia's data center business revenue to reach $39.2 billion, an increase of about 74% from $22.5 billion in the same period last year. The gaming business is expected to reach $2.8 billion, slightly higher than last year's $2.6 billion.

It is worth noting that analysts expect Nvidia's revenue in China to reach US $6.2 billion, a 150% increase from US $2.4 billion in the same period last year. The U.S. market is expected to contribute $21.6 billion in sales.

However, due to the Trump administration's ban on H20 chips, Nvidia has announced that it will include an impairment loss of $5.5 billion. The news was first disclosed in a regulatory filing in April.

Morgan Stanley released a research report on May 27, saying that although the "H20 sales restrictions" have brought short-term financial pressure, which may lead to Nvidia's revenue loss of approximately US $5 billion, the market may underestimate the long-term potential of explosive growth in demand for AI reasoning. Superimposed on the improvement of Blackwell architecture supply, Nvidia's performance in the second half of the year may usher in an accelerated inflection point. The bank maintained its "overweight" rating on Nvidia and still listed it as the top stock in the semiconductor industry.

Most importantly, Morgan Stanley believes that the explosive growth of demand for AI reasoning is the fundamental factor that determines Nvidia's long-term value.

Morgan Stanley believes that the market is insufficiently aware of the explosive growth of demand for AI reasoning. Leading cloud vendors such as Microsoft, Amazon, and Google have recently disclosed "unexpected growth in Token (AI computing unit) usage", which directly reflects the surge in actual calls of AI models by end users.

Analysts pointed out that inference needs are driven by real business rather than the construction of training clusters supported by venture capital, which provides a key verification for the sustainability of Nvidia's revenue.

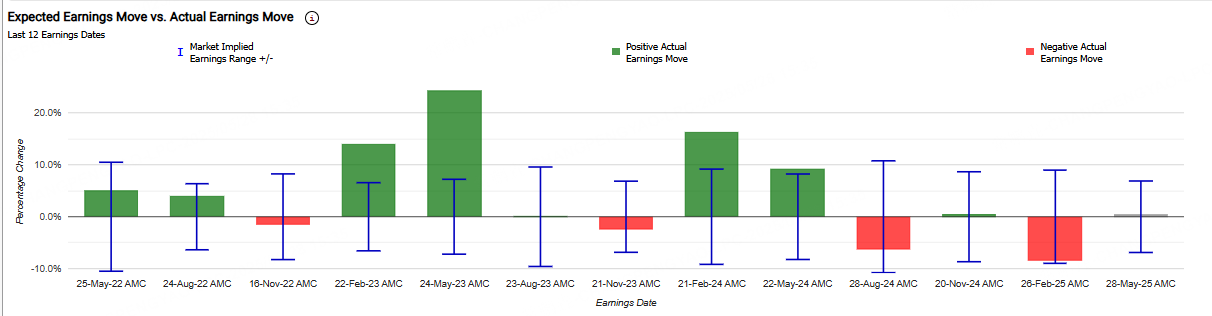

Nvidia's post-earnings volatility

Over the last 12 quarters, the options market has overvalued the probability of NVDA stock earnings movements by a high67%。 The forecast fluctuation after the earnings announcement is on average±8.4%,The average fluctuation range of actual profit is7.7%(absolute value).

The average share price movement was ± 8. 1%, with the largest increase of +24.4% and the largest decline of-7.6%. Over the past six quarters, Nvidia has gained and fallen by-2.5%, +16.4%, +9.3%,-6.4%, +0.5%,-8.5%.

In view of the current Nvidia financial report market, investors who have different expectations for Nvidia's stock price trend can adopt different strategies. Investors who are cautious and bullish in holding shares can adopt the collar strategy, investors who want to go long or short can use the spread strategy, and investors who want to short volatility can use the short-selling wide straddle strategy.

For investors who don't want to predict the rise and fall of Nvidia, investors can make profits by going long conservatively, and the strategy here can consider the bull market bearish spread strategy.

Bull Put Spread Strategy

Investors can use the bull put spread, with Nvidia now trading at 135.5. Investors can bet that after the earnings report, the stock price will rise slightly.

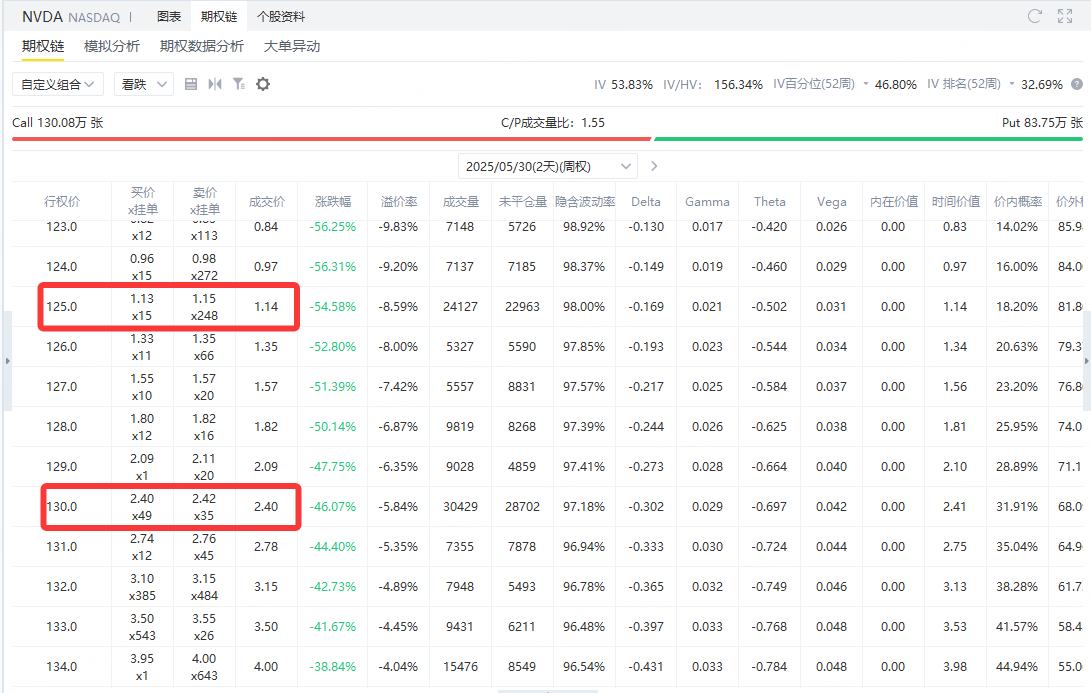

Investors can sell Put with an exercise price of 130 and get a $240 premium.

In the second step, investors can buy a put option of 125, which costs $114 premium.

Investors are betting that Nvidia stock will rise slightly or stay around 130 after earnings by selling put options at 130 strike and buying put options at 125 strike.

Strategy Building

Investors can complete the strategy construction through the following two steps:

Sell Put option with strike price of $130 (Put), receiving premium of US $2.40 per share, corresponding to revenue of US $240 per contract;

Buy a Put option with an exercise price of $125, paying a premium of $1.14 per share, corresponding to a cost of $114 per contract.

The portfolio's net premium revenue was:$240-$114 = $126 (per contract)

This net income represents the maximum profit an investor can make when the share price is above $130.

PROFIT AND LOSS

This strategy is an option strategy with limited risk, and the maximum gain and maximum loss are determined when the position is opened.

Maximum Profit: $126

Condition: If Nvidia's stock price when the option expiresAbove $130

Neither option will be exercised at that time, and premium's net income will be the profit

Maximum loss: $374

Conditions: If Nvidia's stock price at expirationUnder $125

Short Put executed, need to buy stock at $130

Long Put was also executed, sold at $125

The loss between the legs is $500 (strike spread × 100), minus $126 premium revenue, and the final net loss is $374

Break-even point: $128.74

Calculated as: Strike price of $130 selling Put minus net premium income of $1.26 (per share)

Investment Logic and Risk Control

The central idea of the strategy is to bet on NvidiaThere will be no significant decline after the financial report。 As long as the stock price stays above $130, investors can reap the full premium gains. Even if the stock price retreats slightly, it can still be profitable as long as it doesn't fall below the breakeven point of $128.74.

From a money management perspective, the maximum risk of this strategy is $374 and the maximum profit is $126. Here is a file inHigh volatility earnings window periodA classic structure that takes into account risk control and income efficiency.

The bull put spread is a rational choice in the face of high uncertainty events such as earnings reports. Compared with directly betting on a sharp rise in stock prices, it is more suitable for the current market expectation of "high volatility and overall optimism". By reasonably choosing the exercise price and term, investors can steadily obtain excess returns while controlling the pullback/retracement.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.